You are using an outdated browser no longer supported by Oyez. Please upgrade your browser to improve your experience.

Zebersky Payne Shaw Lewenz is a boutique litigation and trial law firm that handles almost exclusively high-stakes litigation matters. Though its flagship office is in Fort Lauderdale, Florida, Zebersky Payne Shaw Lewenz handles complex commercial litigation, class actions, consumer protection litigation, personal injury, and wrongful death matters across the United States and the world.

11 times Big Brands Violated Consumer Protection Laws

- May 2, 2018 September 21, 2022

- Jordan A. Shaw

With the recent Facebook fiasco, consumer protection and the safety of our personal information is yet again in the public spotlight.

Facebook is not the only big name brand out there who has dropped the ball on consumer’s safety in recent years.

Many brands we know, and trust, have made costly mistakes in regards to keeping their consumers safe. It just does not always hit your newsfeed.

The other problem is, most people are not even sure about what consumer protection means.

It can be fuzzy for most people at times.

That is why: When trying to explain the scope of consumer protection laws to clients (and family members), I always find it best to use everyday examples.In this post, I will show you 11 times when brand names we all know (and trust), violated the Consumer Protection Act.

But, first…

What is consumer protection?

Consumer protection relates to a specific area of law that ensures the ethical and fair treatment of consumers of products and services in the US and promotes a competitive marketplace for the benefit of the consumer.In the US, modern consumer protection law started as early as the 19 th century, when public crises forced the government to respond by creating a body with jurisdiction to oversee products and services offered to the public.

Since then…

Consumer protection laws have evolved to cover topics like ethical marketing and advertising, identity and privacy protection, financial services regulation, deceitful business activities, anti-trust laws and more.

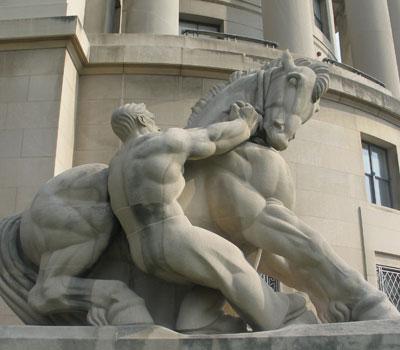

All of this falls under the jurisdiction of the Federal Trade Commission or FTC.

What is the FTC?

Founded by President Woodrow Wilson in 1914, the FTC, or Federal Trade Commission, is a government body created to protect consumers in the US from unethical or unfair treatment and deceptive business practices.

On their website, FTC.gov , the Federal Trade Commission says that it has three goals:

- To protect consumers by preventing fraud, deception and unfair business practices in the marketplace,

- To maintain competition by preventing anti-competitive business practices, and lastly;

- To advance individual and collective organizational performance .

To achieve its goals:

The Federal Trade Commission works closely with people from all sectors, from policy and lawmakers to businesses owners and the public and focuses on three main areas of activities:

1.Advisory Board

The FTC provides research and advice to key national and international governmental agencies to help guide and shape rules that help to maintain a safe and fair marketplace

2 Law Enforcement

The FTC acts as both an investigator and an enforcer. It collects complaints from the public, conducts follow-up investigations and, if necessary, files a lawsuit against the offending entity.

(examples coming up soon)

3. Education

The FTC provides educational workshops and materials for both the general public and business communities to promote a fair and ethical free Global market while educating people on current scams and fraudulent activities of which to remain aware.

11 Times Big Household Brands Violated Consumer Protection Laws

Every year the FTC can process well over a hundred Consumer Protection Act violation lawsuits.

(You can keep an eye on all of them on the FTC’s website .)

If you were to look though, you probably wouldn’t know most of the companies, so it would be harder to relate to for your daily life.

So, to make things easier:

I grabbed 11 consumer protection cases where big brands you know (and trust), violated the consumer protection act.

Let’s take a look…

AT & T’s Misleading Marketing

Ever wonder how “unlimited” phone plans mean that after watching a certain number of videos on YouTube that your internet would still slow down?

So did the FTC in 2014…

That is when:

They brought a formal complaint against AT & T for misleading customers by marketing “Unlimited” plans that…tended to have too many limitations.

(For the FTC, This falls under what is called the Marketing Practices Division)

The FTC’s complaint was that, while AT&T was promoting “Unlimited” plans…

Once consumers passed a certain level of data usage, their service would slow down – by up to 90%.

If that does not sound unlimited to you, it didn’t to the FTC either, who considered it deceitful advertising, and in direct violation of the Consumer’s Protection Act.

Although this case is still in the courts at the date of writing, AT&T is doing their best to try and dismiss this case. However, no luck so far.

Reference: AT & T’s Case

Lenovo Risking All With a 3 rd Party Install

All computers come with “bloatware.”

Bloatware is a nickname used to describe pre-installed applications and programs on new computers. Probably named so because of their tendency to fill up (and slow down) what should be an empty machine. Maybe because of the discomfort they cause too.

Most bloatware is harmless…

…but, that was not the case with one such program, which Lenovo pre-installed on their computers.

VisualDiscovery, a popup ad delivery program, came as part of the package when buying a Lenovo computer.

Unbeknownst to Lenovo, this made them an accomplice in violating the Consumer Protection Act, but not because of the popup ad functionality. Although annoying, it is not technically in breach of consumer protection law (yet).

The issue was:

This 3 rd party program could access whatever sensitive information it wanted on the user’s system. This included their online logins, banking details, and in some cases, their social security number.

All in all, a serious breach of the Consumer Protection Act.

(This is an example of a case which would be handled by the Privacy and Identity Protection Division of the FTC)

To remedy the situation, the courts ordered Lenovo to conduct comprehensive software security audits on any pre-installed software to ensure consumers safety.

Plus, they had to get consumers express permission before activating any such software on their new computer.

Reference: Lenovo’s Case

Dish Network Keeps Calling

Telemarketing calls can be annoying.

When you have already put your name on the national Do Not Call registry and STILL get telemarketing calls, it can be infuriating.

That is what many people felt when Dish Network – in connection with their telemarketing partners – made millions, yes, millions, of robocalls to customers on the “Do Not Call” list.

(what are “robocalls”? We talk more about that in this article)

However, regardless of whether someone is on the registry, it is still in breach of the Consumer Protection Act when you use automatic dialing systems to call people with pre-recorded messages without their express written consent.

This rule is the basis of the Telephone Consumers Protection Act (TCPA), an area of Consumer Protection law.

In the end, a class action suit has held against Dish Network, who were forced to pay 341 million dollars for their violations of the Telephone Consumer Protection Act.

Reference: Dish Network’s Case

DeVry’s Deception

Here’s another example of promising something to consumers that you cannot deliver.

For years, the popular university advertised promises around the idea that their students would find jobs within six months of graduating and would make better money than their peers.

DeVry claimed that as much as 90% of students would have a job within six months of graduating, and would earn up to 15% more than their peers.

A formal investigation from the FTC proved otherwise.

Although it was found to be true that most students did have a job after graduating, many of the jobs were not in the alumni’s field of study.

They found business graduates working as servers in restaurants, and others working in car sales. DeVry also failed to acknowledge that a number of the students who had jobs six months after graduating already had those jobs before graduating .

DeVry’s promise was misleading.

It led consumers to believe that they had a high certainty of obtaining a job within their chosen field after studying with DeVry.

The court agreed that DeVry’s advertising was in direct violation of the Consumer Protection Act.

DeVry ended up paying a $100 Million settlement and had to refrain from such promises in any and all future public communications.

Reference: DeVry’s Case

Amazon’s Child’s play

Back in the 90s and early 00’s (known as the naughty’s), every parent’s biggest fear was getting a surprise momentous phone bill because of their kid’s shenanigans.

It is still a parent’s fear. The only difference is that now it is the App and Play Stores that makes the hairs on the back of their neck stand on their ends.

The good thing is that thanks to the FTC’s hard work, it is not as easy as it used to be for kids to buy 10,000 tokens on Candy Crush or Plants vs. Zombies.

Up until recently…

Companies like Amazon had little in place to protect parents from paying for in-app purchases made by their, less financially astute, children.

This ended up costing parents millions of dollars in app purchases they did not approve.

To remedy the situation:

The FTC stepped in, stating that Amazon must change its in-app purchase processes to protect account holders from paying for purchases they did not willingly make.

Amazon has since instated a refund policy for these occurrences and put new security measures in place to stop children from making large purchases on their parents’ accounts.

As a side note, Apple went through this exact same issue in 2014 for in-app purchases made without a parent’s consent.

Reference: Amazon’s Case

Volkswagen’s Cheated Tests

You probably heard about this example in the news.

In their monumental lawsuit, Volkswagen had to pay more than 14 Billion dollars to fix problems they had caused by deceiving consumers.

What did they do?

Volkswagen cheated emissions tests, reporting that their cars were up to the standards they should have been…

…and they deceived customers about how “eco-friendly” their vehicles were in marketing communications.

These actions put them in violation of both the Environmental Protection Act and the Consumer protection act.

As Deputy Attorney General Sally Q. Yates succinctly described it:

“By duping the regulators, Volkswagen turned nearly half a million American drivers into unwitting accomplices in an unprecedented assault on our atmosphere,”

This is a perfect example of:

How consumer protection violations not only end in costly lawsuits and damages. They also have a ripple effect that changes the market’s view of a company for years to come.

Just like a personal relationship, a consumer’s trust is hard to win back once broken.

Reference: Volkswagen’s Case

Western Union Supports Scammers

If you have ever been scammed online…

…chanced are the transaction took place through a Western Union.

In fact, many overseas scammers rely heavily on the access to international transfers that Western Unions provides.

————–

For example:

Nigerian 419 scams, otherwise known as “advance fee” scams. These (now famous) scams are when a scammer finds a way to manipulate an individual to send them money.

This type of scam usually uses a story that creates an emotional connection with the person to build trust which then leads to favors or asking for help…

Alternatively it involves promises of large sums of money, in exchange for a small fee.

(How many Nigerian Princes have emailed you in the last 12 months?)

There are other countries from where these types of scams originate, but as over 51% of these types of scams originate from Nigeria, these scams are referred to as Nigerian scams.

The criminal code for this kind of scam is 419, explaining the number.

———–

Because so many of such scams successfully used Western Union’s services to complete their transactions, the FTC filed a suit against Western Union in 2014, issuing a 586 Million dollar fine to the company to reimburse those affected between January 2014 and 2017.

If you were affected by a scam operated through Western Union during that period, you can still (as of the time of this writing) apply for a claim in the case. See the reference below.

Reference: Western Union’s Case

Uber’s Two Strikes

Uber is often criticized for its disruptive business model and actions.

But, they crossed the Consumer Protection line with, not one, but two separate accounts of violating the consumer protection act.

The first time was back in 2017.

This is when Uber was caught making hyperbolic promises about how much new Uber drivers could make, explicitly quoting high earnings for both New York and California drivers.

When the FTC conducted their independent research, they found average yearly earnings up to $30,000 lower than claimed by Uber.

This deceitful advertising cost Uber 20 Million dollars in settlements.

The other instant was more recent when it became known that Uber employees were able to access and misuse personal data obtained from ride-sharing contractors.

Although still under investigation…

…it is apparent that an Uber employee’s access key was used to make over 100,000 Uber driver’s bank account details and social security details public.

The severity of this breach is still yet to be seen because such a thing can have lifelong repercussions for the drivers ( a social security number is with you for life)

The case continues…

Reference: Uber’s Case 1 , Uber’s Case 2

7 – Eleven Eats Competition

Consumer protection does not always have to be about deceit or unethical behavior.

It also involves protecting consumers through promoting competition.

When companies have competition, it motivates them to offer the best possible deal to consumers, to “beat” their competitors.

That is why you see many brands trying their hardest to improve quality or lower prices.

In fact, there is a point in Apple’s history where Bill Gates bailed Steve Jobs out of potential bankruptcy precisely for this reason.

Without competition, a business has fewer incentives to lower prices or strive to make better quality products for its customers.

This is why:

When 7 – Eleven announced that it was buying 1,000+ of its competitor’s stores, the FTC took notice.

By doing so, they radically reduced competition within multiple geographical marketplaces, which would lower incentives for them to provide their customers the best prices.

(This falls under the protection subcategory known as anti-trust laws)

In this case, 7-Eleven’s parent company had to agree upon restructuring its deal to maintain a fair level competition in the marketplace.

Reference: 7-Eleven’s Case

Herbalife Pays For the Wrong Reasons

If you have ever been to a seminar hosted by a Multi-level marketing company, you know how many grandiose stories of a person joining and just a few months later being able to quit their job and buy a mansion, you will hear at those events.

The problem is, this is often misleading for new “recruits” who sign up thinking the company will solve all their life’s problems.

When Herbalife, a major international Multi-Level Marketing brand with over 4 Billion dollars in revenues, actively promised new registrants that they would have the opportunity to quit their jobs, make career level incomes and potentially become rich in the process…

A Consumer Protection investigation followed, which proved their claims to be false.

In reality, less than half of all Herbalife salespeople made less than $300 in a single reporting period.

The other problem that surfaced was their benefits structure. As it turned out, Herbalife incentivized the recruiting of new people more than the purchasing of useful goods.

This incentive structure is the basic principle of a pyramid scheme, which is illegal.

All these findings led to a $200 million dollar lawsuit and a court order to restructure their business model and payment structures.

Reference: Herbalife’s Case

Lending Club’s Hidden Fees

Nobody likes hidden fees . Especially the Consumer Protection Act.

The Lending Club is a popular peer-to-peer lending platform that connects those they call investors, interested in lending money at an interest rate, with borrowers.

This peer-to-peer lending platform promoted its services as free of “hidden fees” or surprises, but this was not true.

Investigations found that the Lending Club issued hidden charges that ended up costing their customers hundreds, or even thousands, of dollars more than they thought they would have to pay.

Furthermore:

Many potential borrower clients received congratulatory emails insinuating they had passed all criteria to obtain a loan, before Lending Club’s final credit history checks, which could often result in a final rejection for the loan.

In early 2018, Lending Club was sued for deceitful marketing activities and unlawful hidden fees.

Want to know how to avoid hidden fees? Read this post.

What did you think?

In my opinion, these examples are a reminder that we, the consumers, can’t just rely on companies to do the right thing. It’s our duty to stay vigilant and keep our eyes out for unethical behavior in the marketplace. Every one of us can help to keep big corporations honest.

If you have experienced a violation of the Consumers Protection Act, leave a comment below.

Or, better yet; give us a call. 1+ (877) 722-5943

(954) 989-7781 (954) 989-6333

Hablamos Español and Nós Falamos Portugues

RECENT NEWS

PractICE AREAS

- Commercial Litigation

- Personal Injury

- Consumer Litigation

- Class Action Litigation

- Insurance Litigation

- Healthcare Litigation

- Business Law

- Real Estate

Top 10 Case Study on Consumer Rights

We know consumer laws and courts exist, but only by reading through some case law can you understand how you as a consumer can exercise your rights!

Table of Contents

On an everyday basis, we purchase products and services. From our basic necessities like food and clothing to services like banking and education, we are dependent on companies and organisations to live comfortably in the present day, and we give them our hard-earned money in return. But sometimes, companies might fail to provide quality services or products. Many know there exist consumer courts and laws that protect consumers from consumer exploitation . But have you ever wondered who goes to these courts and what types of cases are filed? You would be surprised to know how basic these cases can be. So, here are 10 interesting case study on consumer rights curated for you.

Top 10 Case Studies on Consumer Rights

1. banks can’t always escape using ‘technical difficulties’.

We have come to rely on banks so much. A recent case study on consumer rights highlighted the need for stronger regulations. More than ever, most of our transactions are digital and heavily reliant on banks for these. Have you ever had your transaction fail due to the server being down or other errors?

Dipika Pallikal, a squash champion and Arjuna awardee found herself in an awkward situation when she used her Axis Bank Debit Card in a hotel at Netherlands’ Rotterdam failed. She had had 10 times the bill amount in her account at that time. Due to this, she faced a loss of reputation and humiliation. The bank said the incident was a case of ‘ Force Majeure’ (an act of god/ something beyond control)

Apart from that, the bank had also returned a cheque of ₹1 lakh issued to her by the government of India and blamed it on a technical error.

Dipika moved the consumer court in Chennai against Axis Bank

Court Decision

The court found that there was a deficiency of service on the part of Axis Bank and directed the bank to pay a compensation of ₹5 lakh and ₹5000 as expenses.

Key Takeaway

Banks are like any other service provider. We trust them with our money and they must perform the services we were promised. They cannot hide behind ‘technical difficulties’ or ‘ force majeure ’ and let customers suffer for it.

2. You Don’t Have to Be a Celebrity to Win a Consumer Case

A humble tea vendor, Rajesh Sakre, is an example of this. He had ₹20,000 in his State Bank of India account and had withdrawn ₹10,800. On his next visit to the ATM, however, he realized all his money was gone. When he asked the bank authorities they blamed it on him.

So, he went to the District Consumer Disputes Redressal Forum with his grievance. He couldn’t afford a lawyer and he argued the case himself. This case study on consumer awareness presents insights into how consumers are becoming more vigilant.

The forum ruled in his favor and ordered the State Bank of India to return the ₹9,200 with 6% interest, pay ₹10,000 as compensation for mental anguish caused by the issue, and ₹2,000 for legal expenses.

It doesn’t matter who you are, as long as you have a valid case you can approach the Consumer Cases Forum. And even big companies and government entities like the State Bank of India can be made to answer for their mistakes.

3. Not All Free Items Are Welcome

Imagine you bought a bottle of Pepsi and found a packet of gutka floating in it! It happened to Rajesh Rajan from Ahmedabad when he bought Pepsi from a local store. He sent a legal notice for defective goods to the company immediately and approached a Consumer Cases Dispute Redressal Forum. Every case study on consumer complaints tells a unique story of a consumer’s journey towards justice.

Moreover, he claimed that there was a deficiency in service that could have caused a health hazard to him. He demanded compensation of ₹5 lakh for the same.

The consumer forum passed an order in favor of Rajesh Rajan and directed the company to pay a total of ₹4008 (₹4000 for compensation and ₹8 for the Pepsi he purchased).

Rajesh moved the State Consumer Dispute Redressal Commission, asking for higher compensation as ₹4008 was too low and he had spent ₹500 on sample testing itself. The State Commission passed an order asking the company to pay ₹20,000 as compensation and ₹2000 towards costs as it found Rajesh’s argument reasonable.

Free items are not all welcome! It is a deficiency in service on the part of the provider if you find anything in your food (packaged or otherwise) that isn’t supposed to be there. The Consumer Cases Forums are a good place to take them.

4. Paying More Than the MRP? You Shouldn’t.

It has become common to charge more than the maximum retail price (MRP) for packaged goods. Especially in places like theatres, food courts, railway stations, etc, we see this happen a lot and mostly ignore it. Among the prominent consumer cases last year, the MRP case stood out for its complexity

Mr Kondaiah from Andhra Pradesh, on the other hand, didn’t ignore it when he noticed that Sarvi Food Court charged him ₹40 for a water bottle where the MRP was ₹20. He filed a case against them in the District Consumer cases Disputes Redressal Forum for ‘unfair trade practice’. He supported his claim by producing the bill. The MRP case study on consumer rights brought to light some gaps in the existing regulations.

The court decided in favour of Mr Kondaiah and said that a practice is not justified just because it is widely common. Mr Kondaiah was awarded a compensation of ₹20,000, ₹20 (the extra money charged) and ₹5,000 in costs.

No authority has the power to charge above the MRP for any packaged goods. It doesn’t matter where it is sold, you are not required to pay a rupee above the MRP.

5. No MRP at All on the Product?

Baglekar Akash Kumar, a 19-year-old got a book and ₹12,500 because of the book. How? He purchased the book online and when it was delivered, he noticed that there was no MRP mentioned in it. He browsed the internet and saw that the book was sold at different prices in different places.

So, he went to the consumer cases forum and filed a case against Penguin Books India Pvt. Ltd and the paper company.

The court held that not publishing MRP on the product without a valid reason is an ‘unfair trade practice’. MRP exists to ensure that a consumer is not overcharged for the product. So, it is mandatory for companies to print MRP.

The publishers were asked to print the retail price of the book and Akash was awarded ₹10,000 as compensation and ₹2,500 as costs.

It is required under law for companies to put MRP on every product. If you see a product without MRP, then it is a violation of Consumer Cases Protection Laws and you can take them to court.

6. Medical Services Fall Within the Scope of the CPA

Do medical services fall under CPA? When there was a little confusion in this regard, the Indian Medical Association (IMA) decided to get this question resolved once and for all. The CPA case study on consumer rights brought to light some gaps in the existing regulations. The Medical Services case study on consumer complaints became a landmark case in consumer rights advocacy.

IMA approached the Supreme Court, asking them to declare that medical services are out of the scope of the CPA. They gave the following arguments to support their claim:

- Medical professionals are governed by their own code of ethics made by the Medical Council of India.

- In the medical profession, it is hard to guarantee the end result of treatments. Many external factors which are out of the control of the professional can impact the outcome. So, allowing consumer claims will cause people to file a case whenever a treatment doesn’t work out.

- There are no medical science experts in the consumer complaints online.

- Medical service provided by government hospitals will not fall under the Act especially when the service is provided for free.

These were decent points. After consideration, the court settled the claims in the following manner.

Medical services provided by any professional (private or government) will be covered by CPA. This means people can file a case in a Consumer Court if the service provided is not in confirmation with the Act.

- Doctors and hospitals who treat patients for free cannot be sued by a person who availed their services for free.

- In a government hospital, where services are provided free of charge – the Consumer Protection Act India would not apply.

Apart from these two exceptions, the Act will apply when a person gets treated in government hospitals for free, when a poor person gets treated for free, and when insurance money is used for treatment.

7. Tired of the False Claims Made by Skin and Hair Care Products Yet?

Maybe you are not tired yet or you are too tired to question. However, a 67-year-old man from Kerala’s remotest areas was tired of these consistent lies and how companies got away with them.

In 2015, K Chaathu complained against Indulekha (beauty product manufacturers) and Mammootty (an actor who was the brand ambassador of the company) for putting up misleading ads. The tagline of the soap was ‘soundaryam ningale thedi varum’ which meant ‘beauty will come in search of you. The ads also claimed that people using the soap would become ‘fair’ and ‘beautiful’ but the 67-year-old didn’t become fair or beautiful.

Funny, right?

Compensation Paid

Indulekha paid him ₹30,000 in an out of court settlement while the initial claim of Chaathu was ₹50,000. When he was asked about this, he said that this case was never about the money but about how these companies put up advertisements every day with false claims. And it is not okay to let these people get away with it.

Key Takeaways

Advertisements are made to sell the products, so exaggeration of results is too common. But this doesn’t make it okay to make false claims just for the sake of selling the products. Making false claims in violation of the CTA.

8. Homebuyers Are Consumers

Imagine you decide to buy a house (a dream come true for many). You do a lot of research, pool your hard-earned money, and pay a real estate developer to build the house for you. They promise to deliver within 42 months but 4 years later they haven’t even started construction.

This is what happened to two people and they decided to move the National Consumer Disputes Redressal Commission (NCDRC) for it. The Homebuyer’s case study on consumer rights was instrumental in changing local regulations.

NCDRC decided in favour of the homebuyers and asked the real estate developer to refund the money with a simple interest of 9% per annum. They were also awarded a compensation of ₹50,000 each.

The real estate developer challenged this in the Supreme Court, saying that the issue is covered under another Act (Real Estate (Regulation and Development) Act) and therefore cannot be taken in a consumer court. But the Supreme Court denied their argument saying that as long as the other Act explicitly stops people from getting remedy under other laws, they will be allowed to do so.

Our laws are in such a way that even though there are other remedies available, in most cases where you are a buyer of a product or a service, you will have protection under the Consumer Protection Act.

9. Insurance Claims Cannot be Rejected on Mere Technicalities

We pay the premium and get insurance to protect us from losses we can’t foresee. Sadly, many people have had bad experiences with the insurance company. Om Prakash, for example, had his truck stolen and claimed insurance for the same. The truck was stolen on 23.03.2010, the FIR was filed on 24.03.2010, and the insurance claim was filed on 31.03.2010.

The insurance investigator was sent and he confirmed that the claim was genuine. The claim was approved for the amount of ₹7,85,000/-. But the amount was never given to Om Prakash. With the rise in consumer court cases , companies are now more cautious about their policies and practices. When he sent the insurance company a legal notice for the same, they replied saying that there was a breach of terms and conditions:

“immediate information to the Insurer about the loss/theft of the vehicle”

Om Prakash was late to apply for insurance because he was held up by the police to try and recover his vehicle.

While the consumer courts didn’t allow his case, the Supreme Court allowed his appeal and held in favour of him. It was ruled that insurance companies cannot escape from paying the claimants on technical grounds. Especially when the claimant has valid reasons for it.

The Court directed the Respondent company to pay a sum of ₹8,35,000/- to the Appellant along with interest @ 8% per annum. He was also awarded ₹50,000 as compensation.

Over the years, many judgments have been made to ensure that insurance companies are accountable and do not escape from paying valid claims. If you experience a similar situation with your insurance provided, you can approach the consumer court.

10. iPhone 5S Gold for ₹68 + ₹10,000

Let’s close the list with a fun one! How would it be to get an iPhone at just ₹68? In 2014, Nikhil Bansal (a student) saw this unbelievable offer on Snapdeal (a discount of ₹46,651) and ordered it immediately as any sane person would. He received an order confirmation but later he was told that the order was canceled. They claimed that the offer itself was a technical glitch. “The iPhone case study on consumer complaint showcased the challenges consumers face even in today’s digital age.

When he approached the e-commerce consumer complaints India Forum, he claimed that these kinds of offers were misleading people and it was the duty of Snapdeal to honour the order. The forum ruled in his favor and asked Snapdeal to deliver him the iPhone for ₹68 and asked him to pay a compensation of ₹2,000.

When Snapdeal appealed this order, the compensation was raised to ₹10,000!

Key Takeaway – Case Study on Consumer Rights

E-commerce stores are just as answerable as any other shop owner under the Consumer Protection Act. So if you face any issues like this with them, consider taking it to the consumer court. Through each case study on consumer rights, we can learn more about our rights and responsibilities

Consumer forums exist to protect consumers from consumer exploitation and ensure that we are not cheated by the companies we pay for getting products or services. Knowing your rights is the first step towards becoming a conscious consumer.

Don’t hesitate to approach the consumer court if you have a valid claim of consumer exploitation . Even if it is for an ₹ 8 product like Pepsi, a valid claim should be taken to the forum.

What is the Consumer Protection Act?

The Consumer Protection Act is a law that safeguards the interests of consumers against unfair trade practices and ensures their rights to quality goods and services.

When was the Consumer Protection Act passed?

The Consumer Protection Act was passed in 1986 and later updated with the Consumer Protection Act, 2019.

Who is a consumer under the Consumer Protection Act?

A consumer is any individual who purchases goods or services for personal use, not for manufacturing or resale.

Who can file a complaint under the Consumer Protection Act?

A complaint can be filed by a consumer, any recognized consumer association, or the Central or State Government on behalf of a consumer.

What is a consumer rights case study?

A consumer rights case study involves analyzing a real-life scenario where a consumer faced issues with a product or service and sought legal resolution under consumer protection laws.

What are consumer cases in India?

Consumer cases in India refer to legal disputes brought by consumers against businesses for grievances related to defective goods, poor services, or unfair trade practices.

What are some examples of consumer rights?

Examples of consumer rights include the right to safety, the right to be informed, the right to choose, the right to be heard, and the right to redressal.

What is the consumer rights class 10 project?

The consumer rights class 10 project typically involves students researching and presenting on the various rights of consumers and how they are protected under the law.

Who is a consumer class 10 SST project?

In the class 10 Social Science (SST) project, a consumer is defined as an individual who purchases goods or services for personal use and is protected under consumer laws.

What is COPRA? (Consumer Operating Protection Regulation Authority)

The Consumer Protection Act (COPRA) is a significant piece of legislation in India aimed at protecting the rights of consumers.…

What is Consumer Privacy and Why is it Necessary?

Understanding Its Significance and Necessity In an era where personal data has become a valuable commodity and digital interactions are…

Consumer Protection Act, 1986: Rights and Filing a Complaint

The Consumer Protection Act, 1986, often referred to as COPRA, is a significant legislation enacted by the Government of India…

Fair Debt Collection Practices Act (FDCPA): Rules, Works and Provisions

The Fair Debt Collection Practices Act (FDCPA) stands as a cornerstone of consumer protection in the United States, aiming to…

Understanding G-Secs and How to Invest in Them for Business?

G-secs refer to government securities or, in other words, loans or capital issued by the government. The biggest advantage associated…

Startups to Continue Receiving a Tax Holiday

Businesses of all sizes and types have been having a tough year courtesy of the coronavirus pandemic. The Indian government…

How the Rupee Depreciation is Enticing NRIs in Real Estate?

The Indian currency has depreciated as much as 5.2% against the US dollar in 2022 so far. The rupee’s depreciation…

Subscribe to our newsletter blogs

- View All Matching Results

New York Consumer Protection Laws Gives Rise to Per-Violation Statutory Damages

Relatively few consumer class action cases reach trial; most are settled or resolved through motion practice. The paucity of cases tried to judgment makes it notable when, as in the case discussed here, one goes all the way to trial and appeal.

Premier Nutrition sold a product called Joint Juice that contained glucosamine and chondroitin, ingredients familiar to anyone who has browsed the supplement aisle. As the name suggests, the product was labeled and promoted for joint health. For example, the packaging stated "Use Daily for Healthy, Flexible Joints" and "A full day's supply of glucosamine combined with chondroitin helps keep cartilage lubricated and flexible." Montera v. Premier Nutrition Corp. , No. 22-16375, 2024 WL 3659589 (9th Cir. Aug. 6, 2024).

According to the plaintiff, the advertising and labelling of Joint Juice was deceptive because glucosamine and chondroitin have no effect on joint function or pain. The case started as a putative nationwide class, but the district court declined to certify a nationwide class. In the wake of that decision, the plaintiffs filed separate cases, each under the laws of a different state.

The first case to proceed to trial was a class consisting of New York purchasers asserting claims under New York law. Two overlapping New York consumer protection statutes prohibit, in part, "deceptive acts or practices in the conduct of any business" and "false advertising in the conduct of any business." N.Y. Gen. Bus. Law §§ 349, 350.

Of importance to this case, the recovery available under these two statutes varies greatly. Although both permit recovery of actual damages, Section 349 authorizes statutory damages of $50, while Section 350 authorizes statutory damages of $500. Neither statute makes clear if statutory damages are calculated on a per-person or per-violation basis and, for reasons that will become apparent, there is no controlling precedent from the New York state courts that provides an answer.

The jury found in favor of the plaintiff class on both its Section 349 and Section 350 claims, finding in pertinent part that Premier Nutrition "engaged in an act or practice that [was] deceptive or misleading in a material way" and that the class suffered injury as a result. Slip op. at *3. It found that 166,249 units of Joint Juice had been sold in New York during the class period and that actual damages were about $1.5 million, based on the average purchase price. Statutory damages, of course, would be much greater. The class sought statutory damages of more than $91 million, which it reached by multiplying $550 by the number of units sold. Although the district court entered judgment on the jury verdict – rejecting Premier Nutrition's motions to decertify the class and for judgment as a matter of law or a new trial – it agreed with Premier Nutrition that an award of $91 million would be constitutionally excessive based on the standard developed in cases limiting the amount of punitive damages. Accordingly, it awarded damages of about $8.3 million, based on $50 per unit.

Both sides appealed. Premier Nutrition sought reversal, and the class argued that the district court erred in not awarding the full measure of statutory damages based on the measure of $550 per unit. A threshold issue was whether the measure of statutory damages under New York law should be calculated on a "per violation" basis or on a "per person" basis. Unless each member of the class made only one purchase, a per-violation basis will yield greater damages. It is also easier to determine, because one need only look to the number of purportedly offending products sold, instead of trying to figure out how many separate individuals purchased them.

In the absence of controlling precedent from the New York state courts, the U.S. Court of Appeals for the Ninth Circuit had to determine if the New York courts would apply the damages provisions of Sections 349 and 350 on a per-person or per-violation basis. Although the court could have certified the question to the New York Court of Appeals (the highest court in the New York court system), it declined Premier Nutrition's request to do without elaboration in a footnote, slip op. at *16 n.15, and determined the issue itself.

The court began with the text of the statutes, which create private causes of action for persons "injured by reason of any violation" of either statute. It concluded that "the plainest reading of that phrase is that a cause of action arises for each violation." Slip op. at *14. It next reviewed the history and development of Sections 349 and 350. Originally, only the state attorney general could sue to enforce them. In 1980, the legislature amended them to add a private right of action and provide for statutory damages, in part to "encourage private enforcement" and "add a strong deterrent against deceptive business practices." In 2007, it increased the amount of statutory damages available under Section 350 to $500 because the existing limit of $50 was "too low to be effective." Id . The court's review of the history of the statutes similarly pointed toward their authorization of statutory damages calculated on a per-violation basis.

Potentially pointing in the other direction was a peculiarity of New York's code of civil procedure, which prohibits maintaining a case seeking statutory damages as a class action. N.Y. C.P.L.R. § 901(b). At least one purpose of this prohibition would seem to be a way to control a defendant's exposure to class aggregation of statutory damages, suggesting that if such a case did proceed as a class action, the intent of the statute would be best served by not permitting a different mechanism to aggregate damages, i.e., to permit a per-violation calculation. The Ninth Circuit saw things differently, concluding that the unavailability of a class action suggested that statutory damages for violations of Sections 349 and 350 should be calculated on a per-violation basis, because a per-person basis in the absence of a class action would provide only a "meager incentive" that would be inadequate to "accomplish the Legislature's express goal of deterring statutory violations." Id . at *14.

Having rejected Premier Nutrition's challenge to the district court's per-violation calculation of statutory damages, the Ninth Circuit turned to the class's argument that the district court erred by not awarding the full measure of statutory damages ($550 per unit for a total of $91 million). On this issue, the class had the benefit of the Ninth Circuit's intervening decision in Wakefield v. ViSalus, Inc. , 51 F.4th 1109 (9th Cir. 2022), which held that the familiar test to determine if punitive damages were constitutionally excessive did not apply to statutory damages. Rather, the standard for statutory damages asks if the award is " extremely disproportionate to the offense and 'obviously' unreasonable." Id . at 1122-23. Given that the intervening Wakefield decision rendered erroneous the district court's analysis based on the test for punitive damages, the Ninth Circuit remanded the case to the district court to apply the test announced in that decision to the statutory damages award based on the jury's verdict.

Readers not familiar with class action jurisprudence might wonder why the plaintiff was able to bring a class action for violation of New York consumer protection statutes as a class action in federal court in California given that the same legislature that enacted these statutes also closed the doors of the New York courthouses to class actions for their alleged violation. Those with a knack for federal civil procedure or experience in the class action field would respond with two words: Shady Grove. Specifically, the U.S. Supreme Court held in 2010 that C.P.L.R. § 901(b) is procedural for Erie purposes and, hence, had no application in federal courts exercising diversity jurisdiction. Shady Grove Orthopedic Associates, P.A. v. Allstate Insurance Co. , 559 U.S. 393 (2010) . Thus, even though this case could not have been brought as a class action in the New York state courts, Shady Grove means that it could proceed as a class action in federal court in California.

The inability to bring this type of case as a class action in New York state court explains the absence of decisions from the New York state courts addressing the per-violation versus per-person issue. Without the ability to proceed as a class, the New York state courts would be an unfavorable forum for consumer false advertising claims, and plaintiffs' counsel would surely avoid them. Hence, the seemingly odd situation in which an unsettled question of New York law of importance to consumer class action cases is unlikely to be resolved by the New York courts absent certification of the question by a federal court faced with the issue.

Related Blog

Related practices, related insights.

Please note that email communications to the firm through this website do not create an attorney-client relationship between you and the firm. Do not send any privileged or confidential information to the firm through this website. Click "accept" below to confirm that you have read and understand this notice.

Have You Seen Us on TV? When you become a Friend of AARP Foundation today, your first monthly gift will be MATCHED!

Public benefits/senior assitance

Job Training

Legal Advocacy

You have the power to change the lives of seniors in poverty .

1 in 3 older adults struggle to meet their basic needs. Your gift can help seniors secure good jobs, get the benefits they've earned, and stay connected to their communities.

- right_container

Get Involved

News & Stories

Executive Leadership

Board Members

Financials & Governance

Our Mission

Empowering Older Workers

Work Programs and Career Support for Older Adults

AARP Foundation Litigation

Grantmaking

Ways to Give

Grant Opportunities

Donate Today

Make a Gift to Help Struggling Seniors

Partnerships

Bring Our Programs and Services to Your Community

Volunteer with Tax-Aide

Help Older Adults Prepare Taxes

Volunteer with Experience Corps

Make a Difference in a Child's Life

Our Programs & Services

Find Local Assistance

Food Security

Make Food More Affordable

Workorce Development

Build Job Training Skills and Coaching

Medicare Savings Programs

Save on Medicare

SCSEP - Paid Job Training

Senior Community Service Employment

Featured Story

After Retirement, A Newfound Career Restores Purpose

Litigation In the News

Is Your Pension Safe?

Food Security Research

Research on Food Security Among Older Adults

2023 Supreme Court Cases Preview

What's at Stake for Older Adults

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Looking Ahead: Consumer

The Court is likely to continue to evaluate consumers’ right to have their day in court in the coming year. In the decade since the Supreme Court decided AT&T Mobility v. Concepcion , 563 U.S. 333 (2011) , clauses requiring mandatory pre-dispute arbitration and prohibiting class actions have proliferated. In Concepcion , the Court held that the Federal Arbitration Act (FAA) preempted a California law under which class-action bans in arbitration clauses were deemed to violate state public policy and, thus, were unenforceable . Id. at 343. As of 2018, at least half of U.S. households and 25 million employees were subject to mandatory arbitration clauses prohibiting class actions.

You have the power to change the lives of seniors in poverty

Make a Gift

The importance of arbitration clauses in civil litigation, thus, continues undiminished, and two cert petitions pending before the Court provide further opportunities for the Court to clarify the reach of arbitration. Both cases, Viking River Cruises, Inc. v. Moriana (No. 20-1573) , and HRB Tax Group v. Snarr (No. 20-1570) , challenge judicial decisions holding that California laws authorizing plaintiffs to proceed in representative capacities are not preempted by the FAA.

AARP Foundation Highlights

Thanks to the support of our donors and partners in 2022, we helped older adults with low income secure more than $726 million in new income, benefits, refunds, and credits.

In Moriana , a plaintiff whose employment contract required her to waive her right to bring a private attorney general action sued her employer under California’s Private Attorneys General Act (PAGA) for allegedly violating California labor law. Moriana v. Viking River Cruises, Inc ., No. B297327, 2020 WL 5584508, at *1 (Cal. Ct. App. Sept. 18, 2020) . Under PAGA, a plaintiff can seek damages against her employer on behalf of herself and other employees if the State declines to intervene in the case. Petition for Writ of Certiorari, at 8, Moriana (20-1573). Those employees receive a quarter of any monetary recovery, with the remaining three-quarters going to the State. Id. at 9. The California Supreme Court has held that Concepcion does not require arbitration of a PAGA claim because such claims represent a dispute between an employer and the State, whereas the aim of the FAA is to ensure efficient resolution of disputes over a litigant’s private rights. Iskanian v. CLS Transportation Los Angeles, LLC , 59 Cal. 4th 348, 384 (Cal. 2014) . (The Ninth Circuit has also rejected a challenge to Iskanian , though on the grounds that PAGA actions do not raise the same efficiency concerns as class actions.) The Viking Cruises cert. petition argues that Iskanian is nearly identical to Concepcion , in that both involved the State declining to enforce an arbitration agreement pursuant to an important public interest and asks the Supreme Court to overrule Iskanian . Petition for Writ of Certiorari, at 2-3, Moriana (20-1573).

The second case, HRB Tax Group v. Snarr , involves a California rule governing “public injunctions,” which are defined as injunctions that have “‘the primary purpose and effect of’ prohibiting unlawful acts that threaten future injury to the general public.’” Snarr v. HRB Tax Group, Inc. , 839 Fed.Appx. 53, 54 (9th Cir. 2020) (quoting McGill v. Citibank, N.A. , 393 P.3d 85, 90 (Cal. 2017)). California case law makes unenforceable a contract that waives the right to seek public injunctive relief in all forums. Snarr , 389 Fed. Appx. at 54. In Snarr , the plaintiff sought a public injunction against HRB, claiming the tax preparation company misleadingly steered tax filers away from a free service and toward a paid one, in violation of California consumer protection laws. Id. at 55. The plaintiff’s arbitration agreement with HRB forbids public injunctions and so is unenforceable under California law, and the Ninth Circuit refused to compel arbitration of the plaintiff’s claim. Id. at 54

In so doing, the court relied on Blair v. Rent-A-Center, Inc. , 928 F.3d 819 (9th Cir. 2019) , a prior circuit case holding that the FAA does not preempt the public-injunction rule. Blair rests on the premises that, unlike the ban on class-action waivers at issue in Concepcion , the public-injunction rule does not single out arbitration and does not undermine the purported efficiency and informality of bilateral arbitration, given that a plaintiff can seek a public injunction in a bilateral arbitration without resort to class-certification procedures. Id . at 827-29

In its petition seeking review of Snarr , HRB rejects these arguments, contending that the rule’s focus on the general public and the higher stakes and complexity at issue undermine the traditional benefits of bilateral arbitration. Petition for Writ of Certiorari, at 16-17, Snarr (No. 20-1573). HRB also argues that, in practice, the public-injunction rule allows plaintiffs to avoid arbitration by seeking public injunctions. Id. at 5. In opposing Supreme Court review, Snarr distinguishes substantively complex claims (like those for a public injunctions) from the procedural complexity at the heart of the Court’s arbitration jurisprudence and notes that the evasion HRB raises can occur only in the particular cases of arbitration provisions drafted as HRB’s is. Respondent’s Brief in Opposition, at 26-27, Snarr (No. 20-1573). Snarr additionally argues that, under Supreme Court precedent, the “FAA does not require enforcement of arbitration provisions that expressly waive statutory claims and remedies,” as HRB’s contract does, and that the public-injunction rule applies equally to all contracts, whether or not they contain arbitration clauses. Id. at 5-6.

If the Supreme Court takes up Viking Cruises or Snarr , we will learn how far the Court is willing to extend its arbitration jurisprudence. Any decisions will have important consequences for consumer litigation in California and other states authorizing private-attorney-general suits and public injunctions.

Ali Naini [email protected]

View the Full Supreme Court Preview

Unlock Access to AARP Members Edition

Already a Member? Login

More From Forbes

Supreme court upholds consumer rights: federal government liable for fcra violations.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

The Supreme Court affirmed consumers’ right to pursue legal action against entities, including the ... [+] federal government, that negligently or willfully neglect to address consumer complaints under the FCRA.

A recent Supreme Court ruling in Department of Agriculture Rural Development Rural Housing Service v. Kirtz , No. 22-846 , rebuffed the federal government’s effort to sidestep a lawsuit arising from inaccurate debt reporting, adversely affecting a Pennsylvania man’s credit. This decision paves the way for potential litigation against the federal government in connection with the Fair Credit Reporting Act .

The U.S. Department of Agriculture’s Rural Housing Service (USDA RHS) provides loans to help build or improve housing and community facilities in rural areas. Reginal Kirtz took out a loan from the USDA RHS. Despite repaying the loan in full, the USDA RHS erroneously reported Kirtz’s loan status as delinquent.

Under the Fair Credit Reporting Act (FCRA), as amended by the Consumer Credit Reporting Reform Act of 1996, consumers retain the right to pursue legal action against lenders who knowingly or negligently furnish false information to credit reporting entities. Kirtz invoked the FCRA to sue the government for non-compliance with the law.

The government initially claimed immunity from Kirtz’s lawsuit, asserting that the FCRA applies to private entities but not the federal government. While a federal judge initially concurred, the Third Circuit overturned this ruling.

The central issue before the Supreme Court was whether the federal government, acting as a lender, could be subject to lawsuits for disseminating inaccurate information in violation of the FCRA or if it could invoke sovereign immunity.

Best High-Yield Savings Accounts Of September 2023

Best 5% interest savings accounts of september 2023.

The FCRA regulates the gathering, disclosure, and utilization of consumer credit data. It applies to various consumer reporting agencies, encompassing credit bureaus, medical information firms, and tenant screening services.

The FCRA safeguards the accuracy and confidentiality of data collected by consumer reporting agencies , stipulating permissible reasons for accessing consumer reports and limiting access to such information. Entities providing information to consumer reporting agencies, known as data furnishers, bear legal responsibilities, including ensuring data accuracy and promptly investigating disputed information.

Sovereign immunity is a legal doctrine that shields a sovereign state, such as the United States government, from being sued without its consent. Sovereign immunity generally protects the government from legal claims seeking damages unless Congress explicitly waives that immunity.

Justice Neil Gorsuch delivered the Court’s opinion and largely upheld the Third Circuit’s decision, emphasizing the FCRA’s unequivocal waiver of sovereign immunity. The opinion noted that while initially focused on consumer reporting agencies and individuals requesting credit information, the FCRA’s definition of “person” broadly includes partnerships, corporations, cooperatives, associations, and governmental entities. The enactment was further broadened in 1996 with provisions targeting entities supplying information to consumer reporting agencies. These provisions mandate that entities correcting inaccuracies in credit reports must promptly investigate and rectify errors.

Gorsuch noted that the federal government is among the largest furnishers of credit information to consumer reporting agencies. The Court’s examination of the statute affirmed consumers’ right to pursue legal action against entities, including the federal government, that negligently or willfully neglect to address consumer complaints under the FCRA.

The Supreme Court’s ruling on the FCRA litigation against the federal government marks a significant milestone in consumer protection and legal accountability. Consumers now have a clear avenue to hold federal agencies accountable for FCRA violations, empowering individuals to seek remedies when their credit reports are inaccurately affected. Federal agencies, including the USDA, must comply with the FCRA’s provisions. They cannot seek sovereign immunity and can be subject to lawsuits if they willfully or negligently supply false information about consumers to credit bureaus.

The Kirtz case reminds all data furnishers to remain vigilant in navigating the evolving landscape of credit reporting regulations and reinforces the principles of accuracy, transparency, and accountability upheld by the FCRA.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

Skip to main navigation

- Email Updates

- Federal Court Finder

Consumer Protection

| Title | Name | Subject Matter | Procedural Posture | Last Updated |

|---|---|---|---|---|

| Southern District of Florida | Consumer Protection, Contract | Motion for Order Approving Settlement Agreement | ||

| Southern District of Iowa | Bankruptcy, Consumer Protection | Motion for Default Judgment | ||

| District of Kansas | Consumer Protection | Evidentiary Hearing, Motion for Summary Judgment | ||

| District of Kansas | Consumer Protection | Jury Trial | ||

| District of Massachusetts | Consumer Protection, Securities/Commodities | Motion for Summary Judgment | ||

| Eastern District of Missouri | Consumer Protection, Contract, Patent, Trademark | Trial |

Starbucks sued for allegedly using coffee from farms with rights abuses while touting its ‘ethical’ sourcing

A consumer advocacy group is suing Starbucks, the world’s largest coffee brand, for false advertising, alleging that it sources coffee and tea from farms with human rights and labor abuses, while touting its commitment to ethical sourcing.

The case, filed in a Washington, D.C., court on Wednesday on behalf of American consumers, alleges that the coffee giant is misleading the public by widely marketing its “100% ethical” sourcing commitment on its coffee and tea products, when it knowingly sources from suppliers with “documented, severe human rights and labor abuses.”

“On every bag of coffee and box of K-cups that Starbucks sells, Starbucks is heralding its commitment to 100% ethical sourcing,” said Sally Greenberg, CEO of the National Consumers League, the legal advocacy group bringing the case. “But it’s pretty clear that there are significant human rights and labor abuses across Starbucks’ supply chain.”

The lawsuit cites reporting about human rights and labor abuses on specific coffee and tea farms in Guatemala , Kenya and Brazil , and alleges that Starbucks has continued to purchase from these suppliers in spite of the documented violations.

"We are aware of the lawsuit, and plan to aggressively defend against the asserted claims that Starbucks has misrepresented its ethical sourcing commitments to customers," said a spokesperson for Starbucks.

In an earlier statement they said, “We take allegations like these extremely seriously and are actively engaged with farms to ensure they adhere to our standards. Each supply chain is required to undergo reverification regularly and we remain committed to working with our business partners to meet the expectations detailed in our Global Human Rights Statement ."

In Brazil, labor officials have cracked down on several reported Starbucks suppliers over abusive and unsafe labor practices in recent years, including garnishing the cost of harvesting equipment from farm workers wages, not providing clean drinking water, personal protective equipment and bathrooms, and employing underaged workers. In 2022, 17 workers, including three minors, were rescued by Brazilian inspectors from “modern slavery,” according to Reporter Brasil , at a coffee farm managed by a man whose coffee roaster company received Starbucks’ seal of certification a month earlier.

In response to the Reporter Brasil stories and reported labor abuses in Kenya and Guatemala cited in the lawsuit, Starbucks issued statements at the time that the company was “deeply concerned,” and that it would “thoroughly investigate” claims of labor violations, “take immediate action” to suspend purchases or “ensure corrective action” occurred.

Starbucks told NBC News it has since taken corrective action in both Guatemala and Kenya.

In a promotional video on its coffee academy website, a Starbucks coffee buyer says the company’s ethical sourcing stamp “means that we are buying coffee, making sure that it’s good for the planet and good for the people who produce it.”

Greenberg said the suit aims to prevent Starbucks from making claims like those — particularly its “Committed to 100% Ethical Coffee Sourcing” advertising — unless the company improves labor practices within its supply chain.

Starbucks, like many companies, uses third-party certification programs to ensure the integrity of its supply chains for tea and cocoa. The company launched its own sourcing standards, called C.A.F.E. Practices, in 2004 to oversee its coffee sourcing in more than 30 countries. The verification program is administered by a company called SCS Global Services in collaboration with Conservation International.

The verification program holds Starbucks coffee suppliers to more than 200 environmental, labor and quality standards. Farms that fail to meet those can be barred from supplying the company until corrective action is confirmed.

But there have long been issues with how effective such programs are, according to experts.

In 2021, Rainforest Alliance, the third-party that certifies Starbucks’ supply chains for tea and cocoa, was sued in D.C. court by another consumer advocacy group over “false and deceptive marketing” of Hershey’s cocoa as “100 percent certified and sustainable.” A judge ruled last year that the case could move forward only against Hershey, as the manufacturer of the products.

Rainforest Alliance did not immediately respond to a request for comment.

“There is this huge pile of evidence that shows that the mechanisms that [certifiers are] relying on to address problems like forced labor, child labor, gender based violence, are extremely flawed and not working very well,” said Genevieve LeBaron, director of the School of Public Policy at Canada’s Simon Fraser University.

“We have incident after incident that’s uncovered in these supply chains. And still, companies go around and make these kinds of claims that they have 100% sustainable or ethical sourcing” said LeBaron, whose research into cocoa and tea has shown that the prevalence and severity of labor violations on certified and uncertified farms was “basically identical."

LeBaron, who has consulted for the United Nations on global supply chain ethics, said the issue is not unique to Starbucks, but ethical commitments from large purchasing players like Starbucks can have an outsize impact on the integrity of supply chains if they are backed up.

Starbucks has 10 “farmer support centers ” in coffee-producing regions around the globe, including Brazil and Guatemala, but does not release public lists of certified suppliers, making it difficult to track how often its suppliers are found to be engaging in labor abuses.

“I think it is really hard to have an ethical supply chain. And I would say, you know, a lot of the reason for that is that, especially in agriculture, there’s a sort of status quo of sourcing goods way below the cost of actually producing them. And as long as you have that, you’re gonna have problems,” LeBaron said.

Kenzi Abou-Sabe is a reporter and producer in the NBC News Investigative Unit.

Adiel Kaplan is a reporter with the NBC News Investigative Unit.

- 608.784.5678

- Alternative Dispute Resolution

- Banking Law

- Business & Corporate Law

- Criminal Defense

- Divorce & Family Law

- Employment & Labor Law

- Estate Planning & Elder Law

- Insurance Law

- Municipal & School Law

- Personal Injury

- Real Estate

- Robert P. Smyth

- Maureen L. Kinney

- Terence R. Collins

- Brent P. Smith

- Ellen M. Frantz

- Steven P. Doyle

- Sonja C. Davig

- Brian G. Weber

- Joseph G. Veenstra

- Brandon J. Prinsen

- Anthony R. Gingrasso

- Justin W. Peterson

- James M. Burrows

- David A. Pierce Jr.

- Katelyn K. Doyle

- Napela Shim

- Insights & Events

- Pay My Bill

Consumer protection cases headline Supreme Court cases in 2021

4 years ago by Joe Veenstra, Consumer Rights Attorney

Supreme Court poised to make some decisions on consumer protection issues

The year before us looks interesting when it comes to several consumer protection matters such as FTC penalties, automatic telephone dialing systems, COVID-19-related class-action lawsuits and other consumer protection issues. Let's take a closer look at the consumer protection-related trends and cases we're keeping an eye on in 2021.

Consumer protection issues at the forefront in 2021

Covid-19 and the possibility of class-action lawsuits.

From masks to hand sanitizer and other PPE meant to stem the spread of the COVID-19 pandemic, consumer goods and services have gone under the microscope. We're watching for a potential spike in complaints and allegations about these items and potential class-action lawsuits.

This comes in the wake of the U.S. Food and Drug Administration easing regulation regarding PPE and related products during the pandemic. As manufacturers attempt to rise to the top, claims of these products' effectiveness could prompt legal action if they don't perform as promised, don't protect consumers as advertised or, in some cases, actually lead to consumer harm.

We're keeping our eyes on several cases, including Archer et al. v. Carnival Corp. et al., as well as Juishan Hsu et al. v. Princess Cruise Lines Ltd., suits that aim to hold luxury cruise providers accountable for passenger exposure to COVID-19 and resulting harm.

Monetary FTC penalties considered by the Supreme Court

Under Section 13(b) of the Federal Trade Commission Act, the FTC can seek the return of what are known as ill-gotten funds through disgorgement. At issue is whether payday loan companies engaged in predatory practices in the case of AMG Capital Management LLC et al. v. FTC. Critics say Section 13(b) is too expansive, leading companies to settle instead of paying steep penalties. If the FTC should lose the case, they could be significantly limited in their efforts to seek monetary remedies via Section 13(b) as an enforcement tool.

The Telephone Consumer Protection Act

Another case before the Supreme Court in 2021 could impact protections under the Telephone Consumer Protection Act (TCPA), which restricts automated telephone dialing systems. In the case of Facebook v. Duguid, Supreme Court justices are considering whether equipment that dials consumer telephone numbers from a preexisting list is legal under the act. If Facebook comes out on top, the number of cases considered under the TCPA would be reduced by the newly-limited scope of protections.

Harm standard for class actions under consideration

The Supreme Court is examining a class action suit that could narrow the scope of consumer classes that can sue for damages. The suit, TransUnion LLC v. Sergio L. Ramirez, dating back to 2012, stems from a claim against TransUnion, a credit reporting agency. Class representative Sergio L. Ramirez claimed TransUnion told lenders he may have matched entries in the national database of criminals and terrorists, and as a result, he was not able to purchase a car. TransUnion maintains there is no proof other class members were injured as Ramirez was, and there is no proof a third party ever saw the inaccurate credit reports on them.

Automatic renewal laws

Automatic renewal laws are also in the spotlight in 2021; these regulations control subscription renewal terms to eliminate unwanted charges. New York state is considering a strict ARL, following California's enactment of similar regulations ten years ago. The change would require affirmative consent from a customer before an automatic renewal is in place for products such as recurring shipments of goods, printed publications and weight loss programs. If New York does enact the regulation, other states may follow suit.

2021: The year in consumer law and trends

In short, 2021 is poised to be an interesting year for consumer laws and trends. The legal implications of the decisions related to these issues can impact the lives of many consumers, regardless of whether they find themselves involved in individual or class action lawsuits of their own. It's worthwhile to stay informed to know where your rights as a consumer begin and end and when it's time to pursue justice with a trusted attorney for consumer issues you encounter.

Select a tag below to view all posts with that subject.

- consumer protection

- consumer law

- class-action

- supreme court

Please Share Me On

- Share on Facebook

- Share on Twitter

- Pin on Pinterest

Latest Posts

- Kreyòl Ayisyen

Enforcement actions

When we take an enforcement action against an entity or person we believe has violated the law, we will post court documents and other related materials here.

The Bureau may enforce the law by filing an action in federal district court or by initiating an administrative adjudication proceeding. Administrative proceedings are conducted by an Administrative Law Judge, who holds hearings and issues a recommended decision. Proceedings are conducted in accordance with the Rules of Practice for Adjudication Proceedings .

- Get definitions for enforcement action terms

Acima Holdings, LLC; Acima Digital, LLC; and Aaron Allred

Fifth third bank, n.a., sutherland global services, inc., sutherland mortgage services, inc., and sutherland government solutions, inc., novad management consulting, llc, pennsylvania higher education assistance agency (pheaa) d/b/a american education services or aes, western benefits group, llc, solo funds, inc., chime financial, inc., pennsylvania higher education assistance agency, and national collegiate student loan trusts, bloomtech inc., d/b/a bloom institute of technology or bloomtech, f/k/a lambda, inc.; and austen allred, stratfs, llc f/k/a strategic financial solutions, llc, et al., colony ridge development, llc; colony ridge bv, llc; colony ridge land, llc; and loan originator services, llc, u.s. bank national association, commonwealth financial systems, inc., atlantic union bank, bank of america, n.a., toyota motor credit corporation, enova international, inc., citibank, n.a., chime, inc. d/b/a sendwave, transunion rental screening solutions, inc. and trans union llc, transunion, trans union llc, and transunion interactive, inc., freedom mortgage corporation, tempoe, llc, heights finance holding co. f/k/a southern management corporation, et al..

Celebrating 20 Years of IP Excellence

Latest Consumer Protection Cases in 2021 – Part 1

The bombay dyeing and … vs ashok narang and anr.

In this case, the Appellant, The Bombay Dyeing and Manufacturing Company Ltd was the builder-promoter whereas Mr. Ashok Narang and others were the allotees/buyers of the flats. It was agreed by the Parties that the possession would be delivered by 2017 at a 20:80 scheme consideration (20% initially and 80% at the time of delivery), in which the Respondents had already made payment of 20% in 2012-13 inclusive of tax and premium. The appellants failed to deliver the flats for possession on the stipulated time and extended it by 2 years. Thus, the Respondents filed a complaint u/s 31 of the Real Estate (Regulation and Development) Act, 2016 (“2016 Act”) before the Authority citing breach u/s 12 read with S. 18 of the 2016 Act seeking cancellation of the allotment and also a refund of the amount they had paid. The Authority did not pass any order regarding the refund stating that S. 12 did not apply retrospectively, and also that the cancellation should be done as per the allotment agreement. Further when appealed before the Appellate authority, it found that S. 12 of the 2016 Act had a retroactive operation and directed the respondent to refund with due interest and also ordered cancellation of the allotments. Consequently, the Appellants approached the Bombay High Court wherein the Appellant-counsel submitted that the provisions of the 2016 Act were prospective in operation and that the written agreement for sale was also absent due to which no liabilities could be imposed upon it as u/s 18. To this, the Respondent-counsel contended that the application of the 2016 Act to an ongoing project itself indicated that the provisions were quasi-retroactive in nature. Also, regarding the absence of a written agreement, it was argued that the Appellant could not be permitted to raise a new contention for the first time in the second appeal, thus it had waived the right to raise any such claims and that could not be allowed to approbate and then reprobate later on. The Court pointed out that no one should be made to wait indefinitely for delivery of possession and thereby held that there was a deficiency of service and disposed of the appeals with no order as to costs.

Citation : The Bombay Dyeing and … vs Ashok Narang and Anr., Decided by Bombay High Court on 30th August, 2021, available at : The Bombay Dyeing and … vs Ashok Narang and Anr , visited on 9th September 2021.

PUNIT JAIN VS M/S. IREO GRACE REALTECH PVT. LTD.