Business Plan Examples for Students

Ajay Jagtap

- December 29, 2023

26 Min Read

Do you know what’s the most common mistake students and rookie entrepreneurs make while preparing their first business plan?

Of course, it’s the first business plan we’re talking about; there’ll definitely be a few. However, overcomplicating things and failing to consider a business plan example still remains the most common one.

That’s why we decided to come up with a solution. We’ve curated this list of top business plan examples for students to help you get going.

So whether you need a business plan for a college project, start a side hustle, or win a business competition, these examples are just what you need to create business plans that stand out.

Ready to dive in? Let’s start by understanding the key elements of a business plan example:

Key Elements of a Business Plan Example

Business planning is not as complicated of a process as people think it is; they’re just overcomplicating things. (Don’t think so?)

Let’s simplify the key elements that make up a comprehensive business plan; you’ll understand it better that way.

- Executive Summary: A high-level overview or summary of your plan.

- Company Overview: A detailed description of your business idea, its fundamental elements, history, and future goals.

- Market Analysis: A study of your external business environment that includes details about your industry, competitors, and target market.

- Products and Services: Description of the products or services you intend to exchange for money.

- Sales and Marketing Strategies: A section outlining sales and marketing strategies your business will implement to achieve its financial goals.

- Operations Plan: A section outlining the business processes and daily activities involved in ensuring seamless business operations.

- Management Team: Introduction to your founders, key management, and their compensation plan.

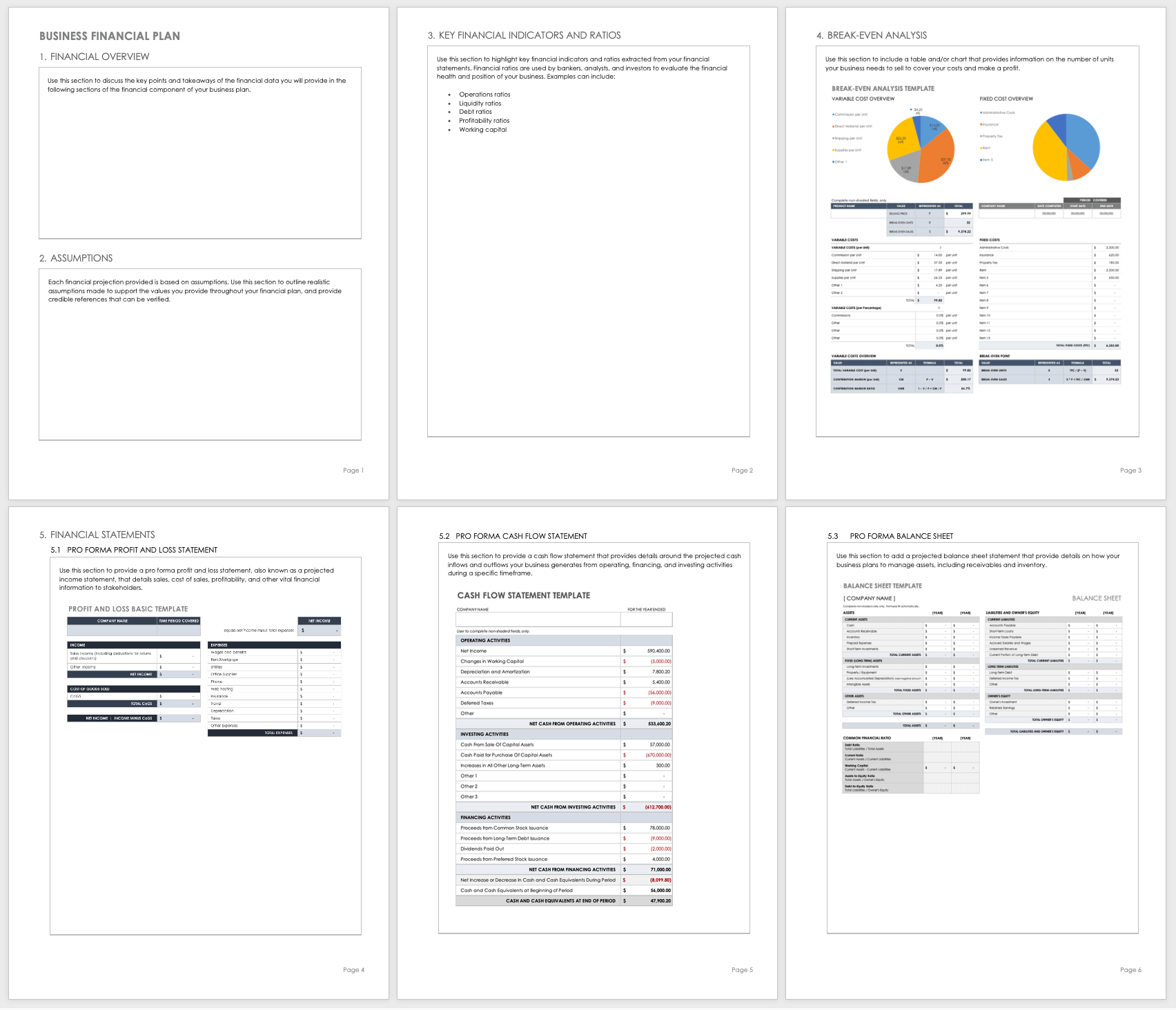

- Financial Plan: Your financial plan is a detailed breakdown of your business’s financial projections and financing needs.

That’s pretty much it about the key elements of a business plan example. Next, let’s explore the best business plan examples for students.

Say goodbye to boring templates

Build your business plan faster and easier with AI assistant

Get 30% off for Students and educators

Top Business Plan Examples for Students

Now that you already know about the components of a business plan template, let’s review some of the best business plan examples for students.

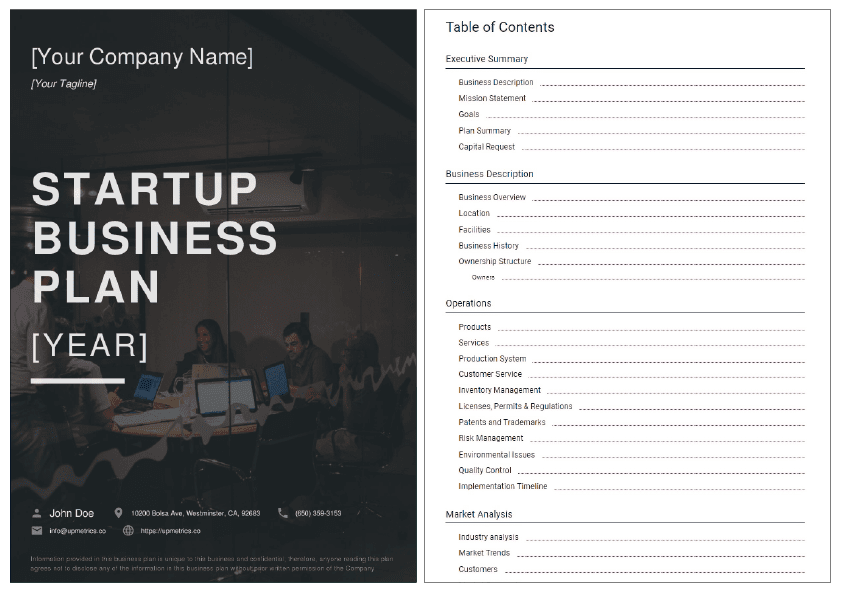

1. Startup Business Plan Example

Upmetrics’ startup business plan example is the ideal solution for students planning to start up or participate in a business plan competition. This business plan template follows the SBA-approved business planning format used by thousands of successful entrepreneurs.

Whether your startup is about a new-age AI-based application, an online shopping site, or traditional IT consulting—this sample business plan is just what you need.

Unlike any traditional small business plan, this example of a startup business plan is lean and agile in approach, focuses on innovation, and emphasizes market validation.

2. Lean Business Plan Example

Since you’re transitioning from a student to an entrepreneur, you may not have enough time to spend on creating a detailed business plan. That’s where this lean business plan template can help.

It’s a condensed version of a traditional plan summarizing all its sections with a primary focus on covering only the critical aspects of the business.

This template is best for startups or businesses uncertain about business planning and student-turned-entrepreneurs with limited time and resources to prepare a business plan.

3. SBA Business Plan Example

Following an SBA-recommended business plan format is key to securing bank loans and business grants. Since it can be time-consuming to find a template that follows a similar outline as the SBA, this SBA-approved business plan example is the way to get started.

This SBA business plan template has nine primary sections, that include executive summary, company description, market analysis, organization, product description, marketing, funding request, and financial projections.

SBA business plan examples ensure you stay on track and don’t deviate from your funding needs.

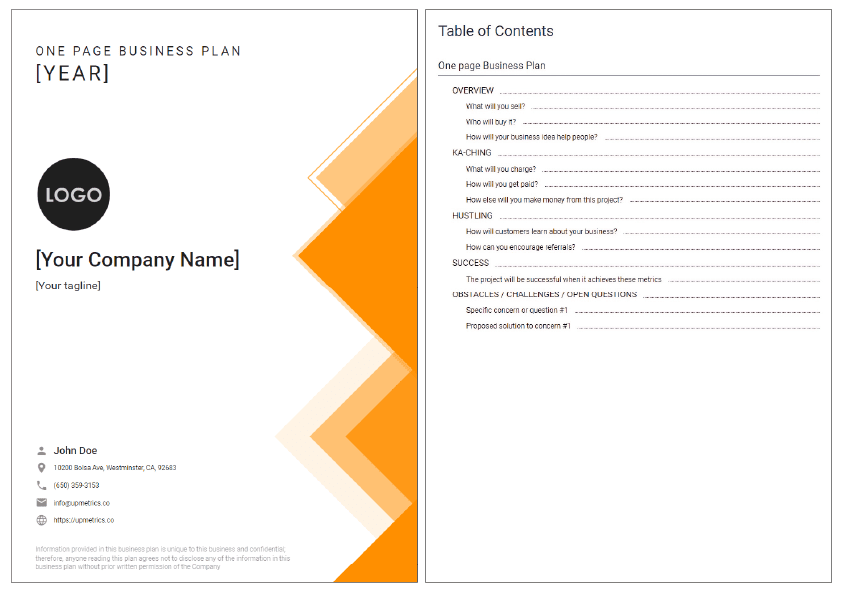

4. One-Page Business Plan Example

As you may have already guessed, a one-page business plan is a one-page version of a traditional business plan. Since it’s a condensed version of a business plan, drafting it can be quite easy and quick compared to a lean or traditional plan.

Employees, partners, and vendors often use one-page business plans as a quick overview of your company and banks and investors as a summary of your operations.

While it may not be the ideal choice for entrepreneurs seeking investment or bank loans, students with side hustles and idea-stage startups can consider this option.

5. HBS Sample Business Plan

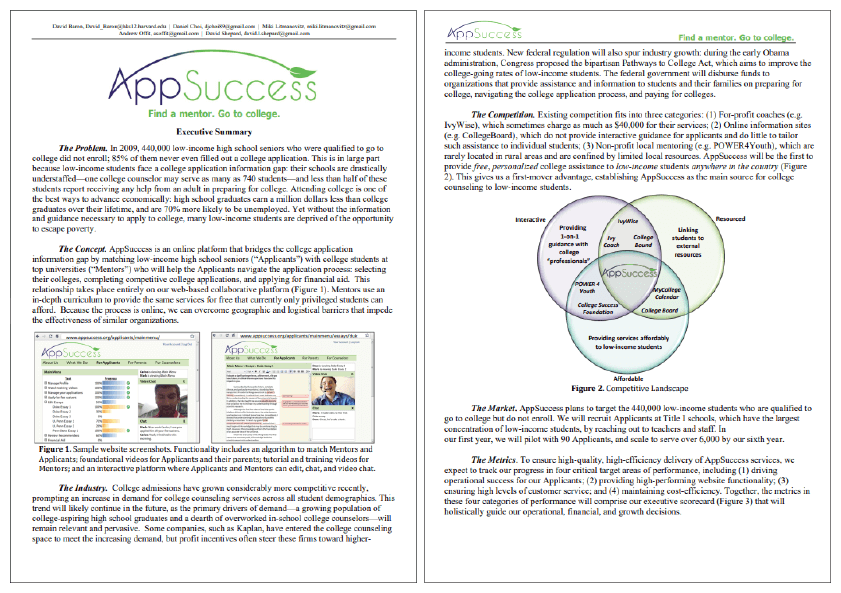

Harvard Business School’s new venture competition selected this sample business plan as a finalist in 2011.

This is a business plan of App Success, a collaborative web-based platform that connects low-income high school seniors with college students from top universities; this business will enable them to collaborate on college selection, college applications, and financial aid applications.

This example can be a great reference for those planning to start a mobile or web-based solution.

6. Kean University Sample Business Plan

Kean University organizes a business plan competition every year for its students where students prepare and present business plans to compete, and this is one of the sample business plans the University provides to participants to understand the format.

It’s a business plan of Blue Water Boatworks, Inc., a boat detailing and cleaning company specializing in servicing recreational fiberglass and aluminum watercraft.

This example can be a great reference for those planning to start a business related to housekeeping, cleaning, or maintenance.

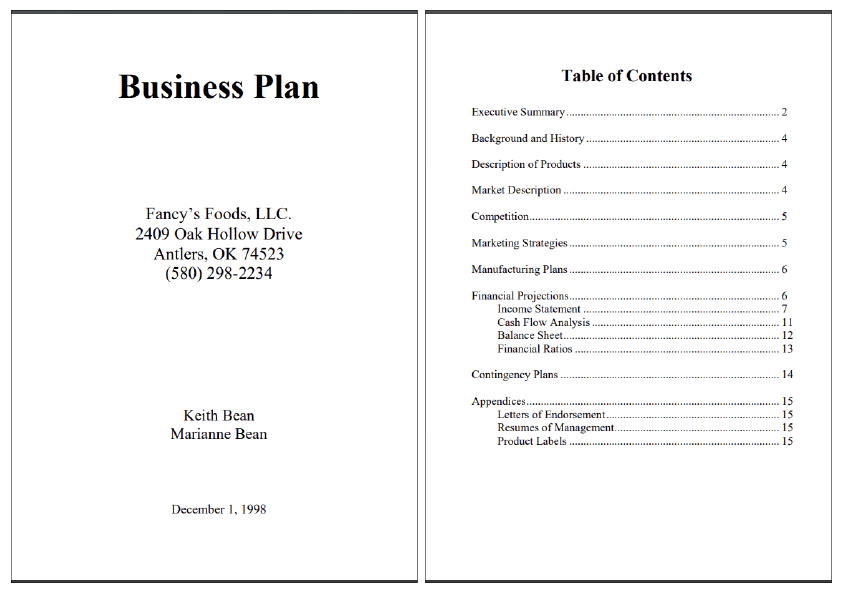

7. UVM Sample Business Plan

If you are looking for a strategic business plan for a food business, the University of Vermont’s Fancy Foods Business Plan can be a guiding resource for you.

Despite the fact that it can be a good reference for detailed planning, it was written in 1998, so any statistics and numbers may not seem relevant to today’s market landscape. Make sure you keep that in mind.

You may closely follow this example as a reference if planning to start a food truck, restaurant, or any other business that serves food.

That was the list of best sample business plans for students. However, there’s more to talk about. You now have a business plan example, but what about pitching to investors? Let’s explore free pitch deck examples for students.

Free Pitch Deck Example for Students

Pitching to investors as a first-time founder can be exciting but also overwhelming at times. Worry not; we’ve got a solution—investor pitch templates. We’ve prepared a set of 8 investor pitch templates and examples for students and entrepreneurs to help create winning business pitches.

Whether you need a pitch to find an opportunity, ask for subject matter knowledge, or a problem-solving pitch, these investor pitch examples have got you covered. Download now.

How to write a winning plan for a business plan competition?

Creating a business plan is no different than creating one for a real business. Similar to how entrepreneurs prepare and present business plans to investors, Students in business plan competitions pitch to judges.

In short, the business planning process remains exactly the same. Let’s discuss how you can write a winning plan to help you win a business plan competition.

- Select a compelling business idea : everything starts with a compelling idea. Make sure you have a viable business idea to compete in the competition.

- Refer to winning business plan examples : Once you are sure about your business concept, refer to business plan examples from previous winners and how they planned the sections of their plan.

- Market Research & Industry Analysis : After referring to business plan examples, conduct industry research and market analysis to make your statistical and financial numbers accurate and realistic.

- Understand business model and revenue streams : Since you are preparing a business plan for a company that doesn’t exist, be sure about the business model and how the business will generate profit.

- Use AI business plan generator : Using an AI business plan generator like Upmetrics can be incredibly helpful in speeding up the business planning process. With industry-specific business plan templates and AI assistance to write your plan, you can write the first draft of your plan in literally no time.

- Presentation and visuals : Prepare visuals and graphs to make your business plan visually appealing and numbers digestible. You may not need to prepare these visuals if you use business plan software manually.

- Proofread and edit : Grammatical errors are the last thing judges want to see in a business plan. Make sure you proofread and edit your draft thoroughly before submitting it.

Easy as that, that’s the way to write a perfect business plan that can lead you to victory in any business plan competition on planet Earth. Let’s have a look at a real-life business and financial plan example.

Business and Financial Plan Example for Students

Having learned about business planning for students, let’s quickly discuss a coffee shop sample business plan and financial statements prepared using Upmetrics.

1. Executive Summary

The Cooper’s Cup will be a new cafe in Phoenix, Arizona. The 1,500 square foot café will be located in the newly constructed Market Square Plaza on the northeast corner of 135th Street and Mission Street. The anchor tenant, the Price Chopper grocery store, has already taken occupancy, and the excellent location brings more than 10,000 shoppers weekly.

The Cooper’s Cup, aptly named for the aromatic brown liquid that will fill the cup, fills the void of original cafes in the market and stands out from its corporate peers with its fast food concepts and prompt services. The Cooper’s Cup is the alternative to fast food/commercial/coffee shops and offers a much calmer, civilized gourmet coffee experience.

There are no televisions in the cafe, the background music is subtle, and work from local artists will hang on the walls. The restaurant is well-appointed, with overstuffed leather chairs and sofas in a library-like setting. The cafe is reminiscent of times gone by – yet is cutting edge technologically with WIFI and state-of-the-art espresso machines.

The Cooper’s Cup measures its financial success in terms of increased market share and earnings. This is a tremendous opportunity with a total local market of $54 million! The keys to success will be offering quality gourmet coffees, taking advantage of its small size, and relying on an outstanding barista staff.

To achieve these goals, the cafe will present some of the area’s finest gourmet beans from local distributors. Because of its small size, the restaurant can enjoy larger margins through lower overhead. The cafe will hand-select baristas and offer salaries comparable to the chains. The baristas will be trained to cross-sell and sell higher-margin products.

The primary objectives of the business plan for Cooper’s Cup are below:

- To increase revenues by $36,000 or 5% in Year 2 and $73,000 or 10% by Year 3

- Achieve a profit margin of 5.2% in Year 2 and 6.90% by Year 3

- Be the Cafe of Choice in the Phoenix area and the recipient of the Best Coffeehouse Award.

Guiding Principles

The Cooper’s Cup is committed to values such as excellence, passion, quality, integrity, and leadership, allowing them to navigate challenges and provide for future opportunities. These core beliefs start with their commitment to their products and their employees. Cooper’s Cup rewards excellence and cherishes loyalty. The cafe will work with its employees to build strong businesses and a secure future.

Mission statement

The Cooper’s Cup is committed to its products and employees, which they believe is the recipe for market success.

Key to success

The Cooper’s Cup stands out from the competition. Below are their Keys to Success:

- Great Products : providing exemplary products at market prices – will make customers want to return again and again.

- Hire Quality Baristas : Pay employees rates similar to the larger chains with opportunities for long-term careers and opportunities for advancement with long-term plans to open a second facility.

- Convert Customers to Connoisseurs : Only 40% of the nation’s coffee drinkers consume premium ground and whole bean coffee – this will aid in the continued growth.

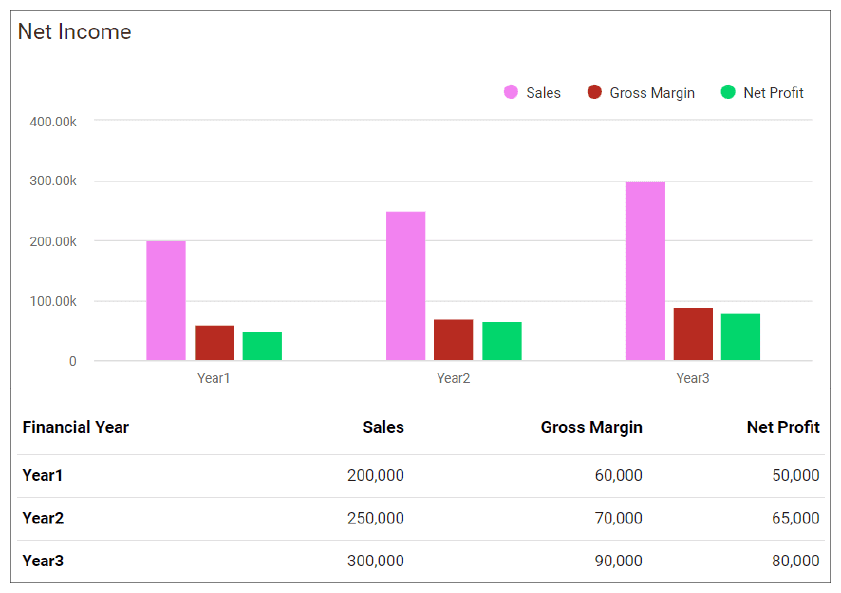

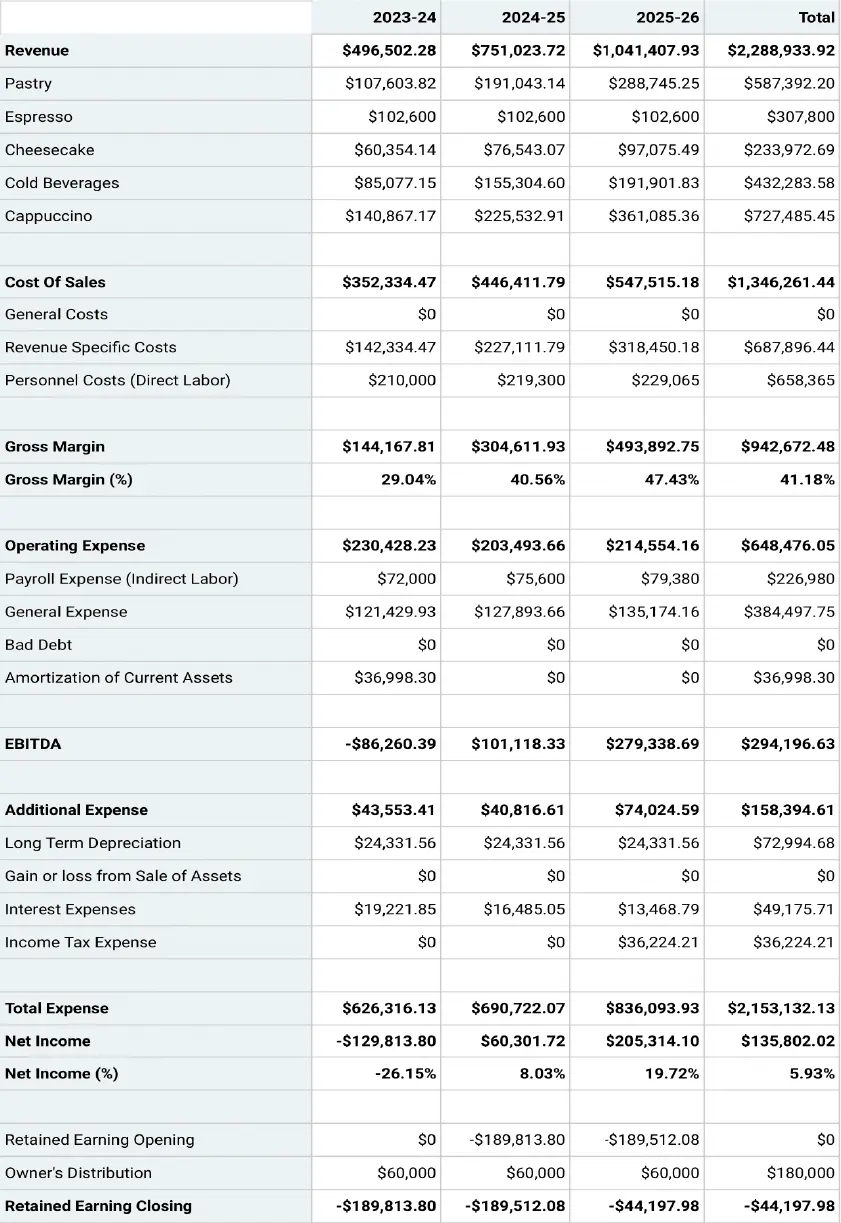

Financial Summary

2. Business Overview

The Cooper’s Cup will be a coffee house/cafe located in Phoenix, Arizona. The cozy cafe will be located in the newly completed Market Square Plaza in the Arizona City area. The cafe will serve gourmet coffee, espresso, drip coffee, lattes, and smoothies. The simple pastry offerings may vary with seasonality, but the primary line will be muffins, bread, cookies, scones, and rolls. All pastries will be supplied daily by a local bakery.

The cafe will be owned and operated by Owen Jones, a veteran restaurateur with several years of experience running and managing chain restaurants. The cafe will be open for business Monday – Thursday 7-10, Fridays and Saturdays, 7-11, and closed Sundays.

The Cooper’s Cup will be formed as an S-Corporation owned by Mr. Doe.

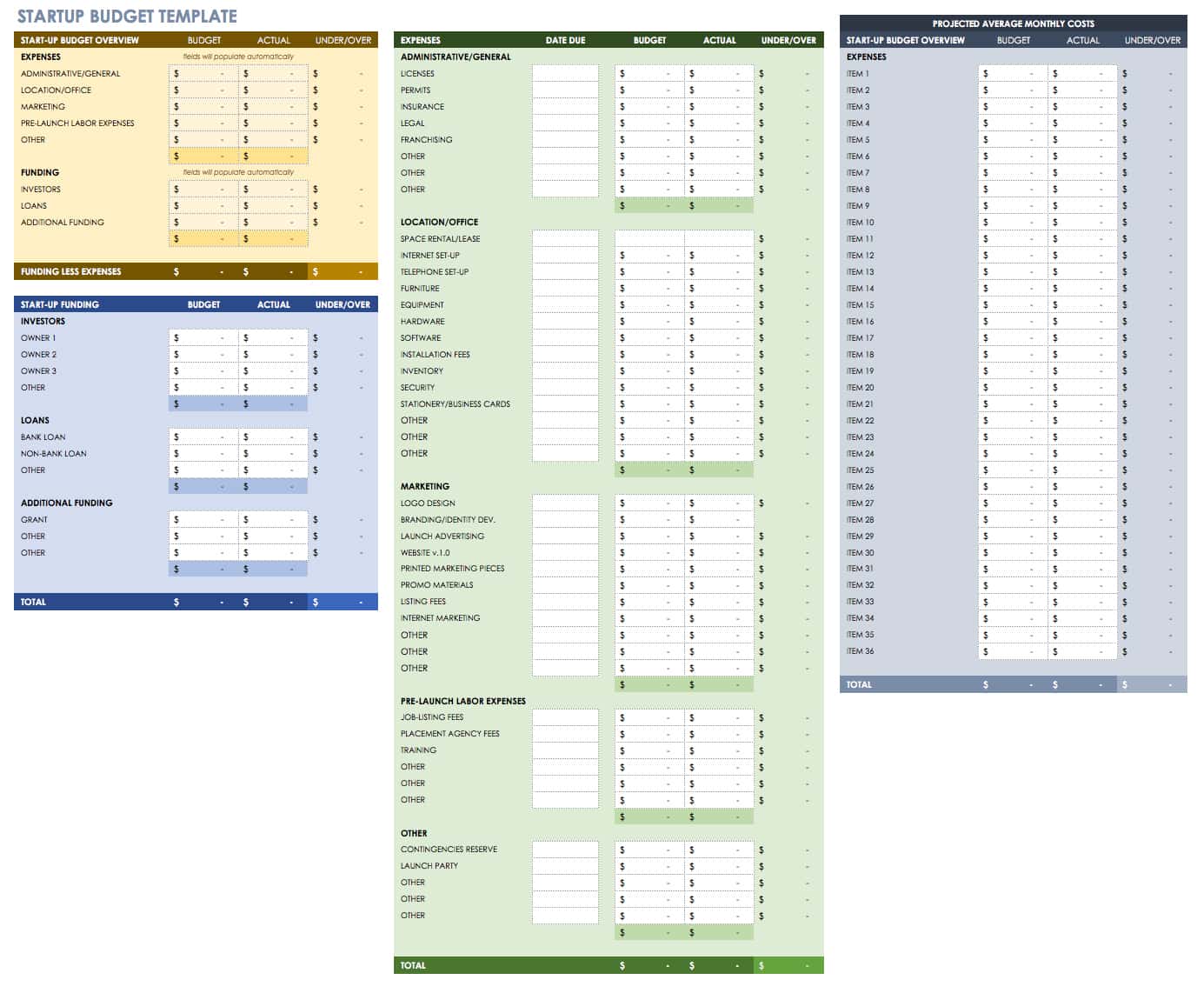

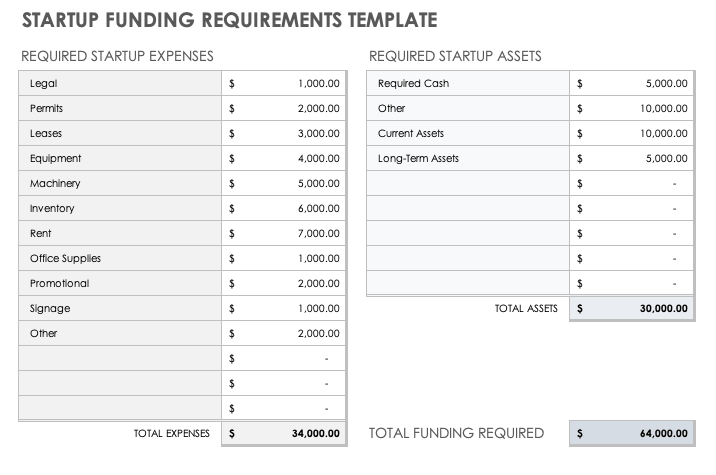

Start-Up Summary

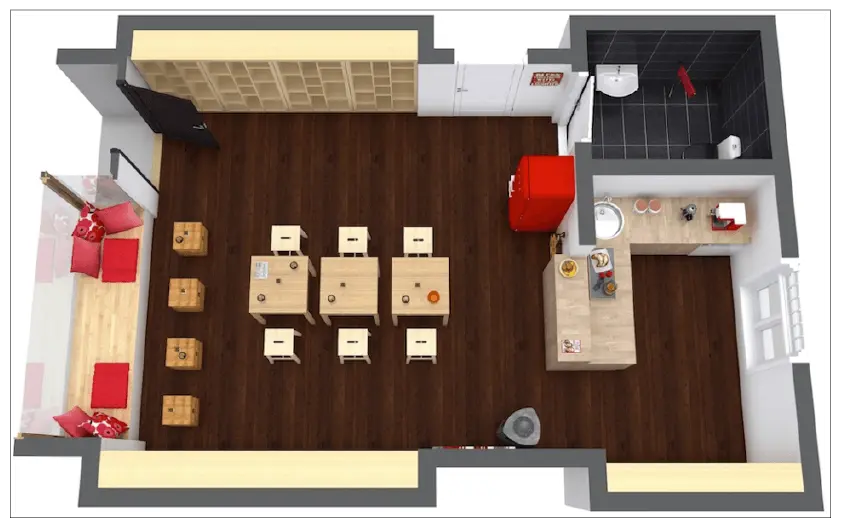

The Cooper’s Cup will have seating for 40 patrons. The rent is $2,075 a month, with a three-five-year lease available. The site comprises 1500 square feet of leased space consisting of a dining room, a coffee bar, two restrooms, and a storage room in the back.

This storefront needs to be plumbed and wired appropriately to be used as a restaurant. Painting, new floors, and countertops are also needed. A custom coffee bar needs to be built. With materials bought on sale and volunteer labor, the cost to renovate will be $71,725.

The coffeehouse equipment will consist of two commercial espresso machines, air pots and urns, a commercial blender, a commercial brewer, top-loading coffee bins, barista syrups, cold drink dispenser, frothing equipment, a commercial refrigerator, microwave, and stainless steel prep bar.

The cost of the equipment is $38,275. The furniture will consist of leather couches and chairs (purchased at auction), coffee tables, bookcases, and window treatments. The artwork will come from local artists and be sold on a consignment basis. The books were secured via donations. The total cost to furnish is $14,000. Other startup expenses will be dishes, furniture, rent deposit, and marketing.

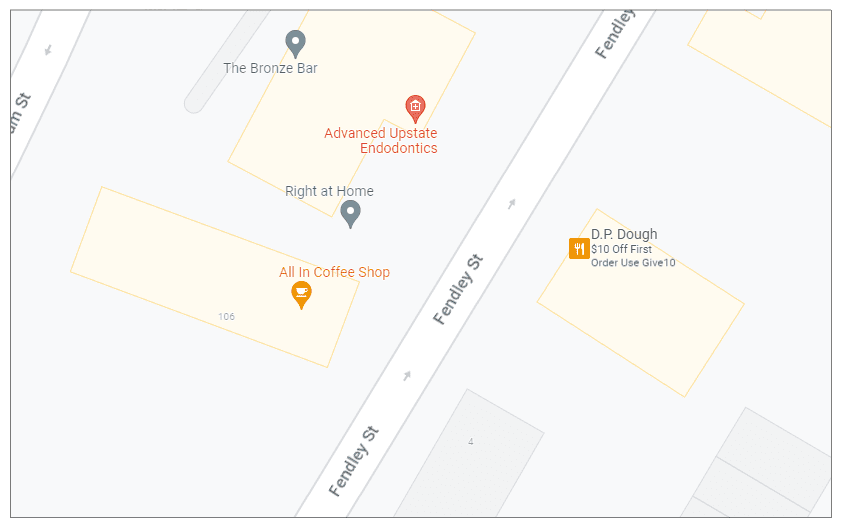

Location and Facilities

The new coffeehouse is located in the highly desirable Phoenix, Arizona, area at the northeastern intersection of 135th Street and Mission Street in the Newmarket Square Plaza. The property is situated in an excellent location, with an easy 6-minute drive time to I-435 and 69 Highway.

The property is 95% leased with Price Chopper as the Anchor Tenant. Other tenants include LifeSpring Med Spa, Jane’s Canines (Pet Store & Boarding), Pride Cleaners Kahn Dental, and Swim U.

Price Chopper brings more than 10,000 shoppers per week to the center. The location comprises a population of 9,420 within a one-mile radius, 61,102 within a 2-mile radius, and 149,550 within a 5-mile radius – with a median household income of $120,856. Sprint / Nextel’s corporate office is within 2 miles of the site.

3. Market Analysis

Phoenix, Arizona, is an award-winning place to live and work and is considered the leading business community in the Midwest. National publications and organizations recognize Phoenix for its business environment and livability. Here’s a sampling: 6th Place, America’s Best Places to Live Money, Top 50 Cities to Live and Play, National Geographic Adventure, 3rd Hottest Town in the U.S., Money, Among 20 Best Places to Live & Work Employment Review, One of only 72 Sterling Tree Cities in the U.S., National Arbor Day Foundation, Top 10 best Locations to Raise a Family, Southern Business and Development, 1st Place, Kid Friendly Report Card, Population Connection, 2nd Best City in America to Live Business Development Outlook.

Phoenix is at the core of one of the most dynamic local markets in the U.S. It offers easy access to the Arizona City region’s amenities, and, as part of the Arizona City metropolitan area, it is within the most centrally located major market in the nation. I-35, I-435, I-635, and U.S. Highway 69 all pass through Phoenix, and no point in the city is more than 3.5 miles from a freeway. The city maintains an excellent arterial street network and plans to construct additional lane-miles as the area grows. Three airports serve the region. Arizona City International Airport (MCI) is just 25 interstate highway miles north of Phoenix. Johnson County Executive Airport—the second busiest in Arizona—provides complete services for private business jets and general aviation. New Century AirCenter, just 12 miles southwest of the city, offers available aviation services and accommodates cargo or passenger jets of any size.

Phoenix supplies some of the most highly educated workers in the nation, with 97% of Phoenix adults over age 25 holding at least a high school diploma. Johnson County, where Phoenix is located, ranks first among the country’s 231 counties with populations greater than 250,000. The county ranks sixth in the percentage of adults with at least a bachelor’s degree and 16th with a graduate or professional degree.

The Phoenix area has a population of 175,265, based on the 2010 census. The median household income is $77,881, and the median age is 37.9. (2010 U.S. Census)

Industry Analysis

The U.S. coffee shop industry includes about 20,000 stores with a combined annual revenue of about $10 billion. Major companies include Caribou Coffee, International Coffee & Tea (The Coffee Bean & Tea Leaf), Peet’s Coffee, and Starbucks. The industry is concentrated: the top 50 companies generate more than 70 percent of sales. Coffee shops are part of the specialty eatery industry, including retail outlets specializing in bagels, donuts, frozen yogurt, and ice cream products. (First Research)

Competitive Landscape

Consumer taste and personal income drive demand. The profitability of individual companies depends on the ability to secure prime locations, drive store traffic, and deliver high-quality products. Large companies have advantages in purchasing, finance, and marketing. Small companies can compete effectively by offering specialized products, serving a local market, or providing superior customer service. Specialty eateries, which include coffee shops, are labor-intensive: average annual revenue per worker is about $50,000. Coffee shops compete with convenience stores, gas stations, quick service, fast food restaurants, gourmet food shops, and donut shops. (First Research)

Market Size

The U.S. coffee shop industry includes about 20,000 stores with a combined annual revenue of about $10 billion. Major companies include Caribou Coffee, International Coffee & Tea (The Coffee Bean & Tea Leaf), Pet’s Coffee, and Starbucks. The industry is concentrated: the top 50 companies generate more than 70 percent of sales. (First Research)

Target Market and Segment Strategy

Most adult coffee drinkers said their lifelong habits began during their teenage years. 54% said they began drinking coffee between 13 and 19. Another 22% reported their coffee cravings started between 20 and 24. This means that 76% of adult coffee drinkers began drinking coffee by the time they were 24. So, despite a large amount of marketing and advertising directed at the younger age groups, savvy coffee shop owners will remember to cater some of their offerings to the adult and senior market. (National Coffee Drinking Study).

The Cooper’s Cup will offer a unique experience for coffee enthusiasts by providing a quiet, cozy, yet sophisticated cafe and a sense of refinement and peace in an otherwise hectic and fast-paced world. While other coffee shops cater to convenience with drive-throughs or loud music venues late into the night, the Cooper’s Cup will stand apart from its competitors with its quiet yet soothing ambiance, capturing a truly unique (and much-needed) market niche.

- Unique products (specialized roasts, local ingredients, locally-themed or named drinks, custom drinks by the star barista, etc.)

- Games, puzzles, mind benders, and other activities that encourage customers to linger over their coffee

- Hosting or sponsoring local events (entertainment, readings, book clubs, etc.)

- Using technology to creatively compete in marketing with big chains — services like FourSquare, Yelp, and Google Places can increase visibility in the local market.

- Delivering amazing service from knowledgeable baristas — spend lots of time training staff and utilizing online services like the American Coffee & Barista School.

- Selling coffee-related items (and tracking down any co-marketing opportunities with a local community college or another student-related group in the area)

4. Products and Services

Product/services descriptions.

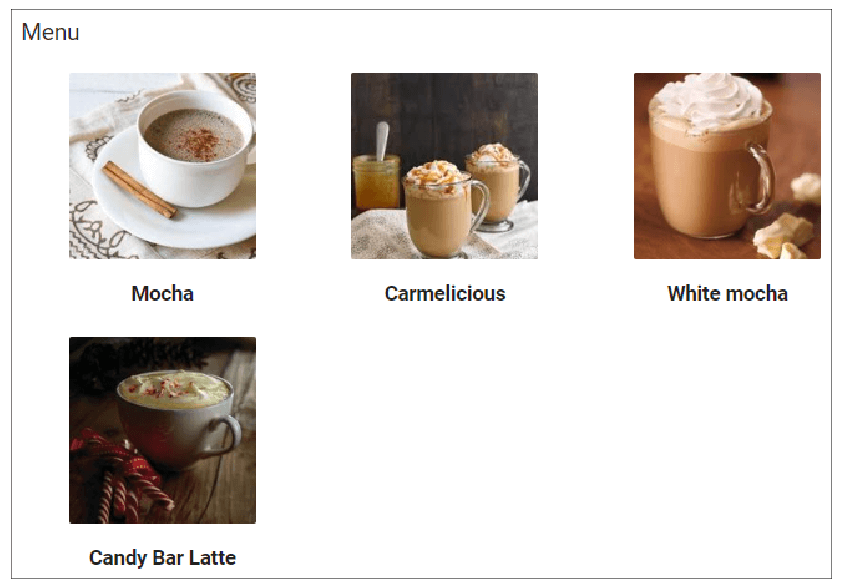

The Cooper’s Cup’s primary offering is gourmet roasted coffees with mocha, carmelicious, white mocha, candy bar latte, and brewed coffee. Complementing the coffee will be a smoothie line including wild berry, strawberry, peach, mango, and lemonade. Rounding out the simple menu line will be pastries obtained from an outside supplier, freshly made and delivered daily. The pastry offerings may vary with seasonality, but the primary line will be muffins, bread, cookies, scones, and rolls.

Product/Service Sourcing

The Cooper’s Cup has negotiated supplier agreements with several local food-service wholesalers and coffee wholesalers in the Phoenix area that have a reputation for quality and reliability:

- Mean Beans Coffee Roasters

- Phoenix Brewers

- Healthy Harvest Bread Co.

- Mary’s Organics

If one of the abovementioned specialty suppliers cannot meet their needs, the following national suppliers can provide all the food-service products they require. In addition, the following wholesalers will supply the cafe with general restaurant supplies:

- Lawrence Food Products Corp.

- Gerry Food Supply Inc.

Future Products/Services

Young families, which comprise Phoenix’s third largest market share, are often overlooked in the coffee market. Coffeehouses traditionally have not been considered ‘kid’ friendly. To overcome this hurdle, Cooper’s Cup has long-term plans (5 years) to open a 2nd coffee shop: A combination indoor play area/coffee bar. This concept allows parents and caregivers to meet and relax with other adults while the children can enjoy the indoor playground amenities.

Additional future services will include in-store sales for home purchases and an online store.

The website will have the option to purchase a prepaid gift card program – Prepaid gift cards provide immediate cash, reduce credit card transaction charges, and draw new customers to the business.

5. Sales and Marketing Strategies

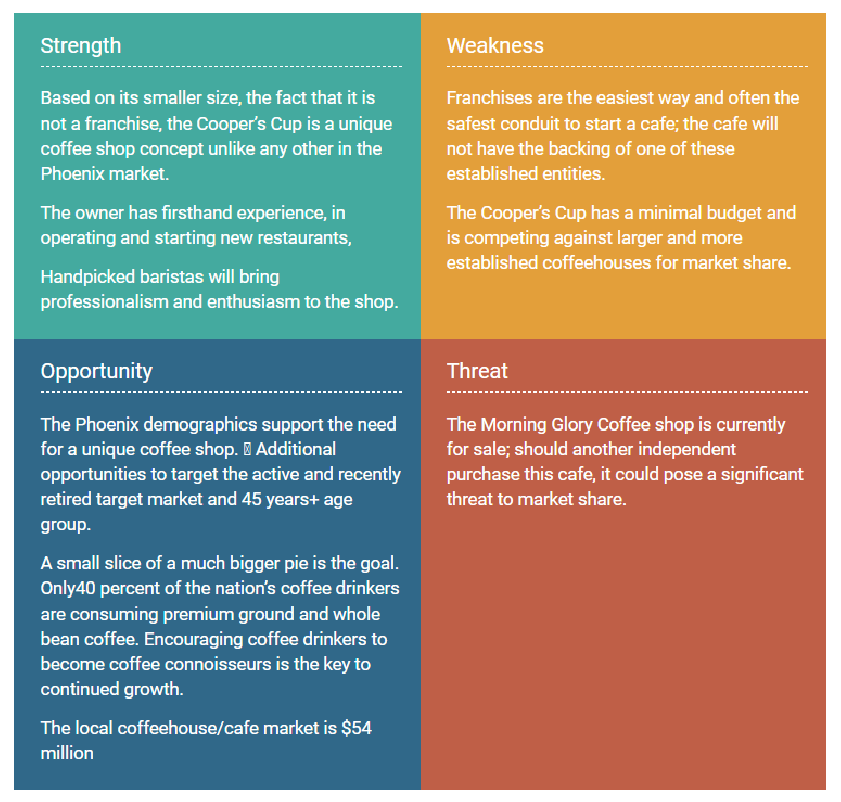

Swot analysis.

Unique Selling Proposition

The Cooper’s Cup stands out from a crowded sea of coffee chains and franchises. What sets it apart from the competition is primarily its smaller, cozier size combined with premium coffees served by knowledgeable baristas, providing so much energy and enthusiasm for its products.

Market Strategy and Positioning

The Cooper’s Cup utilizes a focus strategy on its Market. By specifically targeting three primary segments, they can cater specifically to their needs.

Senior Market (age 45+)

The Cooper’s Cup will target this Market simply by its well-selected location. Although this demographic group could readily drive downtown, they prefer a local cafe to unwind and relax and historically become some of the most loyal patrons.

Newly Hired Employees

The cafe will attract regular customers (weekly or more) – particularly the newly employed (first job) by providing free WIFI services and providing interesting games in the customer area.

Young Families

The third targeted Market, younger families, often find that coffeehouse is not ‘kid’ friendly. The company has long-term plans to create a combination coffee shop/play area so that parents and caregivers can meet with other adults while the children can enjoy the bounce houses, slides, and indoor playground equipment.

Pricing Strategy

The Cooper’s Cup primarily utilizes competition-based pricing. The cafe does not utilize coupons and discounts (other than opening promotions) because they believe that the most valuable customer demographic of daily coffee consumers is not influenced by discount programs or coupons.

Promotion and Advertising Strategy

- Online Advertising – The Cooper’s Cup will advertise regularly on popular social media sites like Facebook. Compared to traditional print advertising, this is a cost-effective tactic that will allow them to reach prospects in a highly targeted way (e.g., based on criteria such as age, gender, geography, etc.).

- Website – Cooper’s Cup will develop a simple Web site, which will provide basic information about the business, the menu, and links to their presence on the aforementioned social media channels.

- Radio Advertising – During the first six months of operation and the busy holiday shopping season, the business will advertise on local radio stations.

Sales Strategy

The Cooper’s Cup will use the following methods to increase sales revenue (as recommended by Andrew Hetzel on Better Coffee, Better Business):

- The menu will focus on the most profitable products sold. The cafe will always draw customer attention to the best products.

- As warranted, the cafe will raise prices to bolster its brand image. Prices communicate the perceived value of a product, so if set too low, the customers might assume that the beverages are inferior compared to the competition.

- Monitor flavoring inventory – Excess flavoring inventory ties up capital and valuable backroom space for storage. The cafe will utilize 4-6 varieties, including sugar-free offerings.

- Control waste and theft – audit sales and inventory reports to evaluate ingredient waste due to inefficient preparation, returned drinks, and employee consumption. Retail locations can easily waste 20% or more of their daily sales in these three key categories, which is a substantial and unnecessary loss.

- Monitor and evaluate hours of operation.

- Run employee sales contests – The baristas are the salespeople and have great influence over the customer ordering process. All baristas will have some form of sales and customer service training to make each transaction active rather than passive. Sales contests will emphasize high-margin items or cross-selling.

6. Operations Plan

Staffing and training.

An ongoing training and education program will ensure that each staff member learns and implements Cooper’s Cup’s exacting service and operational procedures standards. Staff meetings will reinforce service standards and principles. The Cafe will have detailed work descriptions and training programs for each position, from entry-level employees to the ongoing development of managers and owners. New employees will undergo an extensive training program. This ensures that each guest receives a quality experience from all employees, regardless of how long they have been employed. The Cafe embraces the concept of promoting from within. Excellence in one function typically leads to excellence in another. Regular staff evaluations and training will ensure motivation and address critical issues.

Inventory controls

The founder will be responsible for hiring and training managers who, in turn, will ensure that the day-to-day operations will comply with the standards set by Restaurant policy. Weekly management meetings will provide a forum to review and discuss financial and operational performance. Critical decisions related to purchasing, human resources, marketing, capital expenditures, and customer service will also be addressed.

Purchasing cost controls

Food preparation personnel will follow standardized recipes developed by the founders to control food costs and ensure consistency. The coffee shop will offer an innovative menu with nutritious food and beverages while achieving the most significant margin yield.

Customer Service

The hospitality business recognizes the client’s support experience is the critical driver to replicate business. The direction will Offer a superior degree of Professionalism by hiring individuals who deliver the ideal attitude to work and teaching them the skills required to accommodate guests. The restaurant will keep high levels of consumer satisfaction with talented, educated, and well-trained workers who understand and implement the fundamentals of fantastic service. Ongoing training will be provided to enable staff to perform their jobs with confidence and ability. Employees are well-spoken, well-versed, and trained to provide friendly, prompt, and professional service to each customer. This practice teaches employees who, by producing an exceptional customer experience, can optimize sales and raise their reimbursement. The team will have the knowledge and service required to create excellent daily service for every customer.

Technology & Software

While the quality of the cuisine and dining experience contributes significantly to a restaurant’s profitability, attention to business and financial details can transform small changes into significant returns. Critical sales, cost of sales, labor, inventory, marketing, and overhead metrics are monitored daily. Trends are evaluated, and constructive actions will be taken where improvement is needed. The management team will have access to the restaurant’s transactions and reports available in its real-time POS (point of sale) and accounting systems. Trends will be evaluated, and corrective action will be implemented as required.

7. Organization Structure

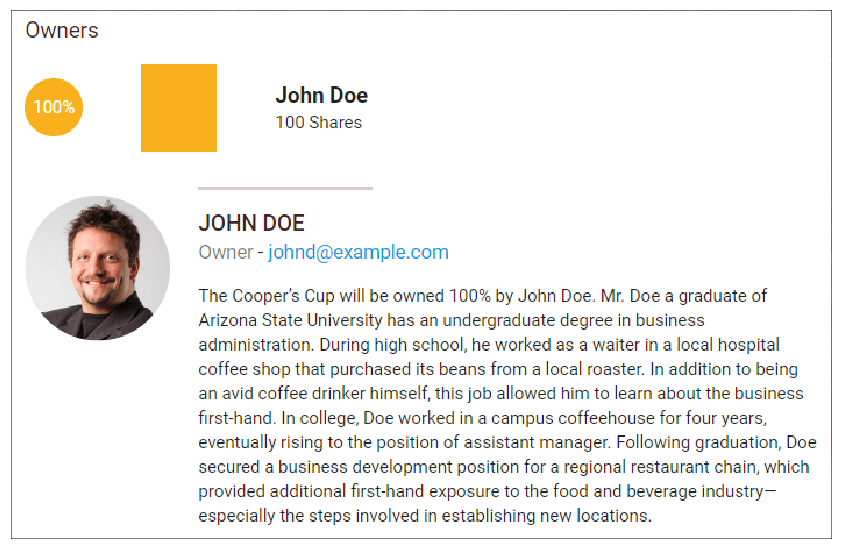

The Cooper’s Cup is formed as an S-Corporation wholly owned by John Doe.

Management Team

The Cooper’s Cup will be owned 100% by John Doe. Mr. Doe, a graduate of Arizona State University, has an undergraduate degree in business administration. During high school, he worked as a waiter in a local hospital coffee shop that purchased its beans from a local roaster. In addition to being an avid coffee drinker, this job allowed him to learn about the business first-hand. In college, Doe worked in a campus coffeehouse for four years, eventually becoming an assistant manager. Following graduation, Doe secured a business development position for a regional restaurant chain, which provided additional first-hand exposure to the food and beverage industry—especially the steps involved in establishing new locations.

Management Team Gaps

The Cooper’s Cup will rely on its POS (Point of Sale) system to generate daily accounting and cost activity reports. Mr. Doe will supply these to an outside bookkeeper for the preparation of annual income taxes.

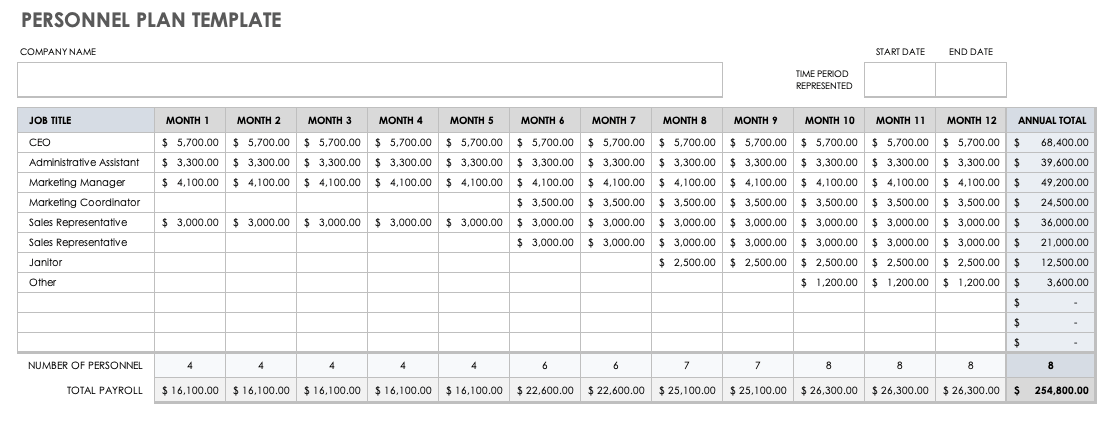

Personnel Plan

Initially, the cafe will hire 1 manager, 5 baristas, and 2 part-time servers. In Year 2, the cafe plans to hire 1 additional full-time barista.

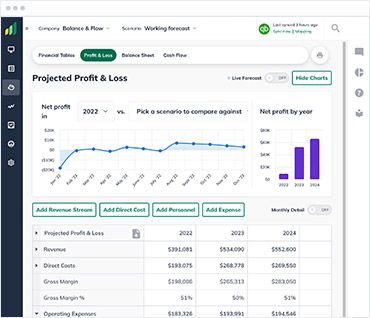

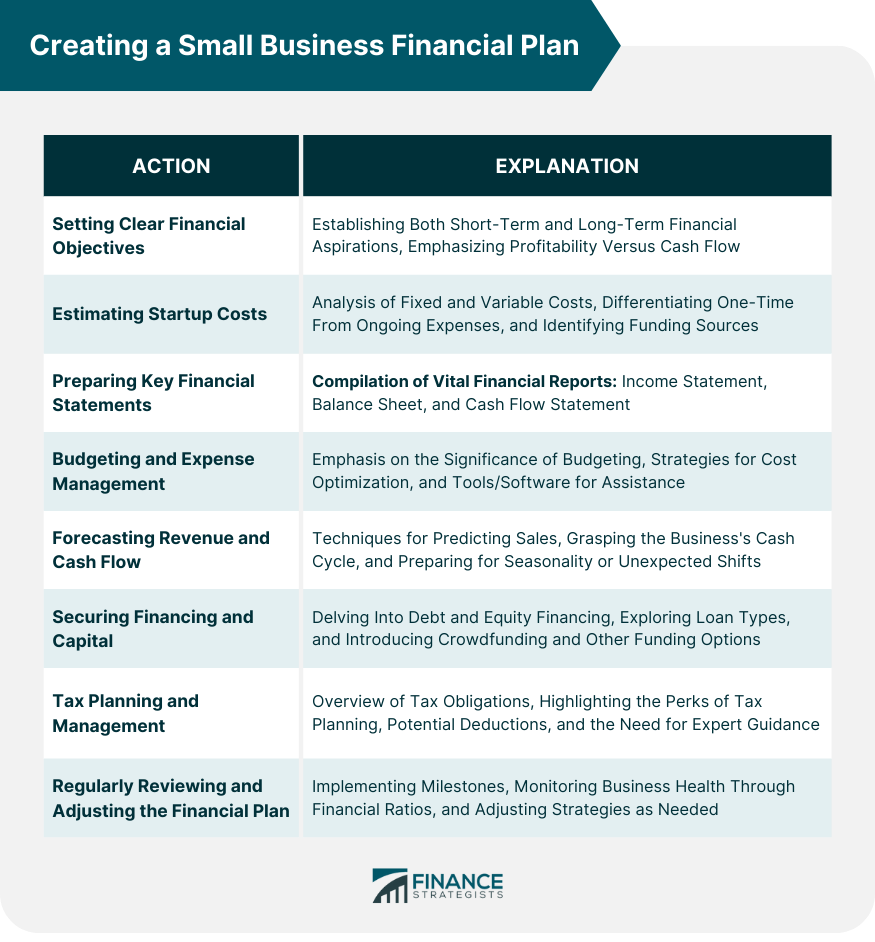

8. Financial Plan

Important assumptions.

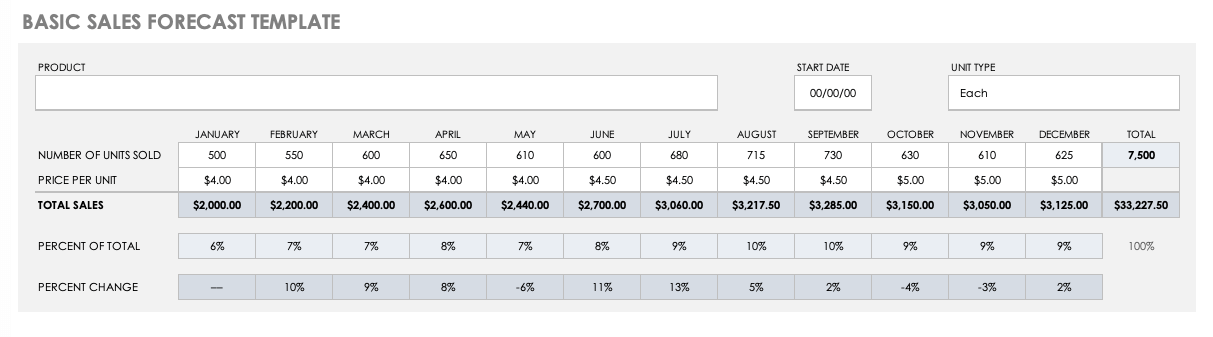

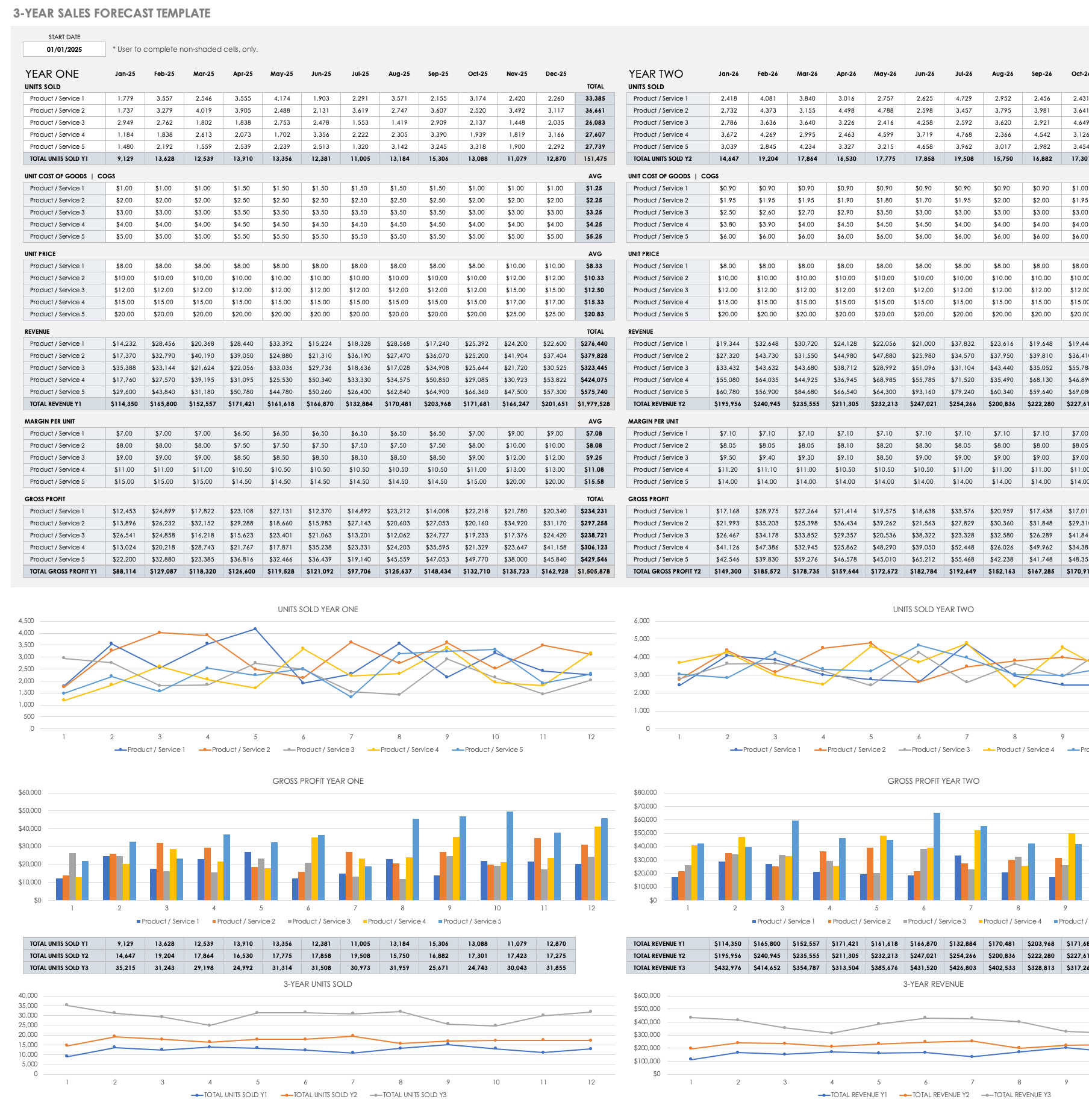

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some month’s revenues peak (such as holidays ) and wane in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp-up in staff over the 5 years forecast

- Barista’s salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

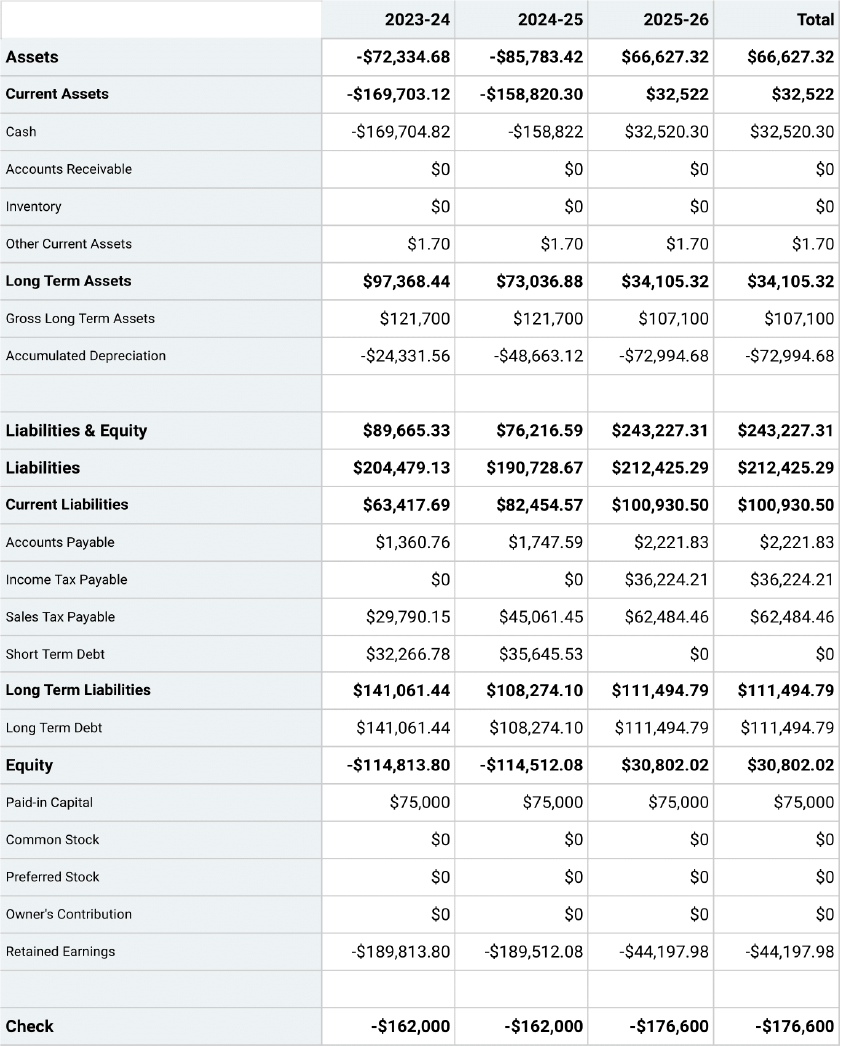

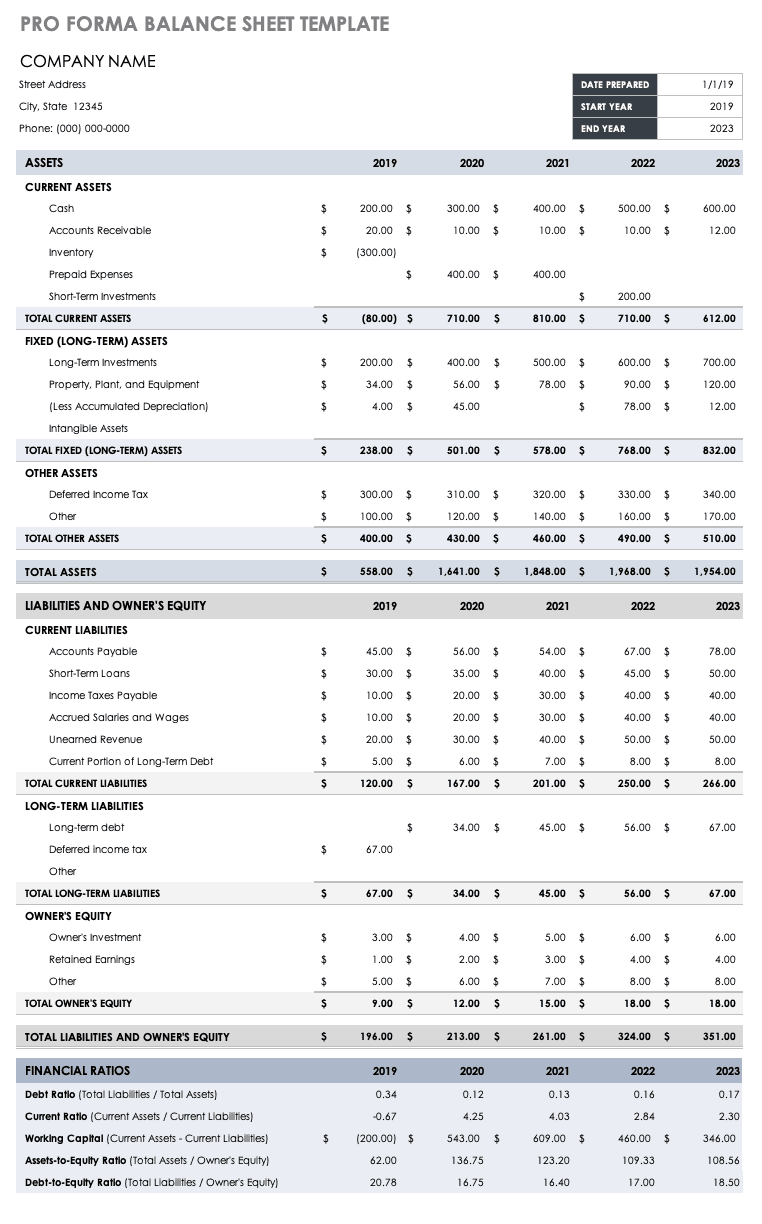

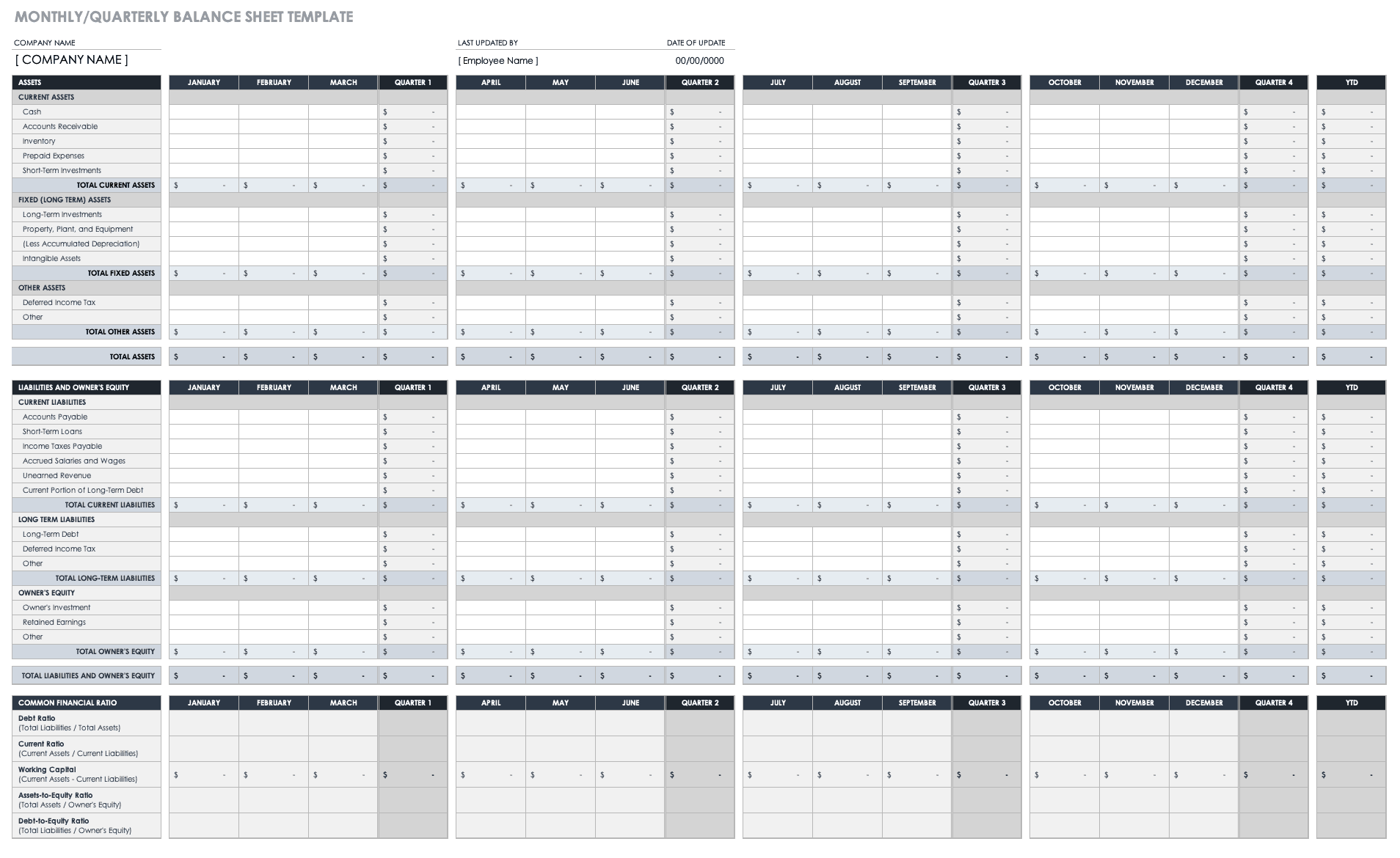

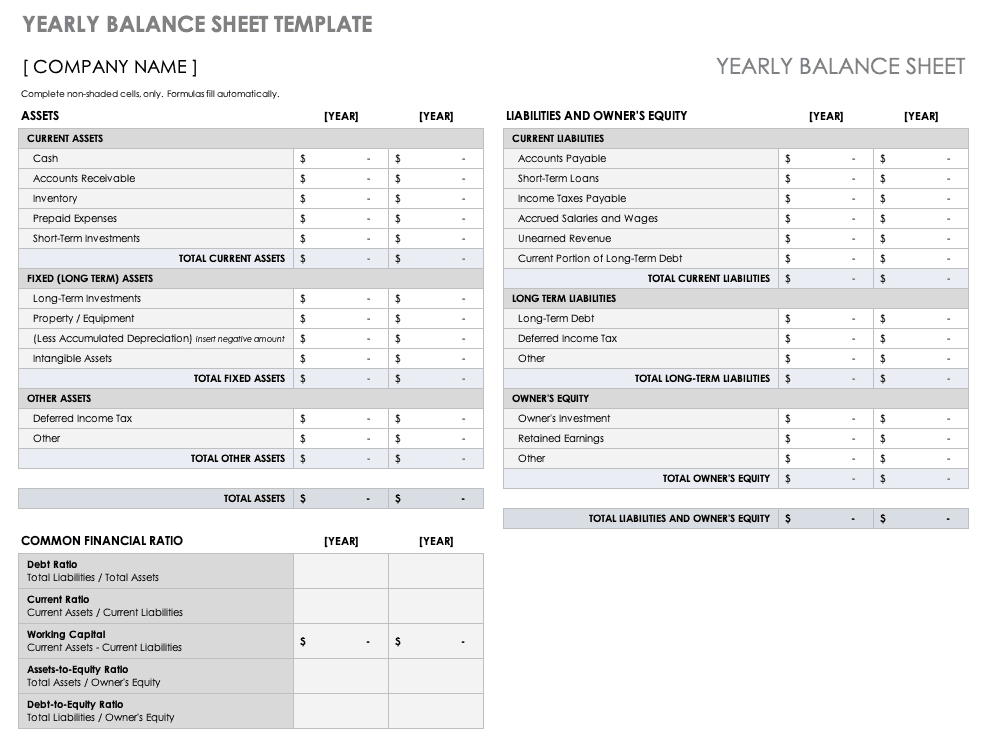

Projected Balance Sheet

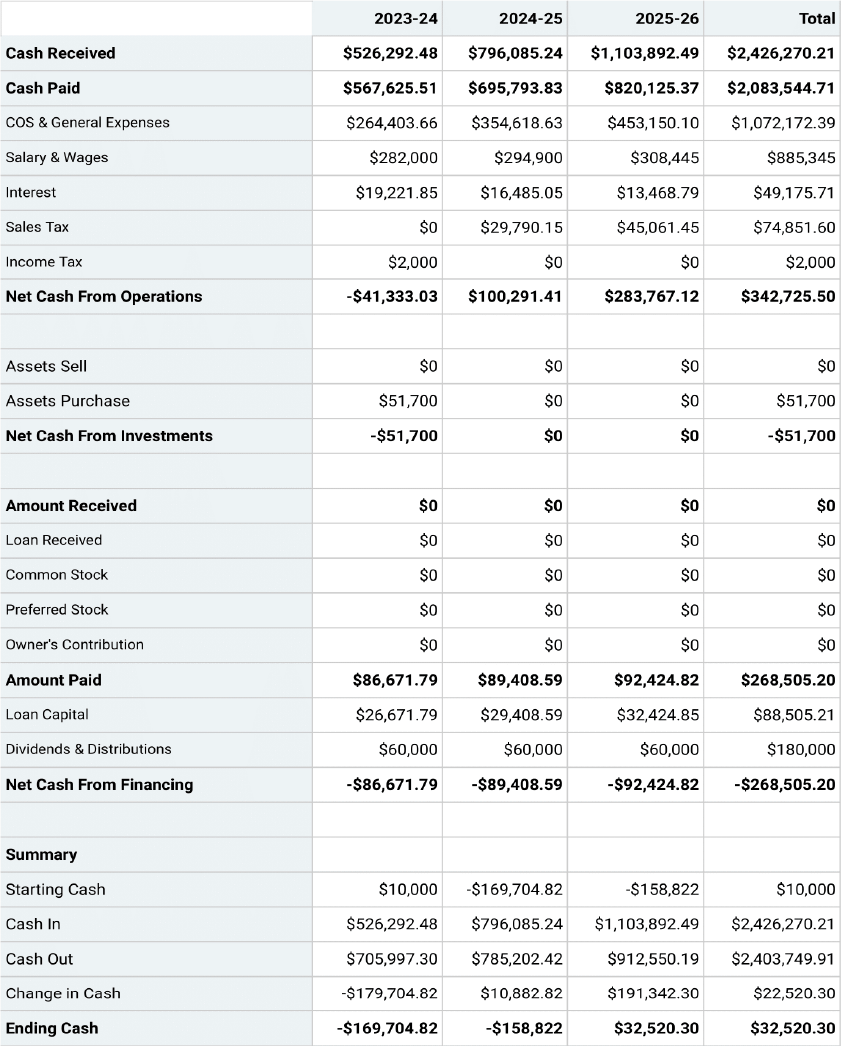

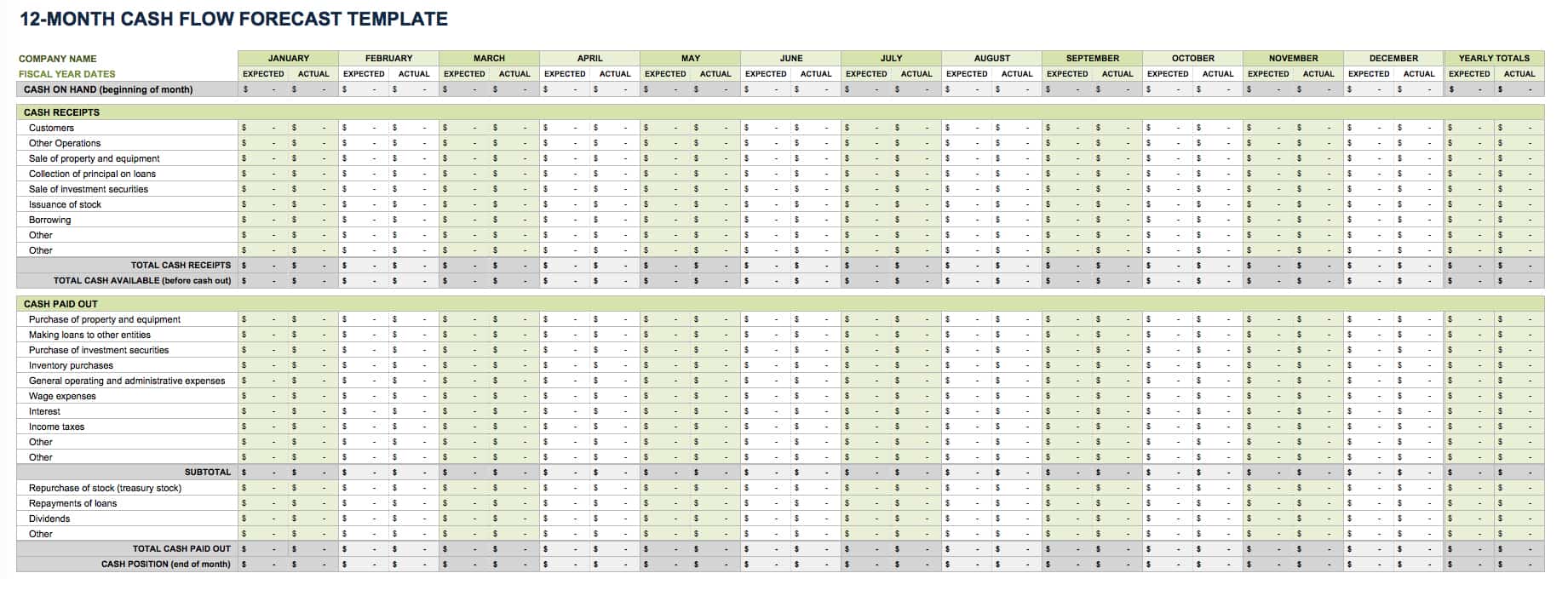

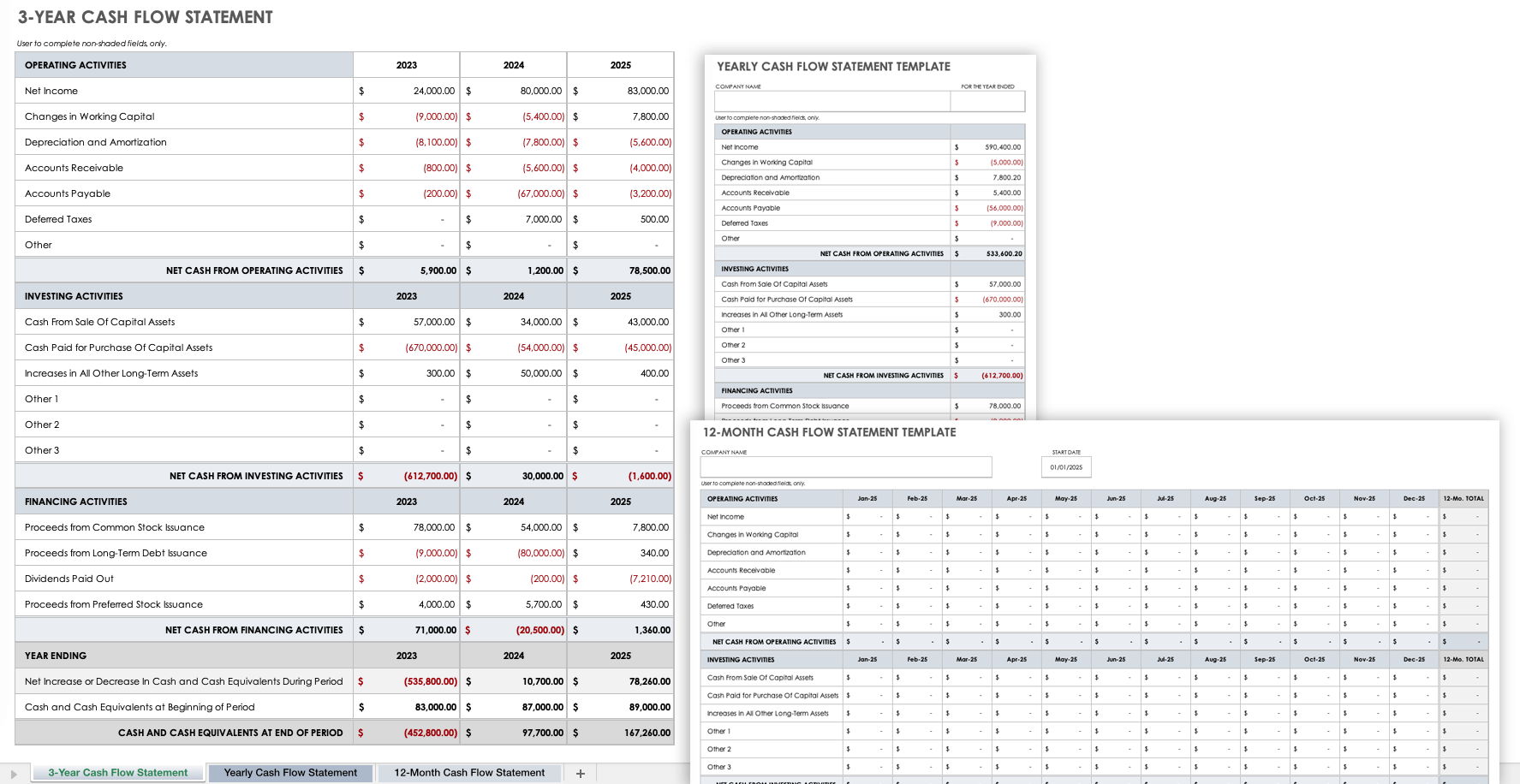

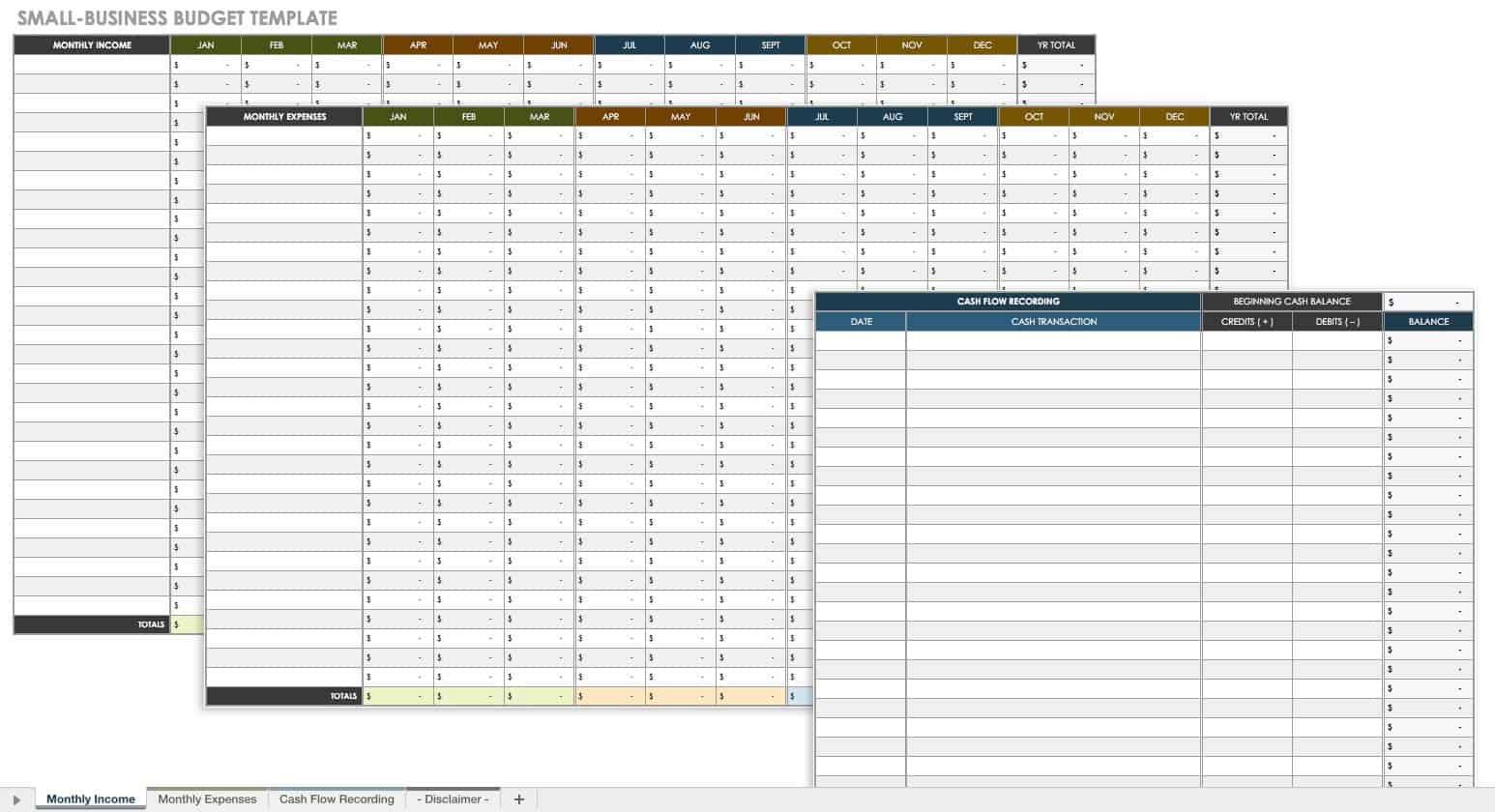

Projected Cash-Flow Statement

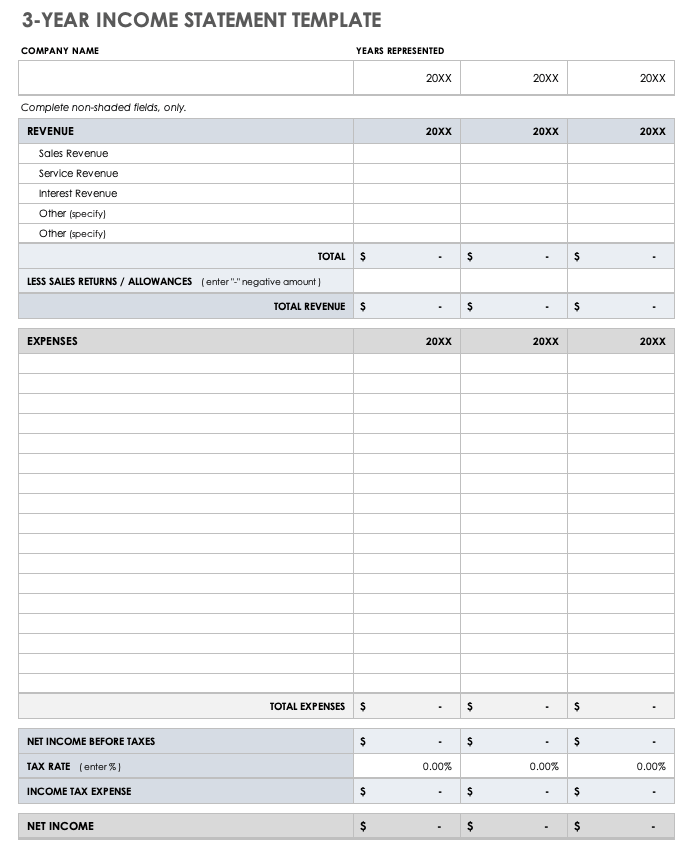

Projected Profit & Loss Statement

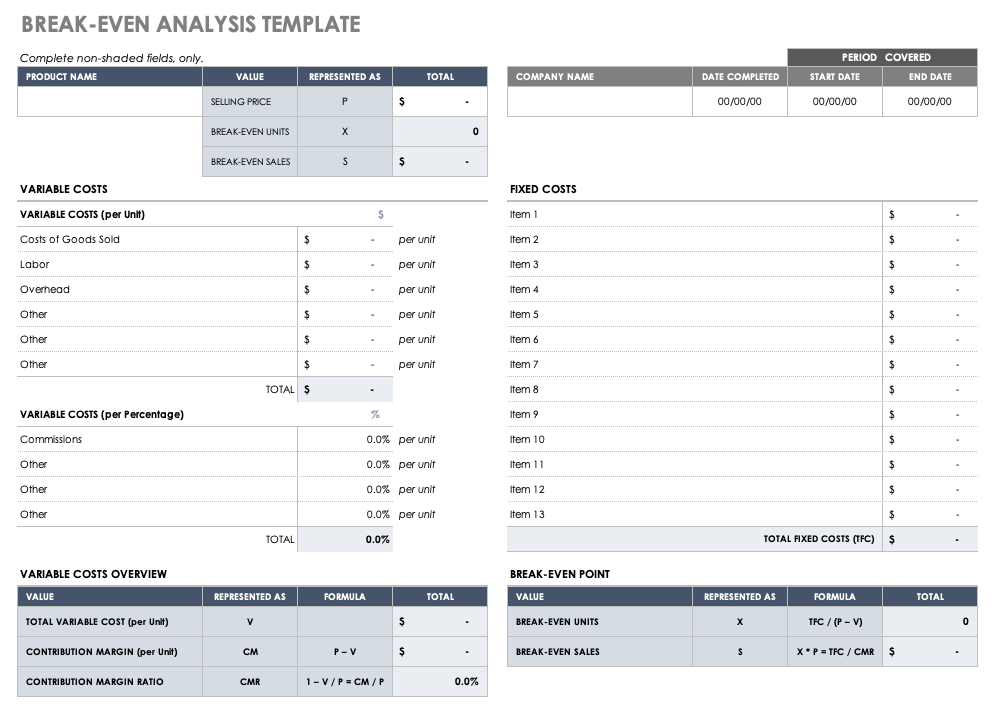

Break Even Analysis

Write Your Business Plan With Upmetrics

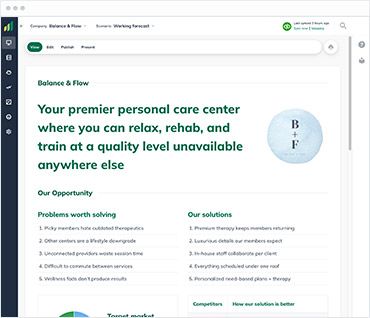

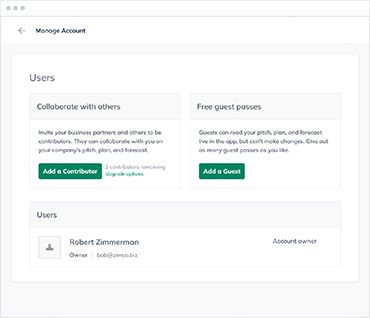

Whether you need a business plan to compete in a competition, win investors, or gain a competitive advantage in the market landscape, Upmetrics can help you get started.

Upmetrics is an AI business plan software that comes with AI assistance, financial forecasting features, and 400+ sample business plans so that you can prepare a business plan in no time.

So what are you waiting for? Try Upmetrics and create your business plan in a snap.

Make your plan in half the time & twice the impact with Upmetrics

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.

Frequently Asked Questions

How do you write a business plan for a college project.

As mentioned earlier in the article, business planning for a college project or competition is no different than for a real business. You can write your business plan using these step-by-step instructions.

- Select a compelling business idea

- Refer to business plan examples

- Prepare a business plan outline

- Create a company description section

- Conduct market research and industry analysis

- Describe your product and services

- Outline sales and marketing strategies

- Create an operations plan

- Introduce management team

- Prepare financial projections

- Summarize your plan with an executive summary

What is a business plan for students?

A business plan is a necessary business document that highlights its purpose, business goals, product/service offerings, go-to marketing strategies, operations and financial plan, key people involved in the business operations, and other necessary details.

As a student, consider a business plan example as a document that helps you better understand business and industry dynamics and learn how a business operates inside out.

What is a business plan competition for students?

Business plan competitions are competitions mostly organized by universities for students passionate about entrepreneurship and the business world. These competitions offer students a platform to showcase their entrepreneurial skills while also providing opportunities for mentorship and networking.

How can I increase my chances of winning a business plan competition?

There cannot be a straightforward answer to this question, but there’s surely a method that can increase your chances of winning a competition—Using AI-powered business plan software.

Why? An AI tool will make you 10X more productive while writing a business plan and preparing financial forecasts. So you can spend more time researching the market and brainstorming business ideas.

Where can I find more business plan examples for students?

Upmetrics’ library of 400+ business plan examples could be an incredible source for students to find more industry-specific business plan examples. There are examples for almost every small business category, including real estate, retail, entertainment and media, food & beverages, and more.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Ready to Kickstart Your Business Planning?

– Don’t Miss It

DECAVERSITY

10 business plan examples for students.

Are you thinking of starting a business? Let’s take a look at some business plan examples for students.

Starting a business as a student is exciting. But, like anyone else, students need support when venturing into entrepreneurship. One of the most important things to start with is learning how to create a strong business plan.

A business plan helps you set clear goals, strategies, and the necessary steps to succeed in the business world. However, not all business plans are the same. There are different types to consider, and choosing the right one depends on your specific business and goals.

In this guide, we'll walk you through the process of creating a solid business plan and introduce you to different plan types. So, let's get started and explore the world of entrepreneurship with a well-structured plan for success.

Writing the Business Plan

Crafting a business plan is a crucial move when you're starting or expanding your business, whether you’re working on a business plan project for students or a fully-fledged business person.

It helps you navigate your journey while also catching the attention of potential investors or lenders. In this guide, we'll break down every part of a business plan and share helpful tips.

What Goes in a Business Plan?

A good business plan typically has several important sections, each with its own job to do.

- Business Overview : Introduction and executive summary.

- Market Analysis : Understanding your target market and competition.

- Marketing and Sales : Strategies to reach and convert customers.

- Product/Service : Description of what you offer.

- Operations and Team : How your business operates and key team members.

- Financial Projection s: Future financial estimates and funding needs.

- Appendix : Supporting documents, if needed.

Now, let’s get into what these sections look like.

Develop a Business Plan Worksheet

Before you start writing your business plan, it's a good idea to start with a business plan worksheet. Think of it as the foundation for your plan—a tool to gather information and get your thoughts organized.

This worksheet will help you come up with your business vision, understand your target market better, and lay out your financial projections. It's the first step to building a solid plan that sets your business on the right track.

The Executive Summary

The executive summary is your business plan's attention-grabbing headline. It's a concise preview of your plan's most critical elements, designed to engage your reader. Here's what to include:

- Mission Statement : Clearly state your business's mission, describing the problem you solve and why your business exists. Define your core values and goals.

- Product/Service Description : Provide a brief, compelling description of your offering, emphasizing its unique features or benefits that set it apart.

- Leadership and Team : Introduce key team members and their qualifications, showcasing their expertise and their role in your business's success.

- Financial Information : Give an overview of your current financial status. Mention revenue and profits if your business is running. If you seek financing, explain how much you need and where you'll invest it.

- Growth Plans : Share your strategy for growth and long-term goals, outlining how you'll expand and achieve profitability.

The executive summary sets the stage for your business plan, making a strong first impression and sparking excitement for what follows.

The Products/Services

In this part, we'll dig deeper into the heart of your business—your products or services. We're going beyond the basics to look at three crucial aspects:

- Benefits to Customers : Discuss how your products or services help your customers. Explain how they solve specific problems or fulfill the needs of your target market. What makes them stand out? What's the unique value they bring compared to what competitors offer?

- Product Lifecycle : Every product or service has a journey. Tell us about the expected lifecycle of yours. Are you planning updates, new versions, or related offerings in the future? Knowing this helps us understand how your business will evolve.

- Intellectual Property : If it applies to your products or services, include any intellectual property rights you have. This might include copyrights, trademarks, or patents. These rights protect your creations and can be valuable assets.

Remember, this section is all about offering the essence of what you're offering and why it's special.

Target Market

Knowing your target market is a cornerstone of business success. Let's simplify:

Who Are Your Customers?

- Demographics : Basic info like age, gender, income, and location helps you target effectively.

What Makes Them Tick?

- Psychographics : Understand their interests, lifestyle, and buying habits to connect personally and tailor your marketing.

Market Trends

- Stay Updated : Keep an eye on industry trends and market shifts. Adapt to capitalize on opportunities.

Why does it matter? Think of it like knowing the weather—it helps you plan. Understanding your target market is your key to getting ahead.

The Marketing Strategy

Your marketing and sales strategies are crucial for attracting and retaining customers.

Marketing Mix

Here, we'll break down each element of your marketing mix—product, price, promotion, and place (distribution).

- Product : Describe your product offerings in detail. What are their unique features and benefits? Why would your target customers choose your products over others in the market? Be clear about what sets you apart.

- Price : Explain your pricing strategy. Will you compete on price, offering lower costs than competitors? Or will you position your products as premium and charge a higher price? Detail any discounts, bundles, or special offers you plan to implement.

- Promotion : Outline your promotional tactics. How will you create awareness and interest in your products? This can include advertising, public relations, content marketing, social media campaigns, and more. Specify your marketing budget and the platforms you'll utilize.

- Place (Distribution) : Describe your distribution strategy. How will your products reach your customers? Will you sell directly to consumers, through retailers, or online? Highlight your distribution channels and logistics. Explain how you'll ensure your products are readily available where your customers want them.

Sales Process

Now it’s time to discuss how you plan to turn potential leads into paying customers.

- Direct Sales : If your strategy involves direct sales, explain how your sales team will engage with potential customers. Provide insights into your sales force, their training, and how they will approach prospects.

- Online Sales : If online sales are a significant part of your strategy, detail your e-commerce platform. Discuss the user experience, payment processing, security measures, and any online marketing tactics to drive traffic and conversions.

- Conversion Strategy : Highlight how you plan to convert leads into paying customers. Will you offer free trials, consultations, or samples? Describe your approach to closing deals and fostering customer loyalty.

By going beyond the surface and addressing these elements in detail, you'll have a marketing and sales strategy that can effectively attract and retain customers for your business.

Discuss Your Distribution Strategy

Your distribution strategy is how you get your products or services to your customers effectively:

- Distribution Channels : These are the paths your products or services take, like physical stores or online platforms.

- Logistics and Transportation : This is how your products move, whether you do it yourself or use other companies.

- Inventory Management : It's about keeping the right amount of stock without having too much or too little.

- Geographic Reach : It's where your customers are, whether nearby, across the country, or worldwide.

- Efficiency and Costs : It's about being fast and not spending too much money.

- Customer Convenience : It means making it easy for customers to buy from you.

- Technology and Automation : Using tools and systems to make things work smoother.

- Scaling and Adaptation : It's about being ready for more customers or changes in the market.

Having a good distribution strategy helps make sure your products or services reach the right customers the right way.

The Competition

It's essential to have a solid grasp of your competitors and strategically position your business to thrive.

Competitive Analysis

To stay ahead of the game, make sure to conduct a thorough competitive analysis. This means rolling up your sleeves and diving deep into the strategies and operations of your rivals.

- In-Depth Examination : Start by examining your competitors meticulously. Look into their products or services, pricing strategies, marketing tactics, and customer base. The goal is to gain a comprehensive understanding of what they do and how they do it.

- Strengths and Weaknesses : Highlight your competitors' strengths and weaknesses. What are they exceptionally good at, and where do they fall short? Identifying these aspects will help them identify opportunities to capitalize on their weaknesses and leverage their strengths.

- Success Insights : Share your insights into what makes your competitors successful. Understand their unique selling propositions, customer engagement strategies, and market positioning. This knowledge will provide you with a foundation for your own strategies.

- Outperforming Plans : Once you've dissected your competitors, outline your plan to outperform them. Whether it's through innovation, superior customer service, or better pricing, make it clear how you intend to gain a competitive edge.

Competitive Advantage

Every business has something that sets it apart from the rest – these are your competitive advantages. In this section, it's time to highlight why customers should choose you over the competition.

- Expert Team : If you have experts on your team, let people know. Customers trust businesses with knowledgeable professionals who offer excellent products or services. If you're new, focus on any relevant experience to build trust as your business grows.

- Unique Partnerships : If your business has forged unique partnerships or collaborations that give you an edge, make it known. These alliances can lead to exclusive offerings, cost advantages, or increased visibility in the market.

- Ideal Location : If your business benefits from an ideal location that attracts foot traffic or serves a specific target demographic, this can be a powerful competitive advantage. Explain how your location enhances your business prospects.

By underlining your competitive advantages, you're essentially telling your audience why you're not just another player in the market.

The operations section is your day-to-day business plan. It helps your team understand how to make your business run smoothly. Here are the key parts:

- Objectives and Goals : State what you want to achieve, both short and long-term. Ensure they align with your overall plan.

- Procedures and Processes : Explain how things will get done, from making your product to customer service.

- Timeline and Milestones : Set dates and goals to track your progress.

- Resource Needs : List what you need to run your business, like equipment and people.

- Supply Chain : Describe how you'll get what you need and manage it.

- Quality Control : Detail how you'll ensure quality, whether through checks or testing.

- Regulations : Mention any rules you need to follow, like permits or licenses.

- Risk Planning : Identify potential problems and your backup plans.

- Growth Strategy : Explain how you'll handle growth, like hiring more people or expanding to new markets.

- Costs : Break down your expenses, both fixed and variable, and how you'll manage them.

By laying out these details, you'll be well-prepared to handle the challenges and growth opportunities that come your way.

The Management Team

In this section of your business plan, you'll want to cover a few key areas:

1. Personal Background : Start by introducing the key people in your management team, if there are any. If it’s just you—don't worry! Give some basic details like names, ages, where they live, their interests, and their educational background. Also, mention any special skills they bring to the table.

2. Business Experience : Talk about their history in the business world. Have they been involved in other businesses? Have they held important positions before? Share their past achievements and roles in previous companies.

3. Track Record : Highlight their successes, the responsibilities they've handled, and their capabilities. Show how their previous experiences have prepared them for the roles they'll play in your business.

4. Education : Mention their formal and informal education, like degrees, certifications, or courses they've taken that are relevant to your business.

5. Financial Standing : Include personal financial statements and supporting documents to demonstrate their financial stability and ability to contribute to the business if necessary.

6. Work History : Detail their direct experience in similar businesses and how it aligns with your current venture.

7. Roles and Responsibilities : Clearly define who does what on the management team. Explain why they're the right fit for their roles and who makes the final decisions.

8. Organization Chart : Create a simple chart that shows how your team is structured and lists each person's responsibilities.

9. Compensation and Benefits : Outline the pay and bonuses each management member will receive. Also, mention any benefits like health insurance or life insurance.

10. External Resources : Tell about any outside resources you can tap into, like lawyers, accountants, or support from organizations that help small businesses.

11. Board of Directors : If you have a board, introduce them and explain how they'll help guide your business.

12. Online Resources : Mention any useful internet resources you'll use for research and networking.

Including these details paints a picture of your team's qualifications and their role in making your business a success.

In this part of your business plan, focus on who will be working with you.

- Current and Future Needs : Start by saying how many people you have on your team right now, if any. Then, talk about how many team members you think you'll need in the near future (like the next year or two) and in the longer term (three to five years from now).

- Skills Required : Describe what skills your team members should have. Think about what makes them good at their jobs and what special skills might be needed for your business.

- Job Descriptions : Explain what each person on your team will be responsible for. This will help everyone better understand their roles. Keep in mind that your roles might change as your business grows.

- Finding People : Discuss how you plan to find and hire the right people. As students, you might use your school's resources and online job platforms or work with other students who have the skills you need.

- Pay and Benefits : Clarify if you'll be paying salaries, hourly wages, or both. You can also mention any extra rewards or bonuses based on performance. Since you're a student, you may not offer extensive benefits initially.

- Extras like Overtime : Say if you'll pay extra for overtime work and when that might happen. Being students, you'll want to manage your workload efficiently, especially during busy times.

By covering these points, you'll show that you've considered your team's needs and are ready to manage your business's human resources effectively, even as students.

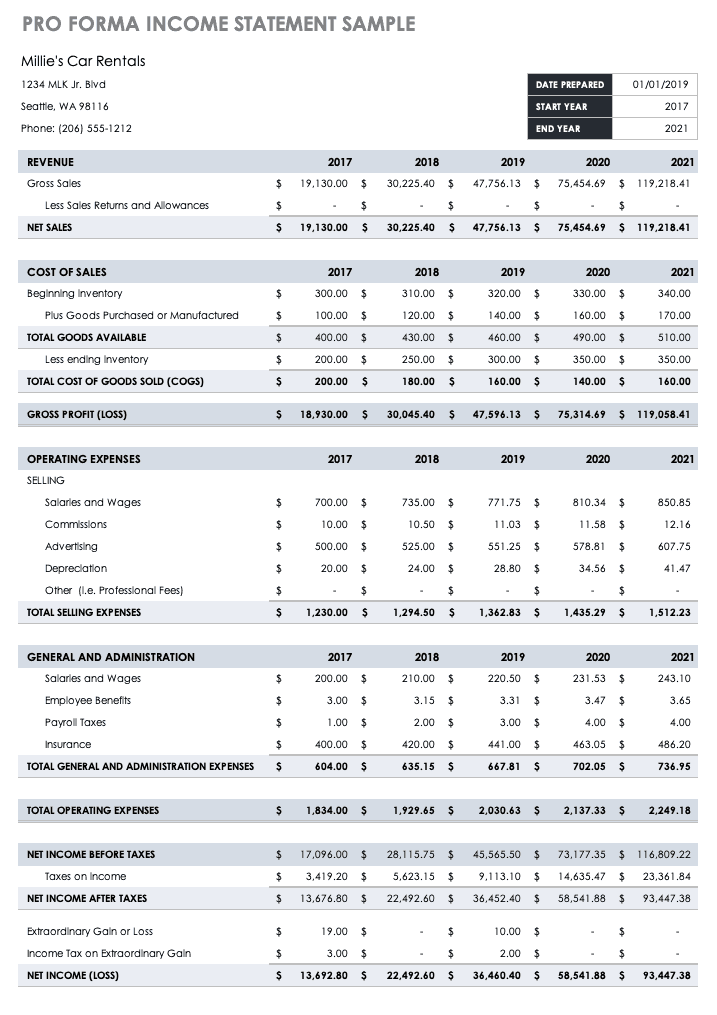

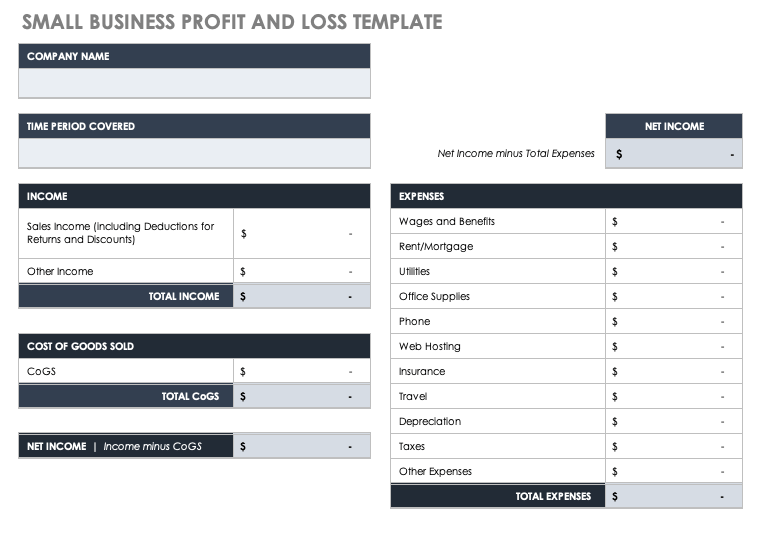

Financial Analysis

Think of this section as the pulse of your business plan. It gives you a detailed look at your business's financial health and sustainability. This part is crucial for students because it helps them make informed decisions and attracts potential investors or lenders.

Balance Sheet

Get a certified public accountant (CPA) to help you create a balance sheet. This document paints a picture of your business's financial situation at a specific moment. It has three main parts:

- Assets : What your business owns ( cash, equipment, or inventory).

- Liabilities : What your business owes (such as loans or outstanding bills).

- Owner's Equity : The owner's stake in the business, which is assets minus liabilities. It's basically your business's net worth.

Break-Even Analysis

This is significant because it tells you when your business will start making money. It determines the minimum amount of sales revenue needed to cover both fixed costs (like rent and salaries) and variable costs (like materials and utilities). It's based on info from the income statement and cash flow projections.

Income Statement (Profit and Loss Statement)

The income statement gives you the lowdown on your business's financial performance over a specific time frame, usually monthly or annually. It shows how much money you made and how much you spent. Subtract the expenses from the income, and you've got your profit or loss. It's all about how well your business handles its cash.

Cash Flow Statement

Cash is king in business, and this statement forecasts how money will move in and out of your company. It predicts all cash coming in and going out, helping you ensure you have enough to cover day-to-day costs and investments and pay off any debts. A strong cash flow is crucial to keeping your business going.

As student entrepreneurs, having a CPA set up your accounting system is a smart move for accuracy. When you present these financial documents in your business plan, make sure they're clear and detailed.

These numbers prove the worth and profitability of your business idea, which can be a big draw for potential investors or lenders. So, be thorough and get the figures right.

Supporting Documentation

You'll also want to include various documents that back up the information you've presented in the main part of your plan. Keep in mind that this list might change depending on how far along your business is. Here's what to include:

- Resumes : Put in resumes of the people who are key to your business. Show off their qualifications and experience to give confidence to potential investors or lenders.

- Credit Information (appendix) : If relevant, add credit reports for yourself or your team members. This will prove that you're financially responsible.

- Quotes or Estimates : Include any quotes or cost estimates you've received from suppliers or service providers. This helps prove that you've done your homework on expenses.

- Letters of Intent from Prospective Customers : If you have letters from potential customers saying they want to use your products or services, toss those in. It shows there's a demand.

- Letters of Support from Credible References : If you have supportive letters from mentors, professors, or industry experts, add those. They can vouch for your idea.

- Leases or Buy/Sell Agreements : If you're renting space or buying equipment, include the agreements. It proves you have the physical assets and responsibilities in place.

- Legal Documents Relevant to the Business : If there are any legal papers like incorporation documents, partnership agreements, or licenses, include them. It shows you're following the rules.

- Census/Demographic Data : If your business relies on specific data about people, include statistics or reports from trustworthy sources. This information will support your market analysis and target audience information.

Remember to keep these documents well-organized in the appendix. This list covers the basics, but tailor it to your specific student business plan's needs and stage of development.

Business Plan Program

Creating a strong business plan is essential for any entrepreneur, and with the help of business plan programs and tools, you can make it more effective.

- LivePlan : LivePlan is a user-friendly business planning software that guides users through creating business plans and offers financial forecasting.

- Bizplan : Bizplan focuses on startups and small businesses, providing step-by-step planning, financial tools, and pitch deck creation.

- Enloop : Enloop automates business plan writing using data inputs and offers financial projection tools.

- PlanGuru : PlanGuru is for in-depth financial analysis and creating detailed financial projections.

- Upmetrics : Upmetrics offers customizable templates, financial forecasting, and collaboration features for various business stages.

- Tarkenton GoSmallBiz : Tarkenton GoSmallBiz provides business planning tools, legal resources, and marketing guidance.

- Bplans : Bplans offers free business plan templates and samples for those starting from scratch.

- Canva : Canva provides pitch deck templates and design tools to enhance presentations.

- QuickBooks : QuickBooks aids in financial tracking and management, complementing business planning.

14 Types of Business Plans with Examples

In this section, we'll explore 10 types of business plan examples for student entrepreneurship.

1. Traditional Business Plans

These classic business plans , often prepared on paper, provide a comprehensive overview of the business, detailing its identity, goals, and strategies for success.

2. Standard Plans

Similar to traditional plans, standard business plans are created digitally, typically using software like Microsoft Word or Excel, making them easier to edit and share.

3. One-Page Business Plans

Incredibly concise, these plans condense all crucial information onto a single page, often using bullet points for clarity and brevity.

4. Annual Business Plans

Tailored for a specific year, these plans outline a business's objectives and actions for that particular period, providing a focused strategy.

5. Lean Plans

Lean business plans are streamlined versions, intentionally omitting some details to protect confidential information while offering a concise yet informative summary.

6. Business Plans for Start-ups

Specifically designed for new ventures, these plans may incorporate surveys, customer insights, and visual aids to support their customized approach.

7. Feasibility Studies

These plans investigate the viability of new product or service ideas, helping businesses make informed decisions about their implementation by analyzing their potential success.

Understanding these various types of business plans is essential for your business management studies, as they serve different purposes and contexts within the business world.

8. Strategic Plans

Concentrating on marketing and branding strategies, these plans often involve extensive market research and prioritize effective brand promotion.

9. Operational Plans

Emphasizing practical steps, operational plans use data, charts, and graphs to guide a business's actions toward its goals, with a strong focus on execution.

10. Internal Plans

Highly detailed and meant exclusively for the company's internal team, these plans contain sensitive information and strategic insights for team members' use.

11. What-If plan

This type of plan explores various scenarios and their potential impact on the business. It helps a company prepare for unexpected situations by outlining strategies for different outcomes.

12. Expansion plan

An expansion plan outlines strategies for growing a business, whether through opening new locations, entering new markets, or diversifying product lines. It details the steps and resources needed for expansion.

14. Business Acquisition Plan

When a company intends to acquire another business, this plan outlines the acquisition strategy, financial considerations, and integration plans. It helps ensure a smooth transition and maximizes the value of the acquisition.

These plans cover a range of scenarios and goals, each serving a unique purpose in the world of business strategy. Hopefully, you can choose a business plan template for high school students that suits your needs.

Final Thoughts

Starting and running a business as a student is a journey. A well-structured business plan is essential for success, helping you define your goals and strategies. To create one, feel free to use these business plan examples for students as a source of inspiration.

It’s your tool to guide your entrepreneurial journey and increase your chances of success. So, get started, create your plan, and get started on your path to entrepreneurship with confidence.

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Write the Financial Section of a Business Plan

An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. here's some advice on how to include things like a sales forecast, expense budget, and cash-flow statement..

A business plan is all conceptual until you start filling in the numbers and terms. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line. You do this in a distinct section of your business plan for financial forecasts and statements. The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business. "This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says Linda Pinson, author of Automate Your Business Plan for Windows (Out of Your Mind 2008) and Anatomy of a Business Plan (Out of Your Mind 2008), who runs a publishing and software business Out of Your Mind and Into the Marketplace . "In many instances, it will tell you that you should not be going into this business." The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Dig Deeper: Generating an Accurate Sales Forecast

Editor's Note: Looking for Business Loans for your company? If you would like information to help you choose the one that's right for you, use the questionnaire below to have our partner, BuyerZone, provide you with information for free:

How to Write the Financial Section of a Business Plan: The Purpose of the Financial Section Let's start by explaining what the financial section of a business plan is not. Realize that the financial section is not the same as accounting. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates. But accounting looks back in time, starting today and taking a historical view. Business planning or forecasting is a forward-looking view, starting today and going into the future. "You don't do financials in a business plan the same way you calculate the details in your accounting reports," says Tim Berry, president and founder of Palo Alto Software, who blogs at Bplans.com and is writing a book, The Plan-As-You-Go Business Plan. "It's not tax reporting. It's an elaborate educated guess." What this means, says Berry, is that you summarize and aggregate more than you might with accounting, which deals more in detail. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. "You can just guess based on past results. And you don't spend a lot of time on minute details in a financial forecast that depends on an educated guess for sales." The purpose of the financial section of a business plan is two-fold. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. They are going to want to see numbers that say your business will grow--and quickly--and that there is an exit strategy for them on the horizon, during which they can make a profit. Any bank or lender will also ask to see these numbers as well to make sure you can repay your loan. But the most important reason to compile this financial forecast is for your own benefit, so you understand how you project your business will do. "This is an ongoing, living document. It should be a guide to running your business," Pinson says. "And at any particular time you feel you need funding or financing, then you are prepared to go with your documents." If there is a rule of thumb when filling in the numbers in the financial section of your business plan, it's this: Be realistic. "There is a tremendous problem with the hockey-stick forecast" that projects growth as steady until it shoots up like the end of a hockey stick, Berry says. "They really aren't credible." Berry, who acts as an angel investor with the Willamette Angel Conference, says that while a startling growth trajectory is something that would-be investors would love to see, it's most often not a believable growth forecast. "Everyone wants to get involved in the next Google or Twitter, but every plan seems to have this hockey stick forecast," he says. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." The way you come up a credible financial section for your business plan is to demonstrate that it's realistic. One way, Berry says, is to break the figures into components, by sales channel or target market segment, and provide realistic estimates for sales and revenue. "It's not exactly data, because you're still guessing the future. But if you break the guess into component guesses and look at each one individually, it somehow feels better," Berry says. "Nobody wins by overly optimistic or overly pessimistic forecasts."

Dig Deeper: What Angel Investors Look For

How to Write the Financial Section of a Business Plan: The Components of a Financial Section

A financial forecast isn't necessarily compiled in sequence. And you most likely won't present it in the final document in the same sequence you compile the figures and documents. Berry says that it's typical to start in one place and jump back and forth. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses. Still, he says that it's easier to explain in sequence, as long as you understand that you don't start at step one and go to step six without looking back--a lot--in between.

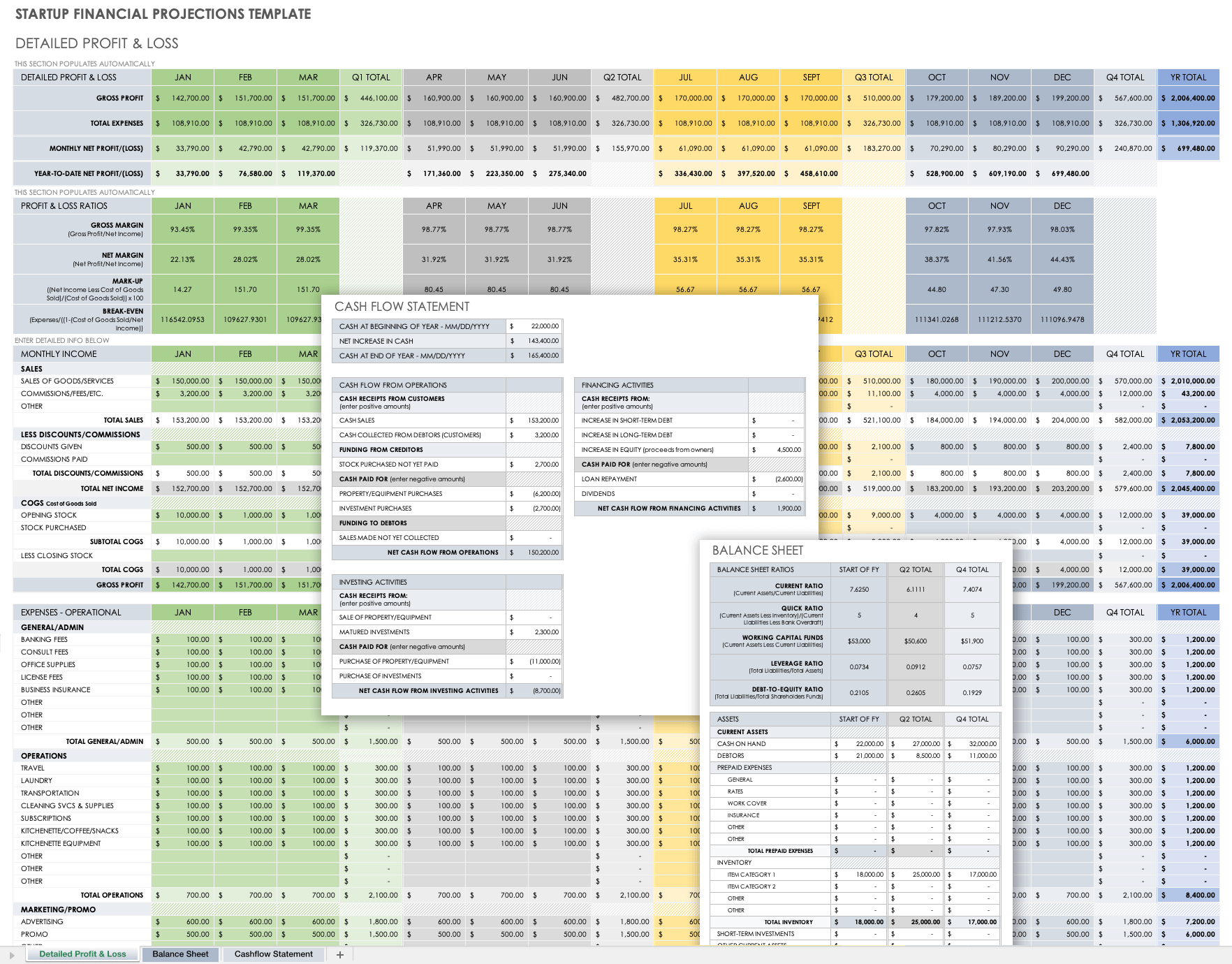

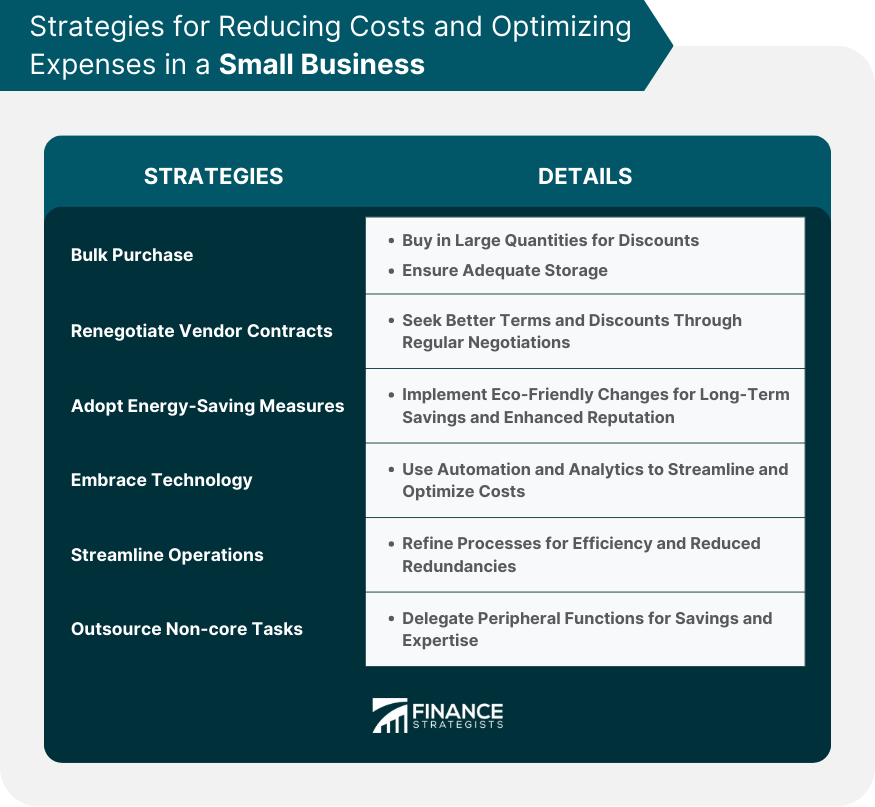

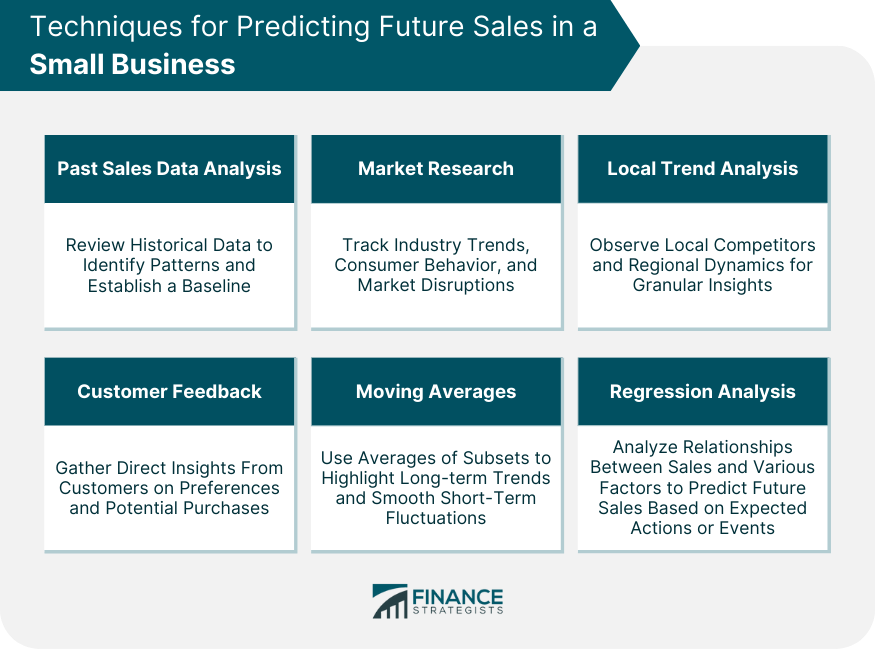

- Start with a sales forecast. Set up a spreadsheet projecting your sales over the course of three years. Set up different sections for different lines of sales and columns for every month for the first year and either on a monthly or quarterly basis for the second and third years. "Ideally you want to project in spreadsheet blocks that include one block for unit sales, one block for pricing, a third block that multiplies units times price to calculate sales, a fourth block that has unit costs, and a fifth that multiplies units times unit cost to calculate cost of sales (also called COGS or direct costs)," Berry says. "Why do you want cost of sales in a sales forecast? Because you want to calculate gross margin. Gross margin is sales less cost of sales, and it's a useful number for comparing with different standard industry ratios." If it's a new product or a new line of business, you have to make an educated guess. The best way to do that, Berry says, is to look at past results.

- Create an expenses budget. You're going to need to understand how much it's going to cost you to actually make the sales you have forecast. Berry likes to differentiate between fixed costs (i.e., rent and payroll) and variable costs (i.e., most advertising and promotional expenses), because it's a good thing for a business to know. "Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Berry says. "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such." Once again, this is a forecast, not accounting, and you're going to have to estimate things like interest and taxes. Berry recommends you go with simple math. He says multiply estimated profits times your best-guess tax percentage rate to estimate taxes. And then multiply your estimated debts balance times an estimated interest rate to estimate interest.

- Develop a cash-flow statement. This is the statement that shows physical dollars moving in and out of the business. "Cash flow is king," Pinson says. You base this partly on your sales forecasts, balance sheet items, and other assumptions. If you are operating an existing business, you should have historical documents, such as profit and loss statements and balance sheets from years past to base these forecasts on. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. Pinson says that it's important to understand when compiling this cash-flow projection that you need to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on. You don't want to be surprised that you only collect 80 percent of your invoices in the first 30 days when you are counting on 100 percent to pay your expenses, she says. Some business planning software programs will have these formulas built in to help you make these projections.

- Income projections. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. Use the numbers that you put in your sales forecast, expense projections, and cash flow statement. "Sales, lest cost of sales, is gross margin," Berry says. "Gross margin, less expenses, interest, and taxes, is net profit."

- Deal with assets and liabilities. You also need a projected balance sheet. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year. Some of those are obvious and affect you at only the beginning, like startup assets. A lot are not obvious. "Interest is in the profit and loss, but repayment of principle isn't," Berry says. "Taking out a loan, giving out a loan, and inventory show up only in assets--until you pay for them." So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment. Then figure out what you have as liabilities--meaning debts. That's money you owe because you haven't paid bills (which is called accounts payable) and the debts you have because of outstanding loans.

- Breakeven analysis. The breakeven point, Pinson says, is when your business's expenses match your sales or service volume. The three-year income projection will enable you to undertake this analysis. "If your business is viable, at a certain period of time your overall revenue will exceed your overall expenses, including interest." This is an important analysis for potential investors, who want to know that they are investing in a fast-growing business with an exit strategy.

Dig Deeper: How to Price Business Services

How to Write the Financial Section of a Business Plan: How to Use the Financial Section One of the biggest mistakes business people make is to look at their business plan, and particularly the financial section, only once a year. "I like to quote former President Dwight D. Eisenhower," says Berry. "'The plan is useless, but planning is essential.' What people do wrong is focus on the plan, and once the plan is done, it's forgotten. It's really a shame, because they could have used it as a tool for managing the company." In fact, Berry recommends that business executives sit down with the business plan once a month and fill in the actual numbers in the profit and loss statement and compare those numbers with projections. And then use those comparisons to revise projections in the future. Pinson also recommends that you undertake a financial statement analysis to develop a study of relationships and compare items in your financial statements, compare financial statements over time, and even compare your statements to those of other businesses. Part of this is a ratio analysis. She recommends you do some homework and find out some of the prevailing ratios used in your industry for liquidity analysis, profitability analysis, and debt and compare those standard ratios with your own. "This is all for your benefit," she says. "That's what financial statements are for. You should be utilizing your financial statements to measure your business against what you did in prior years or to measure your business against another business like yours." If you are using your business plan to attract investment or get a loan, you may also include a business financial history as part of the financial section. This is a summary of your business from its start to the present. Sometimes a bank might have a section like this on a loan application. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and liabilities. All of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right. Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years. "It's a pretty well-known fact that if you are going to seek equity investment from venture capitalists or angel investors," Pinson says, "they do like visuals."

Dig Deeper: How to Protect Your Margins in a Downturn

Related Links: Making It All Add Up: The Financial Section of a Business Plan One of the major benefits of creating a business plan is that it forces entrepreneurs to confront their company's finances squarely. Persuasive Projections You can avoid some of the most common mistakes by following this list of dos and don'ts. Making Your Financials Add Up No business plan is complete until it contains a set of financial projections that are not only inspiring but also logical and defensible. How many years should my financial projections cover for a new business? Some guidelines on what to include. Recommended Resources: Bplans.com More than 100 free sample business plans, plus articles, tips, and tools for developing your plan. Planning, Startups, Stories: Basic Business Numbers An online video in author Tim Berry's blog, outlining what you really need to know about basic business numbers. Out of Your Mind and Into the Marketplace Linda Pinson's business selling books and software for business planning. Palo Alto Software Business-planning tools and information from the maker of the Business Plan Pro software. U.S. Small Business Administration Government-sponsored website aiding small and midsize businesses. Financial Statement Section of a Business Plan for Start-Ups A guide to writing the financial section of a business plan developed by SCORE of northeastern Massachusetts.

Editorial Disclosure: Inc. writes about products and services in this and other articles. These articles are editorially independent - that means editors and reporters research and write on these products free of any influence of any marketing or sales departments. In other words, no one is telling our reporters or editors what to write or to include any particular positive or negative information about these products or services in the article. The article's content is entirely at the discretion of the reporter and editor. You will notice, however, that sometimes we include links to these products and services in the articles. When readers click on these links, and buy these products or services, Inc may be compensated. This e-commerce based advertising model - like every other ad on our article pages - has no impact on our editorial coverage. Reporters and editors don't add those links, nor will they manage them. This advertising model, like others you see on Inc, supports the independent journalism you find on this site.