11.4 The Business Plan

Learning objectives.

By the end of this section, you will be able to:

- Describe the different purposes of a business plan

- Describe and develop the components of a brief business plan

- Describe and develop the components of a full business plan

Unlike the brief or lean formats introduced so far, the business plan is a formal document used for the long-range planning of a company’s operation. It typically includes background information, financial information, and a summary of the business. Investors nearly always request a formal business plan because it is an integral part of their evaluation of whether to invest in a company. Although nothing in business is permanent, a business plan typically has components that are more “set in stone” than a business model canvas , which is more commonly used as a first step in the planning process and throughout the early stages of a nascent business. A business plan is likely to describe the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. An in-depth formal business plan would follow at later stages after various iterations to business model canvases. The business plan usually projects financial data over a three-year period and is typically required by banks or other investors to secure funding. The business plan is a roadmap for the company to follow over multiple years.

Some entrepreneurs prefer to use the canvas process instead of the business plan, whereas others use a shorter version of the business plan, submitting it to investors after several iterations. There are also entrepreneurs who use the business plan earlier in the entrepreneurial process, either preceding or concurrently with a canvas. For instance, Chris Guillebeau has a one-page business plan template in his book The $100 Startup . 48 His version is basically an extension of a napkin sketch without the detail of a full business plan. As you progress, you can also consider a brief business plan (about two pages)—if you want to support a rapid business launch—and/or a standard business plan.

As with many aspects of entrepreneurship, there are no clear hard and fast rules to achieving entrepreneurial success. You may encounter different people who want different things (canvas, summary, full business plan), and you also have flexibility in following whatever tool works best for you. Like the canvas, the various versions of the business plan are tools that will aid you in your entrepreneurial endeavor.

Business Plan Overview

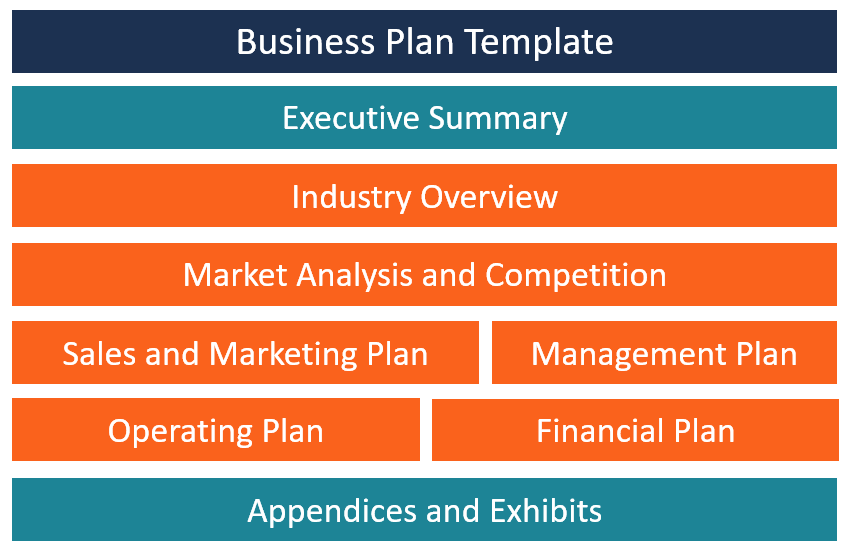

Most business plans have several distinct sections ( Figure 11.16 ). The business plan can range from a few pages to twenty-five pages or more, depending on the purpose and the intended audience. For our discussion, we’ll describe a brief business plan and a standard business plan. If you are able to successfully design a business model canvas, then you will have the structure for developing a clear business plan that you can submit for financial consideration.

Both types of business plans aim at providing a picture and roadmap to follow from conception to creation. If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept.

The full business plan is aimed at executing the vision concept, dealing with the proverbial devil in the details. Developing a full business plan will assist those of you who need a more detailed and structured roadmap, or those of you with little to no background in business. The business planning process includes the business model, a feasibility analysis, and a full business plan, which we will discuss later in this section. Next, we explore how a business plan can meet several different needs.

Purposes of a Business Plan

A business plan can serve many different purposes—some internal, others external. As we discussed previously, you can use a business plan as an internal early planning device, an extension of a napkin sketch, and as a follow-up to one of the canvas tools. A business plan can be an organizational roadmap , that is, an internal planning tool and working plan that you can apply to your business in order to reach your desired goals over the course of several years. The business plan should be written by the owners of the venture, since it forces a firsthand examination of the business operations and allows them to focus on areas that need improvement.

Refer to the business venture throughout the document. Generally speaking, a business plan should not be written in the first person.

A major external purpose for the business plan is as an investment tool that outlines financial projections, becoming a document designed to attract investors. In many instances, a business plan can complement a formal investor’s pitch. In this context, the business plan is a presentation plan, intended for an outside audience that may or may not be familiar with your industry, your business, and your competitors.

You can also use your business plan as a contingency plan by outlining some “what-if” scenarios and exploring how you might respond if these scenarios unfold. Pretty Young Professional launched in November 2010 as an online resource to guide an emerging generation of female leaders. The site focused on recent female college graduates and current students searching for professional roles and those in their first professional roles. It was founded by four friends who were coworkers at the global consultancy firm McKinsey. But after positions and equity were decided among them, fundamental differences of opinion about the direction of the business emerged between two factions, according to the cofounder and former CEO Kathryn Minshew . “I think, naively, we assumed that if we kicked the can down the road on some of those things, we’d be able to sort them out,” Minshew said. Minshew went on to found a different professional site, The Muse , and took much of the editorial team of Pretty Young Professional with her. 49 Whereas greater planning potentially could have prevented the early demise of Pretty Young Professional, a change in planning led to overnight success for Joshua Esnard and The Cut Buddy team. Esnard invented and patented the plastic hair template that he was selling online out of his Fort Lauderdale garage while working a full-time job at Broward College and running a side business. Esnard had hundreds of boxes of Cut Buddies sitting in his home when he changed his marketing plan to enlist companies specializing in making videos go viral. It worked so well that a promotional video for the product garnered 8 million views in hours. The Cut Buddy sold over 4,000 products in a few hours when Esnard only had hundreds remaining. Demand greatly exceeded his supply, so Esnard had to scramble to increase manufacturing and offered customers two-for-one deals to make up for delays. This led to selling 55,000 units, generating $700,000 in sales in 2017. 50 After appearing on Shark Tank and landing a deal with Daymond John that gave the “shark” a 20-percent equity stake in return for $300,000, The Cut Buddy has added new distribution channels to include retail sales along with online commerce. Changing one aspect of a business plan—the marketing plan—yielded success for The Cut Buddy.

Link to Learning

Watch this video of Cut Buddy’s founder, Joshua Esnard, telling his company’s story to learn more.

If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept. This version is used to interest potential investors, employees, and other stakeholders, and will include a financial summary “box,” but it must have a disclaimer, and the founder/entrepreneur may need to have the people who receive it sign a nondisclosure agreement (NDA) . The full business plan is aimed at executing the vision concept, providing supporting details, and would be required by financial institutions and others as they formally become stakeholders in the venture. Both are aimed at providing a picture and roadmap to go from conception to creation.

Types of Business Plans

The brief business plan is similar to an extended executive summary from the full business plan. This concise document provides a broad overview of your entrepreneurial concept, your team members, how and why you will execute on your plans, and why you are the ones to do so. You can think of a brief business plan as a scene setter or—since we began this chapter with a film reference—as a trailer to the full movie. The brief business plan is the commercial equivalent to a trailer for Field of Dreams , whereas the full plan is the full-length movie equivalent.

Brief Business Plan or Executive Summary

As the name implies, the brief business plan or executive summary summarizes key elements of the entire business plan, such as the business concept, financial features, and current business position. The executive summary version of the business plan is your opportunity to broadly articulate the overall concept and vision of the company for yourself, for prospective investors, and for current and future employees.

A typical executive summary is generally no longer than a page, but because the brief business plan is essentially an extended executive summary, the executive summary section is vital. This is the “ask” to an investor. You should begin by clearly stating what you are asking for in the summary.

In the business concept phase, you’ll describe the business, its product, and its markets. Describe the customer segment it serves and why your company will hold a competitive advantage. This section may align roughly with the customer segments and value-proposition segments of a canvas.

Next, highlight the important financial features, including sales, profits, cash flows, and return on investment. Like the financial portion of a feasibility analysis, the financial analysis component of a business plan may typically include items like a twelve-month profit and loss projection, a three- or four-year profit and loss projection, a cash-flow projection, a projected balance sheet, and a breakeven calculation. You can explore a feasibility study and financial projections in more depth in the formal business plan. Here, you want to focus on the big picture of your numbers and what they mean.

The current business position section can furnish relevant information about you and your team members and the company at large. This is your opportunity to tell the story of how you formed the company, to describe its legal status (form of operation), and to list the principal players. In one part of the extended executive summary, you can cover your reasons for starting the business: Here is an opportunity to clearly define the needs you think you can meet and perhaps get into the pains and gains of customers. You also can provide a summary of the overall strategic direction in which you intend to take the company. Describe the company’s mission, vision, goals and objectives, overall business model, and value proposition.

Rice University’s Student Business Plan Competition, one of the largest and overall best-regarded graduate school business-plan competitions (see Telling Your Entrepreneurial Story and Pitching the Idea ), requires an executive summary of up to five pages to apply. 51 , 52 Its suggested sections are shown in Table 11.2 .

| Section | Description |

|---|---|

| Company summary | Brief overview (one to two paragraphs) of the problem, solution, and potential customers |

| Customer analysis | Description of potential customers and evidence they would purchase product |

| Market analysis | Size of market, target market, and share of market |

| Product or service | Current state of product in development and evidence it is feasible |

| Intellectual property | If applicable, information on patents, licenses, or other IP items |

| Competitive differentiation | Describe the competition and your competitive advantage |

| Company founders, management team, and/or advisor | Bios of key people showcasing their expertise and relevant experience |

| Financials | Projections of revenue, profit, and cash flow for three to five years |

| Amount of investment | Funding request and how funds will be used |

Are You Ready?

Create a brief business plan.

Fill out a canvas of your choosing for a well-known startup: Uber, Netflix, Dropbox, Etsy, Airbnb, Bird/Lime, Warby Parker, or any of the companies featured throughout this chapter or one of your choice. Then create a brief business plan for that business. See if you can find a version of the company’s actual executive summary, business plan, or canvas. Compare and contrast your vision with what the company has articulated.

- These companies are well established but is there a component of what you charted that you would advise the company to change to ensure future viability?

- Map out a contingency plan for a “what-if” scenario if one key aspect of the company or the environment it operates in were drastically is altered?

Full Business Plan

Even full business plans can vary in length, scale, and scope. Rice University sets a ten-page cap on business plans submitted for the full competition. The IndUS Entrepreneurs , one of the largest global networks of entrepreneurs, also holds business plan competitions for students through its Tie Young Entrepreneurs program. In contrast, business plans submitted for that competition can usually be up to twenty-five pages. These are just two examples. Some components may differ slightly; common elements are typically found in a formal business plan outline. The next section will provide sample components of a full business plan for a fictional business.

Executive Summary

The executive summary should provide an overview of your business with key points and issues. Because the summary is intended to summarize the entire document, it is most helpful to write this section last, even though it comes first in sequence. The writing in this section should be especially concise. Readers should be able to understand your needs and capabilities at first glance. The section should tell the reader what you want and your “ask” should be explicitly stated in the summary.

Describe your business, its product or service, and the intended customers. Explain what will be sold, who it will be sold to, and what competitive advantages the business has. Table 11.3 shows a sample executive summary for the fictional company La Vida Lola.

Executive Summary Component | Content |

|---|---|

The Concept | La Vida Lola is a food truck serving the best Latin American and Caribbean cuisine in the Atlanta region, particularly Puerto Rican and Cuban dishes, with a festive flair. La Vida Lola offers freshly prepared dishes from the mobile kitchen of the founding chef and namesake Lola González, a Duluth, Georgia, native who has returned home to launch her first venture after working under some of the world’s top chefs. La Vida Lola will cater to festivals, parks, offices, community and sporting events, and breweries throughout the region. |

Market Advantage | Latin food packed with flavor and flair is the main attraction of La Vida Lola. Flavors steeped in Latin American and Caribbean culture can be enjoyed from a menu featuring street foods, sandwiches, and authentic dishes from the González family’s Puerto Rican and Cuban roots. craving ethnic food experiences and are the primary customers, but anyone with a taste for delicious homemade meals in Atlanta can order. Having a native Atlanta-area resident returning to her hometown after working in restaurants around the world to share food with area communities offers a competitive advantage for La Vida Lola in the form of founding chef Lola González. |

Marketing | The venture will adopt a concentrated marketing strategy. The company’s promotion mix will comprise a mix of advertising, sales promotion, public relations, and personal selling. Much of the promotion mix will center around dual-language social media. |

Venture Team | The two founding members of the management team have almost four decades of combined experience in the restaurant and hospitality industries. Their background includes experience in food and beverage, hospitality and tourism, accounting, finance, and business creation. |

Capital Requirements | La Vida Lola is seeking startup capital of $50,000 to establish its food truck in the Atlanta area. An additional $20,000 will be raised through a donations-driven crowdfunding campaign. The venture can be up and running within six months to a year. |

Business Description

This section describes the industry, your product, and the business and success factors. It should provide a current outlook as well as future trends and developments. You also should address your company’s mission, vision, goals, and objectives. Summarize your overall strategic direction, your reasons for starting the business, a description of your products and services, your business model, and your company’s value proposition. Consider including the Standard Industrial Classification/North American Industry Classification System (SIC/NAICS) code to specify the industry and insure correct identification. The industry extends beyond where the business is located and operates, and should include national and global dynamics. Table 11.4 shows a sample business description for La Vida Lola.

Business Description | La Vida Lola will operate in the mobile food services industry, which is identified by SIC code 5812 Eating Places and NAICS code 722330 Mobile Food Services, which consist of establishments primarily engaged in preparing and serving meals and snacks for immediate consumption from motorized vehicles or nonmotorized carts. Ethnically inspired to serve a consumer base that craves more spiced Latin foods, La Vida Lola is an Atlanta-area food truck specializing in Latin cuisine, particularly Puerto Rican and Cuban dishes native to the roots of the founding chef and namesake, Lola González. La Vida Lola aims to spread a passion for Latin cuisine within local communities through flavorful food freshly prepared in a region that has embraced international eats. Through its mobile food kitchen, La Vida Lola plans to roll into parks, festivals, office buildings, breweries, and sporting and community events throughout the greater Atlanta metropolitan region. Future growth possibilities lie in expanding the number of food trucks, integrating food delivery on demand, and adding a food stall at an area food market. After working in noted restaurants for a decade, most recently under the famed chef José Andrés, chef Lola González returned to her hometown of Duluth, Georgia, to start her own venture. Although classically trained by top world chefs, it was González’s grandparents’ cooking of authentic Puerto Rican and Cuban dishes in their kitchen that influenced her profoundly. The freshest ingredients from the local market, the island spices, and her attention to detail were the spark that ignited Lola’s passion for cooking. To that end, she brings flavors steeped in Latin American and Caribbean culture to a flavorful menu packed full of street foods, sandwiches, and authentic dishes. Through reasonably priced menu items, La Vida Lola offers food that appeals to a wide range of customers, from millennial foodies to Latin natives and other locals with Latin roots. |

Industry Analysis and Market Strategies

Here you should define your market in terms of size, structure, growth prospects, trends, and sales potential. You’ll want to include your TAM and forecast the SAM . (Both these terms are discussed in Conducting a Feasibility Analysis .) This is a place to address market segmentation strategies by geography, customer attributes, or product orientation. Describe your positioning relative to your competitors’ in terms of pricing, distribution, promotion plan, and sales potential. Table 11.5 shows an example industry analysis and market strategy for La Vida Lola.

Industry Analysis and Market Strategy | According to ’ first annual report from the San Francisco-based Off The Grid, a company that facilitates food markets nationwide, the US food truck industry alone is projected to grow by nearly 20 percent from $800 million in 2017 to $985 million in 2019. Meanwhile, an report shows the street vendors’ industry with a 4.2 percent annual growth rate to reach $3.2 billion in 2018. Food truck and street food vendors are increasingly investing in specialty, authentic ethnic, and fusion food, according to the report. Although the report projects demand to slow down over the next five years, it notes there are still opportunities for sustained growth in major metropolitan areas. The street vendors industry has been a particular bright spot within the larger food service sector. The industry is in a growth phase of its life cycle. The low overhead cost to set up a new establishment has enabled many individuals, especially specialty chefs looking to start their own businesses, to own a food truck in lieu of opening an entire restaurant. Off the Grid’s annual report indicates the average typical initial investment ranges from $55,000 to $75,000 to open a mobile food truck. The restaurant industry accounts for $800 billion in sales nationwide, according to data from the National Restaurant Association. Georgia restaurants brought in a total of $19.6 billion in 2017, according to figures from the Georgia Restaurant Association. There are approximately 12,000 restaurants in the metro Atlanta region. The Atlanta region accounts for almost 60 percent of the Georgia restaurant industry. The SAM is estimated to be approximately $360 million. The mobile food/street vendor industry can be segmented by types of customers, types of cuisine (American, desserts, Central and South American, Asian, mixed ethnicity, Greek Mediterranean, seafood), geographic location and types (mobile food stands, mobile refreshment stands, mobile snack stands, street vendors of food, mobile food concession stands). Secondary competing industries include chain restaurants, single location full-service restaurants, food service contractors, caterers, fast food restaurants, and coffee and snack shops. The top food truck competitors according to the , the daily newspaper in La Vida Lola’s market, are Bento Bus, Mix’d Up Burgers, Mac the Cheese, The Fry Guy, and The Blaxican. Bento Bus positions itself as a Japanese-inspired food truck using organic ingredients and dispensing in eco-friendly ware. The Blaxican positions itself as serving what it dubs “Mexican soul food,” a fusion mashup of Mexican food with Southern comfort food. After years of operating a food truck, The Blaxican also recently opened its first brick-and-mortar restaurant. The Fry Guy specializes in Belgian-style street fries with a variety of homemade dipping sauces. These three food trucks would be the primary competition to La Vida Lola, since they are in the “ethnic food” space, while the other two offer traditional American food. All five have established brand identities and loyal followers/customers since they are among the industry leaders as established by “best of” lists from area publications like the . Most dishes from competitors are in the $10–$13 price range for entrees. La Vida Lola dishes will range from $6 to $13. One key finding from Off the Grid’s report is that mobile food has “proven to be a powerful vehicle for catalyzing diverse entrepreneurship” as 30 percent of mobile food businesses are immigrant owned, 30 percent are women owned, and 8 percent are LGBTQ owned. In many instances, the owner-operator plays a vital role to the brand identity of the business as is the case with La Vida Lola. Atlanta has also tapped into the nationwide trend of food hall-style dining. These food halls are increasingly popular in urban centers like Atlanta. On one hand, these community-driven areas where food vendors and retailers sell products side by side are secondary competitors to food trucks. But they also offer growth opportunities for future expansion as brands solidify customer support in the region. The most popular food halls in Atlanta are Ponce City Market in Midtown, Krog Street Market along the BeltLine trail in the Inman Park area, and Sweet Auburn Municipal Market downtown Atlanta. In addition to these trends, Atlanta has long been supportive of international cuisine as Buford Highway (nicknamed “BuHi”) has a reputation for being an eclectic food corridor with an abundance of renowned Asian and Hispanic restaurants in particular. The Atlanta region is home to a thriving Hispanic and Latinx population, with nearly half of the region’s foreign-born population hailing from Latin America. There are over half a million Hispanic and Latin residents living in metro Atlanta, with a 150 percent population increase predicted through 2040. The median age of metro Atlanta Latinos is twenty-six. La Vida Lola will offer authentic cuisine that will appeal to this primary customer segment. La Vida Lola must contend with regulations from towns concerning operations of mobile food ventures and health regulations, but the Atlanta region is generally supportive of such operations. There are many parks and festivals that include food truck vendors on a weekly basis. |

Competitive Analysis

The competitive analysis is a statement of the business strategy as it relates to the competition. You want to be able to identify who are your major competitors and assess what are their market shares, markets served, strategies employed, and expected response to entry? You likely want to conduct a classic SWOT analysis (Strengths Weaknesses Opportunities Threats) and complete a competitive-strength grid or competitive matrix. Outline your company’s competitive strengths relative to those of the competition in regard to product, distribution, pricing, promotion, and advertising. What are your company’s competitive advantages and their likely impacts on its success? The key is to construct it properly for the relevant features/benefits (by weight, according to customers) and how the startup compares to incumbents. The competitive matrix should show clearly how and why the startup has a clear (if not currently measurable) competitive advantage. Some common features in the example include price, benefits, quality, type of features, locations, and distribution/sales. Sample templates are shown in Figure 11.17 and Figure 11.18 . A competitive analysis helps you create a marketing strategy that will identify assets or skills that your competitors are lacking so you can plan to fill those gaps, giving you a distinct competitive advantage. When creating a competitor analysis, it is important to focus on the key features and elements that matter to customers, rather than focusing too heavily on the entrepreneur’s idea and desires.

Operations and Management Plan

In this section, outline how you will manage your company. Describe its organizational structure. Here you can address the form of ownership and, if warranted, include an organizational chart/structure. Highlight the backgrounds, experiences, qualifications, areas of expertise, and roles of members of the management team. This is also the place to mention any other stakeholders, such as a board of directors or advisory board(s), and their relevant relationship to the founder, experience and value to help make the venture successful, and professional service firms providing management support, such as accounting services and legal counsel.

Table 11.6 shows a sample operations and management plan for La Vida Lola.

| Operations and Management Plan Category | Content |

|---|---|

Key Management Personnel | The key management personnel consist of Lola González and Cameron Hamilton, who are longtime acquaintances since college. The management team will be responsible for funding the venture as well as securing loans to start the venture. The following is a summary of the key personnel backgrounds. Chef Lola González has worked directly in the food service industry for fifteen years. While food has been a lifelong passion learned in her grandparents’ kitchen, chef González has trained under some of the top chefs in the world, most recently having worked under the James Beard Award-winning chef José Andrés. A native of Duluth, Georgia, chef González also has an undergraduate degree in food and beverage management. Her value to the firm is serving as “the face” and company namesake, preparing the meals, creating cuisine concepts, and running the day-to-day operations of La Vida Lola. Cameron Hamilton has worked in the hospitality industry for over twenty years and is experienced in accounting and finance. He has a master of business administration degree and an undergraduate degree in hospitality and tourism management. He has opened and managed several successful business ventures in the hospitality industry. His value to the firm is in business operations, accounting, and finance. |

Advisory Board | During the first year of operation, the company intends to keep a lean operation and does not plan to implement an advisory board. At the end of the first year of operation, the management team will conduct a thorough review and discuss the need for an advisory board. |

Supporting Professionals | Stephen Ngo, Certified Professional Accountant (CPA), of Valdosta, Georgia, will provide accounting consulting services. Joanna Johnson, an attorney and friend of chef González, will provide recommendations regarding legal services and business formation. |

Marketing Plan

Here you should outline and describe an effective overall marketing strategy for your venture, providing details regarding pricing, promotion, advertising, distribution, media usage, public relations, and a digital presence. Fully describe your sales management plan and the composition of your sales force, along with a comprehensive and detailed budget for the marketing plan. Table 11.7 shows a sample marketing plan for La Vida Lola.

| Marketing Plan Category | Content |

|---|---|

Overview | La Vida Lola will adopt a concentrated marketing strategy. The company’s promotion mix will include a mix of advertising, sales promotion, public relations, and personal selling. Given the target millennial foodie audience, the majority of the promotion mix will be centered around social media platforms. Various social media content will be created in both Spanish and English. The company will also launch a crowdfunding campaign on two crowdfunding platforms for the dual purpose of promotion/publicity and fundraising. |

Advertising and Sales Promotion | As with any crowdfunding social media marketing plan, the first place to begin is with the owners’ friends and family. Utilizing primarily Facebook/Instagram and Twitter, La Vida Lola will announce the crowdfunding initiative to their personal networks and prevail upon these friends and family to share the information. Meanwhile, La Vida Lola needs to focus on building a community of backers and cultivating the emotional draw of becoming part of the La Vida Lola family. To build a crowdfunding community via social media, La Vida Lola will routinely share its location, daily if possible, on both Facebook, Instagram, and Twitter. Inviting and encouraging people to visit and sample their food can rouse interest in the cause. As the campaign is nearing its goal, it would be beneficial to offer a free food item to backers of a specific level, say $50, on one specific day. Sharing this via social media in the day or two preceding the giveaway and on the day of can encourage more backers to commit. Weekly updates of the campaign and the project as a whole are a must. Facebook and Twitter updates of the project coupled with educational information sharing helps backers feel part of the La Vida Lola community. Finally, at every location where La Vida Lola is serving its food, signage will notify the public of their social media presence and the current crowdfunding campaign. Each meal will be accompanied by an invitation from the server for the patron to visit the crowdfunding site and consider donating. Business cards listing the social media and crowdfunding information will be available in the most visible location, likely the counter. Before moving forward with launching a crowdfunding campaign, La Vida Lola will create its website. The website is a great place to establish and share the La Vida Lola brand, vision, videos, menus, staff, and events. It is also a great source of information for potential backers who are unsure about donating to the crowdfunding campaigns. The website will include these elements: . Address the following questions: Who are you? What are the guiding principles of La Vida Lola? How did the business get started? How long has La Vida Lola been in business? Include pictures of chef González. List of current offerings with prices. Will include promotional events and locations where customers can find the truck for different events. Steps will be taken to increase social media followers prior to launching the crowdfunding campaign. Unless a large social media following is already established, a business should aggressively push social media campaigns a minimum of three months prior to the crowdfunding campaign launch. Increasing social media following prior to the campaign kickoff will also allow potential donors to learn more about La Vida Lola and foster relationship building before attempting to raise funds. |

Facebook Content and Advertising | The key piece of content will be the campaign pitch video, reshared as a native Facebook upload. A link to the crowdfunding campaigns can be included in the caption. Sharing the same high-quality video published on the campaign page will entice fans to visit Kickstarter to learn more about the project and rewards available to backers. |

Crowdfunding Campaigns | Foodstart was created just for restaurants, breweries, cafés, food trucks, and other food businesses, and allows owners to raise money in small increments. It is similar to Indiegogo in that it offers both flexible and fixed funding models and charges a percentage for successful campaigns, which it claims to be the lowest of any crowdfunding platform. It uses a reward-based system rather than equity, where backers are offered rewards or perks resulting in “low-cost capital and a network of people who now have an incentive to see you succeed.” Foodstart will host La Vida Lola’s crowdfunding campaigns for the following reasons: (1) It caters to their niche market; (2) it has less competition from other projects which means that La Vida Lola will stand out more and not get lost in the shuffle; and (3) it has/is making a name/brand for itself which means that more potential backers are aware of it. La Vida Lola will run a simultaneous crowdfunding campaign on Indiegogo, which has broader mass appeal. |

Publicity | Social media can be a valuable marketing tool to draw people to the Foodstarter and Indiegogo crowdfunding pages. It provides a means to engage followers and keep funders/backers updated on current fundraising milestones. The first order of business is to increase La Vida Lola’s social media presence on Facebook, Instagram, and Twitter. Establishing and using a common hashtag such as #FundLola across all platforms will promote familiarity and searchability, especially within Instagram and Twitter. Hashtags are slowly becoming a presence on Facebook. The hashtag will be used in all print collateral. La Vida Lola will need to identify social influencers—others on social media who can assist with recruiting followers and sharing information. Existing followers, family, friends, local food providers, and noncompetitive surrounding establishments should be called upon to assist with sharing La Vida Lola’s brand, mission, and so on. Cross-promotion will further extend La Vida Lola’s social reach and engagement. Influencers can be called upon to cross promote upcoming events and specials. The crowdfunding strategy will utilize a progressive reward-based model and establish a reward schedule such as the following: In addition to the publicity generated through social media channels and the crowdfunding campaign, La Vida Lola will reach out to area online and print publications (both English- and Spanish-language outlets) for feature articles. Articles are usually teased and/or shared via social media. Reaching out to local broadcast stations (radio and television) may provide opportunities as well. La Vida Lola will recruit a social media intern to assist with developing and implementing a social media content plan. Engaging with the audience and responding to all comments and feedback is important for the success of the campaign. Some user personas from segmentation to target in the campaign: |

Financial Plan

A financial plan seeks to forecast revenue and expenses; project a financial narrative; and estimate project costs, valuations, and cash flow projections. This section should present an accurate, realistic, and achievable financial plan for your venture (see Entrepreneurial Finance and Accounting for detailed discussions about conducting these projections). Include sales forecasts and income projections, pro forma financial statements ( Building the Entrepreneurial Dream Team , a breakeven analysis, and a capital budget. Identify your possible sources of financing (discussed in Conducting a Feasibility Analysis ). Figure 11.19 shows a template of cash-flow needs for La Vida Lola.

Entrepreneur In Action

Laughing man coffee.

Hugh Jackman ( Figure 11.20 ) may best be known for portraying a comic-book superhero who used his mutant abilities to protect the world from villains. But the Wolverine actor is also working to make the planet a better place for real, not through adamantium claws but through social entrepreneurship.

A love of java jolted Jackman into action in 2009, when he traveled to Ethiopia with a Christian humanitarian group to shoot a documentary about the impact of fair-trade certification on coffee growers there. He decided to launch a business and follow in the footsteps of the late Paul Newman, another famous actor turned philanthropist via food ventures.

Jackman launched Laughing Man Coffee two years later; he sold the line to Keurig in 2015. One Laughing Man Coffee café in New York continues to operate independently, investing its proceeds into charitable programs that support better housing, health, and educational initiatives within fair-trade farming communities. 55 Although the New York location is the only café, the coffee brand is still distributed, with Keurig donating an undisclosed portion of Laughing Man proceeds to those causes (whereas Jackman donates all his profits). The company initially donated its profits to World Vision, the Christian humanitarian group Jackman accompanied in 2009. In 2017, it created the Laughing Man Foundation to be more active with its money management and distribution.

- You be the entrepreneur. If you were Jackman, would you have sold the company to Keurig? Why or why not?

- Would you have started the Laughing Man Foundation?

- What else can Jackman do to aid fair-trade practices for coffee growers?

What Can You Do?

Textbooks for change.

Founded in 2014, Textbooks for Change uses a cross-compensation model, in which one customer segment pays for a product or service, and the profit from that revenue is used to provide the same product or service to another, underserved segment. Textbooks for Change partners with student organizations to collect used college textbooks, some of which are re-sold while others are donated to students in need at underserved universities across the globe. The organization has reused or recycled 250,000 textbooks, providing 220,000 students with access through seven campus partners in East Africa. This B-corp social enterprise tackles a problem and offers a solution that is directly relevant to college students like yourself. Have you observed a problem on your college campus or other campuses that is not being served properly? Could it result in a social enterprise?

Work It Out

Franchisee set out.

A franchisee of East Coast Wings, a chain with dozens of restaurants in the United States, has decided to part ways with the chain. The new store will feature the same basic sports-bar-and-restaurant concept and serve the same basic foods: chicken wings, burgers, sandwiches, and the like. The new restaurant can’t rely on the same distributors and suppliers. A new business plan is needed.

- What steps should the new restaurant take to create a new business plan?

- Should it attempt to serve the same customers? Why or why not?

This New York Times video, “An Unlikely Business Plan,” describes entrepreneurial resurgence in Detroit, Michigan.

- 48 Chris Guillebeau. The $100 Startup: Reinvent the Way You Make a Living, Do What You Love, and Create a New Future . New York: Crown Business/Random House, 2012.

- 49 Jonathan Chan. “What These 4 Startup Case Studies Can Teach You about Failure.” Foundr.com . July 12, 2015. https://foundr.com/4-startup-case-studies-failure/

- 50 Amy Feldman. “Inventor of the Cut Buddy Paid YouTubers to Spark Sales. He Wasn’t Ready for a Video to Go Viral.” Forbes. February 15, 2017. https://www.forbes.com/sites/forbestreptalks/2017/02/15/inventor-of-the-cut-buddy-paid-youtubers-to-spark-sales-he-wasnt-ready-for-a-video-to-go-viral/#3eb540ce798a

- 51 Jennifer Post. “National Business Plan Competitions for Entrepreneurs.” Business News Daily . August 30, 2018. https://www.businessnewsdaily.com/6902-business-plan-competitions-entrepreneurs.html

- 52 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition . March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf

- 53 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition. March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf; Based on 2019 RBPC Competition Rules and Format April 4–6, 2019. https://rbpc.rice.edu/sites/g/files/bxs806/f/2019-RBPC-Competition-Rules%20-Format.pdf

- 54 Foodstart. http://foodstart.com

- 55 “Hugh Jackman Journey to Starting a Social Enterprise Coffee Company.” Giving Compass. April 8, 2018. https://givingcompass.org/article/hugh-jackman-journey-to-starting-a-social-enterprise-coffee-company/

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-4-the-business-plan

© Jan 4, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

- How to Write a Great Business Plan: Financial Analysis

The last article in a comprehensive series to help you craft the perfect business plan for your startup.

This article is part of a series on how to write a great business plan .

Numbers tell the story. Bottom line results indicate the success or failure of any business.

Financial projections and estimates help entrepreneurs, lenders, and investors or lenders objectively evaluate a company's potential for success. If a business seeks outside funding, providing comprehensive financial reports and analysis is critical.

But most importantly, financial projections tell you whether your business has a chance of being viable--and if not let you know you have more work to do.

Most business plans include at least five basic reports or projections:

- Balance Sheet: Describes the company cash position including assets, liabilities, shareholders, and earnings retained to fund future operations or to serve as funding for expansion and growth. It indicates the financial health of a business.

- Income Statement: Also called a Profit and Loss statement, this report lists projected revenue and expenses. It shows whether a company will be profitable during a given time period.

- Cash Flow Statement: A projection of cash receipts and expense payments. It shows how and when cash will flow through the business; without cash, payments (including salaries) cannot be made.

- Operating Budget: A detailed breakdown of income and expenses; provides a guide for how the company will operate from a "dollars" point of view.

- Break-Even Analysis: A projection of the revenue required to cover all fixed and variable expenses. Shows when, under specific conditions, a business can expect to become profitable.

It's easy to find examples of all of the above. Even the most basic accounting software packages include templates and samples. You can also find templates in Excel and Google Docs. (A quick search like "google docs profit and loss statement" yields plenty of examples.)

Or you can work with an accountant to create the necessary financial projections and documents. Certainly feel free to do so... but I'd first recommend playing around with the reports yourself. While you don't need to be an accountant to run a business, you do need to understand your numbers... and the best way to understand your numbers is usually to actually work with your numbers.

But ultimately the tools you use to develop your numbers are not as important as whether those numbers are as accurate as possible--and whether those numbers help you decide whether to take the next step and put your business plan into action.

Then Financial Analysis can help you answer the most important business question: "Can we make a profit?"

Some business plans include less essential but potentially important information in an Appendix section. You may decide to include, as backup or additional information:

- Resumes of key leaders

- Additional descriptions of products and services

- Legal agreements

- Organizational charts

- Examples of marketing and advertising collateral

- Photographs of potential facilities, products, etc

- Backup for market research or competitive analysis

- Additional financial documents or projections

Keep in mind creating an Appendix is usually only necessary if you're seeking financing or hoping to bring in partners or investors. Initially the people reading your business plan don't wish to plow through reams and reams of charts, numbers, and backup information. If one does want to dig deeper, fine--he or she can check out the documents in the Appendix.

That way your business plan can share your story clearly and concisely.

Otherwise, since you created your business plan... you should already have the backup.

And one last thing: always remember the goal of your business plan is to convince you that your idea makes sense--because it's your time, your money, and your effort on the line.

More in this series:

- How to Write a Great Business Plan: Key Concepts

- How to Write a Great Business Plan: the Executive Summary

- How to Write a Great Business Plan: Overview and Objectives

- How to Write a Great Business Plan: Products and Services

- How to Write a Great Business Plan: Market Opportunities

- How to Write a Great Business Plan: Sales and Marketing

- How to Write a Great Business Plan: Competitive Analysis

- How to Write a Great Business Plan: Operations

- How to Write a Great Business Plan: Management Team

The Daily Digest for Entrepreneurs and Business Leaders

Privacy Policy

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.

The balance sheet reports your business's net worth at a particular point in time. It summarizes all the financial data about your business in three categories:

- Assets : Tangible objects of financial value that are owned by the company.

- Liabilities: Debt owed to a creditor of the company.

- Equity: The net difference when the total liabilities are subtracted from the total assets.

The relationship between these elements of financial data is expressed with the equation: Assets = Liabilities + Equity .

For your business plan , you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. A business typically prepares a balance sheet once a year.

Once your balance sheet is complete, write a brief analysis for each of the three financial statements. The analysis should be short with highlights rather than in-depth analysis. The financial statements themselves should be placed in your business plan's appendices.

- Search Search Please fill out this field.

- Financial Statement Analysis

- How It Works

Types of Financial Statements

Financial performance.

- Financial Statement Analysis FAQs

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Financial Statement Analysis: How It’s Done, by Statement Type

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

What Is Financial Statement Analysis?

Financial statement analysis is the process of analyzing a company’s financial statements for decision-making purposes. External stakeholders use it to understand the overall health of an organization and to evaluate financial performance and business value. Internal constituents use it as a monitoring tool for managing the finances.

Key Takeaways

- Financial statement analysis is used by internal and external stakeholders to evaluate business performance and value.

- Financial accounting calls for all companies to create a balance sheet, income statement, and cash flow statement, which form the basis for financial statement analysis.

- Horizontal, vertical, and ratio analysis are three techniques that analysts use when analyzing financial statements.

Jiaqi Zhou / Investopedia

How to Analyze Financial Statements

The financial statements of a company record important financial data on every aspect of a business’s activities. As such, they can be evaluated on the basis of past, current, and projected performance.

In general, financial statements are centered around generally accepted accounting principles (GAAP) in the United States. These principles require a company to create and maintain three main financial statements: the balance sheet, the income statement, and the cash flow statement. Public companies have stricter standards for financial statement reporting. Public companies must follow GAAP, which requires accrual accounting. Private companies have greater flexibility in their financial statement preparation and have the option to use either accrual or cash accounting.

Several techniques are commonly used as part of financial statement analysis. Three of the most important techniques are horizontal analysis , vertical analysis , and ratio analysis . Horizontal analysis compares data horizontally, by analyzing values of line items across two or more years. Vertical analysis looks at the vertical effects that line items have on other parts of the business and the business’s proportions. Ratio analysis uses important ratio metrics to calculate statistical relationships.

Companies use the balance sheet, income statement, and cash flow statement to manage the operations of their business and to provide transparency to their stakeholders. All three statements are interconnected and create different views of a company’s activities and performance.

Balance Sheet

The balance sheet is a report of a company’s financial worth in terms of book value. It is broken into three parts to include a company’s assets , liabilities , and shareholder equity . Short-term assets such as cash and accounts receivable can tell a lot about a company’s operational efficiency; liabilities include the company’s expense arrangements and the debt capital it is paying off; and shareholder equity includes details on equity capital investments and retained earnings from periodic net income. The balance sheet must balance assets and liabilities to equal shareholder equity. This figure is considered a company’s book value and serves as an important performance metric that increases or decreases with the financial activities of a company.

Income Statement

The income statement breaks down the revenue that a company earns against the expenses involved in its business to provide a bottom line, meaning the net profit or loss. The income statement is broken into three parts that help to analyze business efficiency at three different points. It begins with revenue and the direct costs associated with revenue to identify gross profit . It then moves to operating profit , which subtracts indirect expenses like marketing costs, general costs, and depreciation. Finally, after deducting interest and taxes, the net income is reached.

Basic analysis of the income statement usually involves the calculation of gross profit margin, operating profit margin, and net profit margin, which each divide profit by revenue. Profit margin helps to show where company costs are low or high at different points of the operations.

Cash Flow Statement

The cash flow statement provides an overview of the company’s cash flows from operating activities, investing activities, and financing activities. Net income is carried over to the cash flow statement, where it is included as the top line item for operating activities. Like its title, investing activities include cash flows involved with firm-wide investments. The financing activities section includes cash flow from both debt and equity financing. The bottom line shows how much cash a company has available.

Free Cash Flow and Other Valuation Statements

Companies and analysts also use free cash flow statements and other valuation statements to analyze the value of a company . Free cash flow statements arrive at a net present value by discounting the free cash flow that a company is estimated to generate over time. Private companies may keep a valuation statement as they progress toward potentially going public.

Financial statements are maintained by companies daily and used internally for business management. In general, both internal and external stakeholders use the same corporate finance methodologies for maintaining business activities and evaluating overall financial performance .

When doing comprehensive financial statement analysis, analysts typically use multiple years of data to facilitate horizontal analysis. Each financial statement is also analyzed with vertical analysis to understand how different categories of the statement are influencing results. Finally, ratio analysis can be used to isolate some performance metrics in each statement and bring together data points across statements collectively.

Below is a breakdown of some of the most common ratio metrics:

- Balance sheet : This includes asset turnover, quick ratio, receivables turnover, days to sales, debt to assets, and debt to equity.

- Income statement : This includes gross profit margin, operating profit margin, net profit margin, tax ratio efficiency, and interest coverage.

- Cash flow : This includes cash and earnings before interest, taxes, depreciation, and amortization (EBITDA) . These metrics may be shown on a per-share basis.

- Comprehensive : This includes return on assets (ROA) and return on equity (ROE) , along with DuPont analysis .

What are the advantages of financial statement analysis?

The main point of financial statement analysis is to evaluate a company’s performance or value through a company’s balance sheet, income statement, or statement of cash flows. By using a number of techniques, such as horizontal, vertical, or ratio analysis, investors may develop a more nuanced picture of a company’s financial profile.

What are the different types of financial statement analysis?

Most often, analysts will use three main techniques for analyzing a company’s financial statements.

First, horizontal analysis involves comparing historical data. Usually, the purpose of horizontal analysis is to detect growth trends across different time periods.

Second, vertical analysis compares items on a financial statement in relation to each other. For instance, an expense item could be expressed as a percentage of company sales.

Finally, ratio analysis, a central part of fundamental equity analysis, compares line-item data. Price-to-earnings (P/E) ratios, earnings per share, or dividend yield are examples of ratio analysis.

What is an example of financial statement analysis?

An analyst may first look at a number of ratios on a company’s income statement to determine how efficiently it generates profits and shareholder value. For instance, gross profit margin will show the difference between revenues and the cost of goods sold. If the company has a higher gross profit margin than its competitors, this may indicate a positive sign for the company. At the same time, the analyst may observe that the gross profit margin has been increasing over nine fiscal periods, applying a horizontal analysis to the company’s operating trends.

Congressional Research Service. “ Cash Versus Accrual Basis of Accounting: An Introduction ,” Page 3 (Page 7 of PDF).

Internal Revenue Service. “ Publication 538 (01/2022), Accounting Periods and Methods: Methods You Can Use. ”

:max_bytes(150000):strip_icc():format(webp)/Vertical_analysis_final-5a1448af9904473f97b5438ad4bd17fd.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents